Are you ready?! We are. Reminder postcards for returning clients and new clients who onboarded over the summer and fall will be mailed tomorrow. On Monday, Cat will be here to start answering calls and e-mails and getting organizers delivered. The organizer contains our annual engagement letter, a copy of our privacy policy, and an interview and other supplemental forms to help you remember and collect all of the information we need to do your tax returns!

If you are reading this and are still looking for a #taxpro, I am still taking “shopping” appointments. Once tax season really gets going though I don’t have the availability to meet with anyone except new and returning clients. If you’re sure here is where you want to be then I’m happy to bring you in as a new client during tax season but I do require a non-refundable deposit to do your onboarding and accept your information for processing. If you aren’t sure or have any questions feel free to call or e-mail the office. We are happy to help.

The IRS is opening e-filing for business returns soon and e-filing for individual returns will open a couple of weeks after that. Here at Tax Therapy we are about ready to open our season for new and existing clients. Existing clients will receive a reminder postcard and e-mail letting them know that they can call to request their annual tax organizer (engagement documents & client interview). New clients can call to get an organizer and set up a new client intake appointment. Please note that new clients coming in during tax season (as opposed to during the summer and fall) must pay a non-refundable deposit equal to the base price of a federal Form 1040 before we will accept their return for processing.

And it’s a doozy! Every year Kelly Phillips Erb (a.k.a. The Tax Girl) posts a list on Forbes.com of the Top 100 Must-Follow Tax Twitter Accounts. For 2020, I’m on it! Mostly this list is for tax professionals (nerds) rather than taxpayers but it is an honor to be included and as you can see, I’m really excited!

I’m also excited that tax season is basically here. I am still accepting new clients. Cat will be ready to send out preliminary paperwork starting the week of January 13th. I will start processing paperwork the following week. That is also the week I expect that the IRS will open e-filing for the 2020 tax season. So if you are looking for a #taxpro, please get in touch.

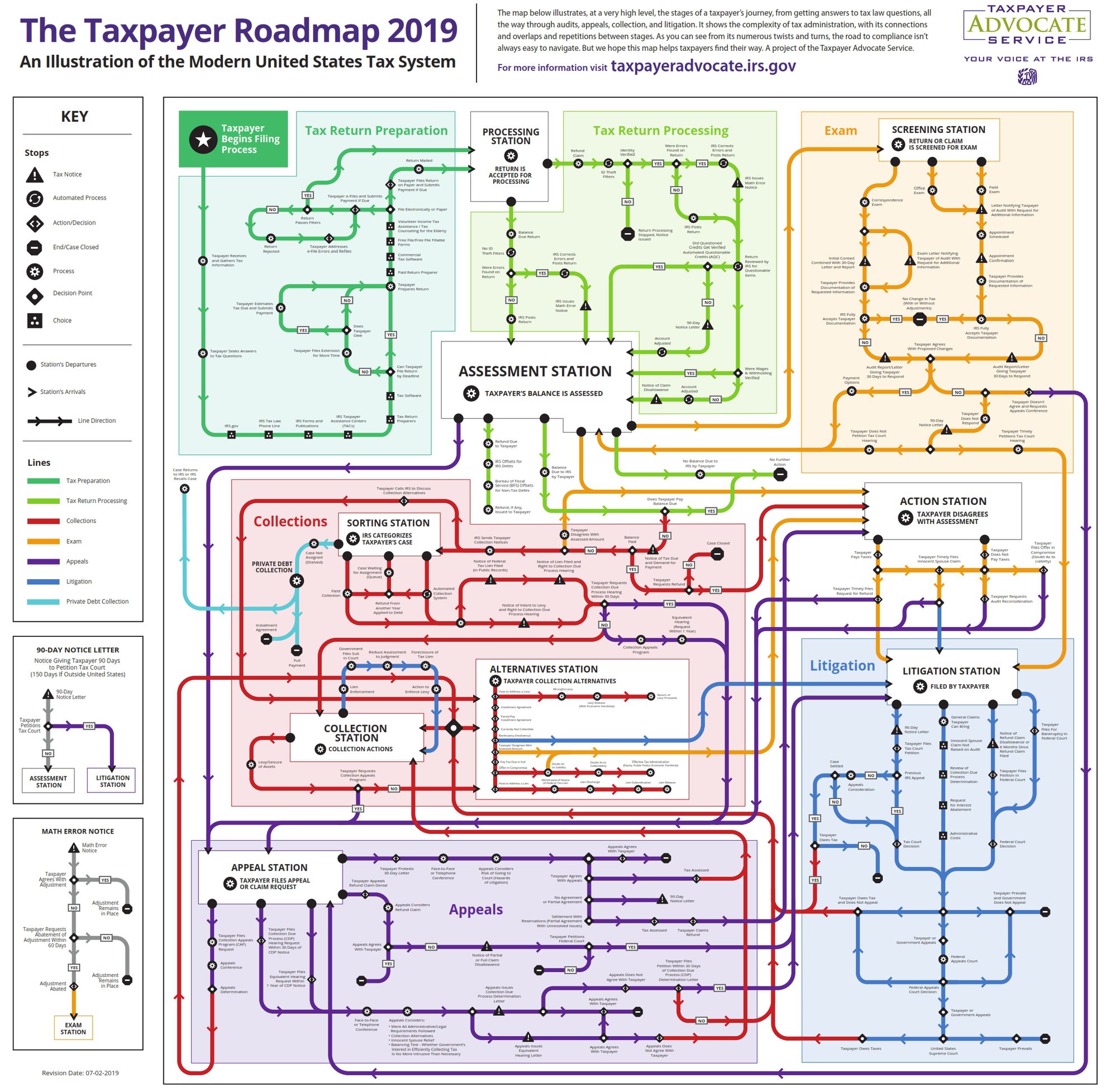

For most taxpayers once the balance due is paid or the refund comes in they stop thinking about taxes. This article provides a great explanation about why tax time is the worst time to ask the important questions or to try to find a new taxpro. In general, if the year holds “potentially taxable events” for you (marriage, children, retirement, college, lost job, new job or promotion, buying or selling business property) the time to start planning is now, not January! The same thing goes if you are considering changing from a DIY option to hiring a #taxpro or switching #taxpros.

Most #taxpros spend November and December installing and testing our software and doing refresher classes on tax law changes. Plus, most of us also have lives outside of the office and like to spend at least some of the holiday season with our friends and families! In January those of us who also offer bookkeeping and payroll services are busy doing end of the year close out work and preparing W2s and 1099s. Even those of us who don’t offer bookkeeping and payroll are usually busy getting ready for tax season: updating engagement letters, refining our client interview process, updating office policies and processes, training new staff, etc. By February we are working on returns (returns for partnerships and S-corporations are due on March 15th, not April 15th!). By March, when many taxpayers start to feel the deadline approaching and decide it’s time to “do their taxes” #taxpros are slammed with work. Many of us are not accepting new clients or, if we are accepting we will require you to go on extension. If you call us on or after April 1st looking to come in as a new client 1) we will hate you (we are totally burned out by the end of March), 2) we may laugh at you (but we don’t really think your request is funny), 3) we are going to either insist you go on extension or refer you to a shop (often one of the large franchises) who is set up to handle last minute walk ins. Note: Yes, we do consider two weeks before the filing deadline “last minute.” By April 1st (and, no, we don’t think the tax-related April Fool’s Day pranks are funny either—please don’t call saying you are being audited or levied if you aren’t) we are almost completely focused on getting returns out of our offices, not bringing them in. We are adding last minute documents to mostly completed returns. We are booking review and signature appointments. We are even planning for next filing season. We are rarely actively looking for new business.

The best time to find a #taxpro is actually summer through early fall. We have had a chance to recover from the April 15th deadline push. We may be busy working on returns on extension (especially if it is close to the September 15th deadline for partnerships and S-corps or the October 15th deadline for individual returns) but typically we are less busy than during the first part of the year. We will have time to review your situation thoroughly, answer what questions we can at your initial consultation, research questions for which we don’t have the answers, and we can give you an idea of our office process and what to expect and the documents we will need to complete your returns. It’s much less hectic and, at least in my office, a bit less formal when new clients come in for “onboarding” during the summer. You will also have a much wider range of appointment times available because existing clients for the most part don’t book appointments in the summer unless they are having a “taxable event”. So, whether you are an existing client ready to do some tax planning or a potential client wanting to find out more about the office, the time to call or e-mail is now! Give us a call at 505-352-0058 or send us an e-mail at info@taxtherapy505.com and we will be happy to schedule a consult.

The best time to find a #taxpro is actually summer through early fall. We have had a chance to recover from the April 15th deadline push. We may be busy working on returns on extension (especially if it is close to the September 15th deadline for partnerships and S-corps or the October 15th deadline for individual returns) but typically we are less busy than during the first part of the year. We will have time to review your situation thoroughly, answer what questions we can at your initial consultation, research questions for which we don’t have the answers, and we can give you an idea of our office process and what to expect and the documents we will need to complete your returns. It’s much less hectic and, at least in my office, a bit less formal when new clients come in for “onboarding” during the summer. You will also have a much wider range of appointment times available because existing clients for the most part don’t book appointments in the summer unless they are having a “taxable event”. So, whether you are an existing client ready to do some tax planning or a potential client wanting to find out more about the office, the time to call or e-mail is now! Give us a call at 505-352-0058 or send us an e-mail at info@taxtherapy505.com and we will be happy to schedule a consult.

Remember this post about “quick questions”? What is true for tax return preparation is even more true for audit and collections representation. When you call the office because you have received an IRS notice (you are being audited, or levied, or your taxes have been adjusted) the solution to the issue raised in the notice is often not simple. It is basically “lawyer work.” Indeed, only lawyers, CPAs, and Enrolled Agents have unlimited representation rights before the IRS. Hiring a professional to represent you before the IRS is not inexpensive. And in this office it is much more expensive than simply having your tax returns prepared by a competent professional (me). I often tell callers who think my preparation fees are expensive that “Rep rates are three times prep rates.” You may find someone to “do your taxes” for less money (and of course you can do them yourself)—but if you have to pay someone to answer IRS notices it can be more expensive in the long-term than just having them done correctly in the first place. In any case—answering tax questions is often like answering law questions and the attorneys at Wolf, Baldwin, and Associates have written this excellent post on why, as in the tax world, there are no “quick questions” in the law world either.

The raging started around the second week of February and it continues online and in the offices of #taxpros around the country right now. Many taxpayers are furious that they are not getting as much back on their income tax refund as they were expecting or worse—they have a balance due! Alas, this was not news to the people at the IRS who had been warning taxpayers via an extensive public information campaign to check their withholding. You see, the Tax Cuts and Jobs Act (TCJA) reduced income tax rates for everyone. But it also eliminated (well, suspended) personal and dependent exemptions and eliminated or capped some types of itemized deductions. And the IRS adjusted withholding tables (how much gets taken out of each paycheck to “put in the bank” towards your federal income tax) to (they thought) more closely align with the taxes that would be owed under the new law. Epic fail.

Epic fail in so many ways.

First, some people are actually paying higher taxes under the new law despite the lower tax rates and wider brackets. If you have a large family, the elimination of dependency exemptions often was not leveled out by the increased standard deduction and child tax credit—especially if your large family includes a couple of older teenagers. The new higher standard deduction doesn’t help much if you used to have itemized deductions that were close to the new amount. Combine the itemized v. standard issue with the suspension of exemptions and many people are getting some nasty surprises. They actually do owe more tax under the new law than they did under the old law. But even for taxpayers who are paying less in taxes, they have smaller refunds or a balance due. Why? Because of those adjusted withholding tables. They were getting more money back in their paychecks for most of the year instead of on their tax refund at the end of the year.

Here’s the thing—the people who made this law (who make all of the tax laws) simply do not, cannot, will not comprehend the day-to-day reality of most taxpayers. Their “conventional wisdom” is about the “time value of money” (yeah, google that stuff). They figure it’s a bad thing to loan your money interest free to the government for the better part of a year instead of having it in your bank account making money for you. The bits they miss are 1) according to the data most Americans don’t have enough money in savings to cover a $400 repair bill, so that extra in the paycheck is going towards necessities or niceties (depending on income, family size, etc.), not into the bank and 2) the interest rates on garden variety savings accounts are so close to zero right now that it really doesn’t matter if that extra withholding is being held by the government or put in a savings account (even in a savings account with upwards of $25K in it). Oh wait! Yes it does matter where that money goes. If the government is holding onto it, the taxpayer doesn’t have easy access to it. Tax withholding and the annual refund is actually an easy (if interest free) savings vehicle for many taxpayers. And one that taxpayers count on each year!

The IRS finally snapped to this and to the fact that the new withholding tables might have been, shall we say “a bit optimistic” about the overall effect of the tax cuts. Hence the public information campaign. Now, having my finger on the pulse of the IRS pretty much year round, I was well aware of this campaign and of the withholding calculator they were encouraging taxpayers to use to do a “paycheck checkup.” Nevertheless, since I have a few clients who were unaware of the most sweeping change to the tax code since 1986, I am not surprised at all that many of my clients and many more taxpayers were completely unaware of this big public information campaign.

Every #taxpro I know (including me) made clients aware of the potential issues during tax season last year and during the summer. I offered (and always have offered) my clients a mid-year withholding checkup where I do a “back of the envelope” calculation based on last year’s information, current year information, and any changes to the big tax picture that may have occurred or are expected to occur before the end of the tax year. Some #taxpros charge for this, others do not. I don’t typically charge for a basic checkup, I will charge for more extensive calculations or tax planning. In any case, non-DIY taxpayers probably had one or more opportunities to address the potential issues with their withholding. Many chose not to, some with unfortunate results.

But what about the DIY people? Well, if they missed the public awareness campaign then they probably got surprised. But what if they were aware and what if they tried to use the withholding calculator? You know what? I tried it. I thought it might be faster and easier than my usual hand calculations. It wasn’t. To use the withholding calculator you practically had to do a half year tax return. You also had to know a lot of tax language (AGI, dependency exemptions, tax credits, itemized v. standard). And here is, again, where the people making the laws and creating these tools have a disconnect with taxpayers. Most taxpayers, even if they do their own returns using commercial software, really don’t understand the process—they only understand the end result: refund or no refund. I have high earning, highly sophisticated taxpayer clients who barely grasp it—not because they are dumb (they most certainly are not) but because there is a lot of specialized language and a lot of moving parts and this is not what they do all the time. If I threw up my hands in frustration trying to use the IRS tool, I can only imagine what a “regular” taxpayer was feeling.

Situations like these are where a good #taxpro adds value. It’s why we cost more than DIY software. We understand the big picture (and often the history) for each client. And we can do calculations by hand faster than you can do them with software and, because of that big picture knowledge, we are often more accurate. I dial my clients into whatever type of refund they want. I have some clients who don’t mind getting big tax bills when they file their returns (they are the clients whose money is making them a lot of money). I have others who like to break even; they want the most take home pay they can manage and don’t mind a small refund or balance due. I have others who want those big refunds. They do use their federal income tax withholding as a no interest savings account. And you know what? That works for them and that’s OK with me!

The bottom line is that a lot of the rage is coming from people who think they are paying higher taxes because their refunds are lower (or not there). Not true. Some rage is coming from people for whom the tax cut actually was not a tax cut. Definitely and depends greatly on individual facts and circumstances. When you hire a #taxpro to “do your taxes” the good ones do more than put numbers in boxes. They help you meet your financial goals and prepare for the effects of tax law changes such as these. So if you decide to “go pro”—choose wisely, choose well.

Today’s post is brought to you by the brainiacs over at the Procedurally Taxing Blog. Specifically, it was this post on a taxpayer winning damages from an employer who both misclassified him as an independent contractor (he got a 1099-MISC instead of a W2) and who reported more on the 1099-MISC than the employee (he was not a contractor) actually got paid. For taxpayers in New Mexico, the federal income tax issues that result from this type of misclassification are often only one part of their problem.

One of the most common issues that brings a DIY taxpayer to my office for representation services is getting an audit notice from the state—for NM State Gross Receipts Tax. Unlike most other states, New Mexico charges gross receipts tax on the sale of goods and services. That’s why NM-GRT is included on my local clients’ invoices. When you are self-employed in New Mexico, you are “in business” in New Mexico with all that implies. Sometimes clients know they are self-employed, but for one reason or another (for example they have come from a state that does not charge gross receipts tax on services) they are unaware of the NM-GRT compliance issue. That’s why it’s usually the first question I ask self-employed potential clients and one of the things I remind current clients who are considering starting “side hustles.”

One of the most common issues that brings a DIY taxpayer to my office for representation services is getting an audit notice from the state—for NM State Gross Receipts Tax. Unlike most other states, New Mexico charges gross receipts tax on the sale of goods and services. That’s why NM-GRT is included on my local clients’ invoices. When you are self-employed in New Mexico, you are “in business” in New Mexico with all that implies. Sometimes clients know they are self-employed, but for one reason or another (for example they have come from a state that does not charge gross receipts tax on services) they are unaware of the NM-GRT compliance issue. That’s why it’s usually the first question I ask self-employed potential clients and one of the things I remind current clients who are considering starting “side hustles.”

Unfortunately what also often occurs is that a client’s employer puts that client “into business” in New Mexico by misclassifying an employee worker as an independent contractor (IC). Sometimes the employer is upfront about this—sort of. Typically the employer tells the worker all the “benefits” of being an IC (deducting certain expenses, etc.) but fails to mention the drawbacks—maintaining income and expense records and mileage logs, self employment taxes (paying into Social Security and Medicare), and here in New Mexico, NM-GRT. The taxpayer thinks they are getting a good deal until they do their own tax return and get audited or get told by their #taxpro that not only do they owe income and self-employment taxes to the IRS, they owe income and gross receipts taxes to the state.

It’s important to remember that “not caught” is not the same as “accurately filed” (or in the case of NM-GRT not filed!). The computer matching used by the state (and the IRS) is only getting more sophisticated. If you aren’t sure about your requirements, it’s best to consult a #taxpro before you get the notice and it’s definitely best to consult one if you get a notice. True #taxpros offer much more than return preparation and audit representation; they manage the process for you and provide peace of mind.

This is how I earn my living. I work pretty much full time, pretty much year round. Even when I’m not doing tax returns, I’m doing representation work (helping people who are being audited or who are in IRS collections), I’m working on the business side of my small business, or I am reading. I am always reading. I’m not a “pop up” tax shop. I’m not seasonal. And this business is definitely not a hobby for me. So please treat me as you would any other professional. If you aren’t sure what that means, here are five tips on how to treat your tax professional (or any professional)…

This is how I earn my living. I work pretty much full time, pretty much year round. Even when I’m not doing tax returns, I’m doing representation work (helping people who are being audited or who are in IRS collections), I’m working on the business side of my small business, or I am reading. I am always reading. I’m not a “pop up” tax shop. I’m not seasonal. And this business is definitely not a hobby for me. So please treat me as you would any other professional. If you aren’t sure what that means, here are five tips on how to treat your tax professional (or any professional)…

Tip #1: If it’s work related, please call the office or e-mail my work address.

Sometimes friends become clients. Sometimes clients become friends. Sometimes we are colleagues with businesses that are similarly aligned. If your doctor was a family friend, would you call her on her personal cell to book an appointment? No? Please do the same for me. My home/work boundaries help keep me sane, not to mention being necessary for my professional liability insurance. If it’s office stuff, let’s take care of it during office hours, using office resources. When I’m out socializing, especially during tax season, I am getting some rare “outside the office” time. I do not want to be on duty (and again, my professional liability insurance also does not want me to be on duty—especially if it’s happy hour). I don’t mind giving out a business card or taking your card for a callback, but I will not discuss specifics outside the office.

Tip #2: If it’s administrative (non tax) work, please reach out to the admin assistant first.

It’s a small office and when Cat isn’t here I am the admin assistant. But that means I am working at her workstation, monitoring her e-mail accounts, and doing work that is typically hers when she is on duty. Again, if you have a doctor or an attorney do you call them with questions about office hours, booking appointments, what to bring to your appointment? Not usually. They have staff for that and during the busy part of tax season, so do I. Please respect the professional boundaries and contact the office and speak to the admin and let her do her job (including determining when a question needs my intervention).

Tip #3: I can explain it to you, I can’t understand it for you.

I want my clients to understand their tax returns and have a good big picture view of their tax situation. I work hard to explain what is going on with each tax return to each client each year. That service is part of what you pay for when you hire a #taxpro as opposed to doing your own returns. But I cannot magically transfer my years of training, education, and experience into your head. I can give you the big picture. I am typically not willing to explain anything in the level of detail that is provided in a training class for tax professionals to non tax professionals—no matter how smart you are or how much I like you and/or value your business. I’m pretty smart. Actually, I’m really smart. But I’m also smart enough to know I’m not going to learn how to design a bridge by asking an engineer to explain it to me. I’m not even going to learn how to design a bridge by asking an engineer to explain it to me in excruciating detail. Again, I want you to understand what is on your tax returns—what you are filing and paying and why. But I cannot train you to do my job at your review and signature appointment so please don’t expect me to.

Tip #4: Your mad search skillz are no substitute for my years of experience and training.

They just aren’t. I’m not saying what you Googled is incorrect. It may be correct. But it also may not be correct and knowing why it is or is not correct is a big part of what you get when you hire a professional. The tax code is huge. Huge. And it has a lot of interconnected parts. Knowing how those parts all work together is what I do. When you Google (or even sometimes when you are using DIY tax software) you often don’t know what you don’t know and you could be missing information that is critical to the big picture. Garbage in, garbage out. I’ve spent years learning how to ask the right questions and to question what on the surface may seem like the right answers. I don’t mind answering questions. I do mind when you stand in my office and challenge my answers based on your search results or what your non-taxpro friends have told you.

Tip #5: Don’t expect me to work for free.

Again, this is how I earn a living. If you are a client, don’t call with questions about your friends’ or family members’ returns. If you are a prospective client, do not call expecting to “pick my brain” on what you are supposed to do to prepare a tax return. Do not expect me to tell you which forms need to be filed or if items are reportable income or are legally deductible. Do not ask if I will review your self-prepared return—I won’t. Do not call to ask me for tips or strategies or “quick questions” if you are not a client. My clients pay for that information. If you want it, then become a client. You would be surprised at how often I have to tell casual friends at group dinners “No, I don’t answer ‘quick questions’ from non-clients when I am at social events.” You would probably be more surprised to know how many calls Cat and I field during the height of tax season from non-clients expecting free information. Imagine trying to install a dishwasher yourself and calling a plumber while you are in the process and saying “Well, I’ve got the dishwasher out and I’ve been talking to my contractor friends and watching YouTube videos and googling for tips and I just want you to kind of walk me through this to be sure I’m getting it right.” And expecting them to 1) do it and 2) do it for free. Not gonna happen with them and not gonna happen here either.

Perhaps the simplest guideline is that if you wouldn’t act this way with a doctor or an attorney, don’t act that way with me. My name is Amber. I am a tax professional.

I love living here in the west. We have lots of sayings about “things cowboy” out here:

I love living here in the west. We have lots of sayings about “things cowboy” out here:

- Cowboy (or cowgirl) up.

- Not my rodeo, not my clowns.

- Not my cattle, not my (uh) manure.

- Big hat, no cattle.

And the list goes on. I’ve visited lots of places in this country and all of them have their advantages, but I can’t imagine ever making a home east of the Rockies. I love the wide open spaces and the freedom they inspire. But sometimes what is an advantage in some circumstances (lots of freedom) proves to be a disadvantage in others, which brings me to today’s topic—tax cowboys.

Unlike, say, rancher type cowboys (who in my experience are a pretty conservative group if a bit dismissive of the whole “paperwork thing”), tax cowboys are more like rodeo cowboys. They are risk takers. They see the tax code and form instructions as a personal challenge. As obstacles to be overcome. As an opportunity to show you (the client) what they’re made of. They’re personable. They have swagger. They are really easy to like and even easier to believe because they often tell you what you want to hear. The problem is the risks they are taking are with your taxes and your money, not their own.

Tax cowboys aren’t the same as ghost preparers. They are often highly experienced, well educated #taxpros. They often are not the lowest bidder on price. They will sign your return as a paid preparer. And yes, signing a tax return as a paid preparer comes with its own set of risks. But the thing about tax cowboys is the big risks they are taking are with positions on your tax return and therefore with your money. “Not caught” is not the same as “accurately filed” and relying on the advice of a paid preparer may get you out of some penalties and interest, but it is rarely enough to get you out of owing more tax (sometimes a lot more tax) if your return is ever examined (audited) by the IRS and/or by the state. You sign that return too. By signing it (or authorizing the e-filing) you are stating that you have reviewed the return and agree with what’s on it. That’s why this office always includes time for a review before you sign the e-file authorization form.

Let me repeat “not caught” is not the same as “accurately filed” and tax cowboys are playing with your money and rolling the dice for you. The consequences will be on you. Fixing the issues will be on you. You may think you like the result now, but you won’t like it later and the algorithms that catch these problems are only getting more sophisticated. Be sure you know the big picture and are ready for the whole eight-second ride!