Quick Question

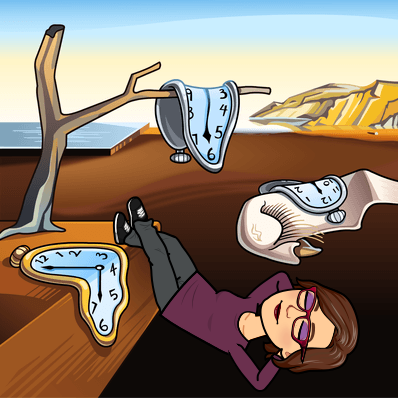

If I had a quarter for every time a client called or e-mailed with a “quick question” or a potential client said “my taxes are really simple” I could probably retire (not that I want to). If you’ve ever asked me a “quick question” you’ll know that most of the time my answer is along the lines of either “Off the top of my head I’d say this, but let me do some more checking and call you back.” or “I’ll have to run the numbers and call you back.” Truth is, in general, there are no quick questions. The tax code is complex and highly dependent on individual facts and circumstances—not to mention actual numbers. Just because a friend or relative or neighbor got this or that credit or deduction doesn’t necessarily mean that you get that credit or deduction too. Even if you think you are in similar financial circumstances you may not be. It never hurts to ask of course and I am happy to answer your questions, but I may not always be able to give the answer you are hoping to or expect to receive. And often I cannot answer your question without completing most or all of your tax return. That is why I encourage you to write down your questions on your organizer paperwork and return them with your other tax documents. And remember, a certain amount of “question time” is built into the price of your tax return preparation fee but extensive planning or calculations are considered a consult and billed hourly. I will always let you know if you are straying into billable territory. Also, if you are not a client, I cannot answer your questions, review your self-prepared returns, etc. I also don’t answer specific tax questions at social gatherings but I am happy to nerd out with you on tax policy!