[Originally published on Forbes.com]

At this point it should not be news to taxpayers that the last two filing seasons have been hard on tax professionals and that this season is not showing any signs of improvement. Still, it’s tax season and taxpayers need to be able to communicate with their tax professionals to ensure that their returns are filed timely, accurately, and most importantly this year, electronically. Indeed, according to a recent survey of tax professionals by Thomson Reuters communication skills are one of the most highly sought after talents in the tax industry. If communication and communication skills are so important, why aren’t tax professionals returning their clients’ calls? Maybe they are, just not in the way clients expect.

At this point it should not be news to taxpayers that the last two filing seasons have been hard on tax professionals and that this season is not showing any signs of improvement. Still, it’s tax season and taxpayers need to be able to communicate with their tax professionals to ensure that their returns are filed timely, accurately, and most importantly this year, electronically. Indeed, according to a recent survey of tax professionals by Thomson Reuters communication skills are one of the most highly sought after talents in the tax industry. If communication and communication skills are so important, why aren’t tax professionals returning their clients’ calls? Maybe they are, just not in the way clients expect.

Most clients grossly underestimate the sheer volume of client calls and e-mails tax professionals receive during filing season. Clients prove it every time they start a call or e-mail with “I know you’re busy but…” Even tax professionals who have administrative support to help with the volume are often overwhelmed by it. Amanda McGowan, an Enrolled Agent in the Denver, Colorado area, teaches a class on achieving the “no call office.” But after speaking with many tax professionals on social media it has become clear that “no call” doesn’t really mean no calls at all. Even the most vehement proponents of the no call office realize that speaking on the phone has its advantages:

- It provides flexibility for clients with different communication styles and different resources.

- Voice inflections often add important nuance to the conversation.

- It allows for open ended questions and, consequently, a more thorough discussion.

- Sometimes it’s simply faster to pick up the phone to do a deeper dive into the reasoning behind a question than to draft an e-mail that contains enough questions to provide a thoroughly anticipatory follow up discussion.

Nevertheless, in the recent chaotic filing atmosphere many tax professionals have realized that the only way to handle call volume is to set firm boundaries around how and when calls will be taken and returned. To ensure that they get enough time to focus on tax returns some tax professionals practice time blocking. They set aside time, usually the times they find most productive, for deep work and block less productive time for returning calls and answering e-mails. How does that look in practice? Well, if your tax professional is a morning person it usually means your calls and e-mails will go unanswered until the afternoon. If your tax professional is a night owl it means you could receive an e-mail response to your voice message in the middle of the night (they aren’t expecting an immediate reply) or that they will return your call in the morning because they reserve their afternoons and evenings for deep work.

Often time blocking is used in addition to call scheduling. To make the best use of their time tax professionals are not refusing to take or return calls, they are simply refusing to take unscheduled calls. Unscheduled calls disrupt workflow and often cannot be resolved without additional research, which then necessitates yet another call. Tax professionals who require calls to be scheduled also typically require the reason for the call to be provided before booking the call. Providing the reason for the call when you book the call allows your tax professional to look up your tax information, review your question, and do any research necessary to answer the question before they ever get on the phone. Pre-booking often makes for a much more satisfactory experience on both sides of the call.

Sometimes, however, tax professionals prefer to follow up to voice messages by e-mail. Why? Because they need to document the conversation for your file. Responding to voice messages by phone typically requires the tax professional to respond twice: once by returning the phone call and again by typing notes documenting the call into your tax file. If the question requires research or is reasonably complex, often the most practical solution for the busy tax professional is to “eliminate the middle man” and respond with an e-mail instead of by phone even when that is not the client’s preferred means of communicating.

Remember, tax professionals are business people and they have to work in ways that are good business. In other words, it may only feel like your tax professional isn’t being responsive when they are, just perhaps not in the way you expect. So what can taxpayers do to help ensure their tax professional returns their calls?

- Don’t call with questions that can be answered by looking at the firm’s website (e.g., Are you open on Saturday?). If your practitioner’s firm has a website try looking there for answers before you call. Many firms have prepared handouts that answer common questions available on their websites (e.g., valuing charitable contributions, tracking business mileage, deductibility of business meals, etc.).

- Don’t expect exceptions to be made for you. If your tax professional sends office updates, newsletters, or other mass e-mail messages, read them. Often these one-to-many communications contain answers to your questions because many other clients are asking the same questions and it’s more efficient to respond to everyone at once than to provide individual responses.

- Respect the office policy concerning when calls will be returned and by whom. Schedule your call if that is what the office requires. Don’t insist on talking to a firm principal or partner when someone else has been provided with the information you were seeking and has been tasked with returning your call.

- Provide a reason for the call when you are calling. Often it is more practical for the tax professional to return your call using e-mail rather than the phone. If you just leave your name and number but no reason for the call, depending on the office your call may not be returned at all.

- Don’t phone to ask if your tax professional got your e-mail or your earlier voicemail unless it has been longer than five to seven business days after you reached out to them.

- Don’t call or leave a voicemail just to see if your tax professional has everything they need to prepare your return. Pro tip: If a tax professional is missing information, they will contact you.

- And never, ever call your tax professional just to “check the status” of your return or you may find yourself looking for a new tax professional.

The two most beautiful words I heard on #TaxTwitter this weekend were “seller’s market.” What does that mean? It means that good #taxpros are in demand. Good #taxpros. I’m seeing loads of newbies on FaceBook who have passed a test or taken a few classes and decided to open a tax practice asking for advice on everything from what to charge to who qualifies as a dependent to, wait for it, how to prepare a Schedule C.

I’ve mentioned before that “not caught is not the same as accurately filed.” By the time taxpayers get the notices on these returns these preparers have probably closed up shop for the season and are nowhere to be found. Not all of them. Some, who decided to charge really low prices to get clients in the door, will still be working filing what I hope are free amended returns to fix their mistakes. That sucking sound you hear is their profit margins going down the toilet because they charged too little to begin with and now they have the pleasure of doing the return twice. At least I hope they aren’t charging for the amended returns. I had to call a client yesterday morning and to tell her I recently became aware of some “fine print” that could result in tax savings for her and because it was something I missed on her returns I would, once I verified my mistake was really a mistake and she qualified for this benefit, be filing three years’ worth of amended returns for her, for free. Why? Because I’m a good #taxpro. And we are in demand.

You want to know how I know we are in demand? Because the first question potential clients are asking me isn’t “How much do you charge?” it’s “Are you taking new clients?” The answer is yes, but not all of them.

Last year was hard on tax professionals. Some of us aren’t convinced “last year” ever ended. People made themselves ill, people got hives from the stress, people died, some died at their desks and here we are starting what appears to be another chaotic filing season. Last year was absolutely brutal on me and I only have a small practice and not many small business clients. I was stressed, exhausted, and angry. I’ve been working continuously since last January and I’m still stressed, exhausted, and angry. I’m just handling it better. Part of the reason I got no break was that I decided that what made the 2020 extended filing season so unsustainable was the administrative work (e-mails, phone calls, etc.) associated with scheduling appointments for potential and existing clients, answering the same questions over and over, and chasing paperwork (specifically my engagement packet and annual client interview) while trying to keep up with tax law changes and preparing tax returns. Part of the reason I’m handling the stress better is that I spent most of October through December of 2020 adding software that automates the administrative parts of return processing and appointment scheduling so that Cat and I can focus on preparing complete and accurate tax returns for our clients instead of answering the same handful of questions dozens (or hundreds) of times by phone or e-mail.

So why the salt? In a word? Pushback.

So why the salt? In a word? Pushback.

I get it. Change is hard. If you think it’s hard to adjust to a new system imagine having to actually set up the new system and use it, not just once but hundreds of times. And yet, most of my clients are managing. Even the ones I thought of as “not super techy” are giving it a try and figuring it out. It’s an imperfect system and I’m learning as I go. It’s not always easy and at times everyone has been frustrated (clients, me, Cat). I am letting the frustrated clients know that I appreciate their patience and feel their pain. I also understand that it’s harder to adapt to a new system when you only use it once or twice a year. I’m cutting some slack, but I’m not cutting slack like I did in 2020 when I basically did whatever I could to help my clients even if it meant sacrificing my own well being.

After fielding a few calls from disgruntled clients, I decided yesterday that I’m simply not taking pushback on my new client management system. My office processes are reasonably flexible and always have been. I will take what I am learning this year and make refinements that make the system and my processes easier on both the client and the office side. I don’t want to frustrate my clients, but I also don’t want to be crushed under the weight of admin work that can be automated.

Consider this, when you find a doctor that is taking new patients do you tell that doctor how to run her practice? I don’t think so. Well, when you find a tax professional, especially an ethical, competent, experienced tax professional, who is taking new clients, it’s probably a good idea to work within their systems instead of telling them how you want to do things.

If you’re reading this and thinking “Well, that’s nasty, I will just take my business elsewhere” I understand. But remember…seller’s market. I’m not trying to price gouge you. I’m not trying to make your life hard. I’m trying to earn a living in a demanding job with extremely high consequences of failure without killing myself in the process. So if my office policies and procedures don’t meet your idea of the way you think things should be done, shop around and find someone with a practice that does. It may be a seller’s market, but there will always be practitioners out there at all price points, experience, and service levels.

Clients who value me will find me and clients who don’t will find a practitioner that better meets their needs. Because truthfully, when it comes to preparing your tax returns, if you can’t tell the difference between me and the person at your church who is using Turbo Tax and charging $100 per return, we are both probably better off if you choose that person, me for the long-term health of my business and you, well, until you aren’t.

#fullambo out

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

For Tax Year 2020 taxpayers who take the standard deduction can make an above-the-line adjustment for cash contributions of up to $300 on their 1040s. There’s a marriage penalty here. The $300 for 2020 is on a per return, not a per taxpayer basis. So single filers can make a $300 adjustment and married taxpayers filing a joint return can make a $300 adjustment. The IRS has recently issued guidance (that contradicts the actual law) that says married taxpayers filing separately can only take a $150 adjustment. It’s incorrect but the tax savings are not worth the expense if the IRS decides to assess a penalty (more on that later).

In the more recently passed legislation the marriage penalty was removed. Each taxpayer may contribute up to $300 in cash to qualified charitable organizations. So for Tax Year 2021 it is possible to take an up to $600 above the line adjustment on a jointly filed return. Singles and Heads of Household still can take up to $300. Again, this is for taxpayers who do not itemize their deductions. Taxpayers who use Schedule A to itemize their deductions continue to deduct all of their qualified contributions on that schedule.

Now for the fine print. The IRS will be watching. The Service has stated that there will be a 50% penalty if you claim this adjustment without proper substantiation. What does that mean? It means receipts. Here’s a link to some information on proper recordkeeping for charitable contributions. In general, clients should always be maintaining the records necessary to substantiate their charitable contributions. But for this adjustment in particular it is even more important for the #taxpro to keep the receipts that substantiate this adjustment in the client’s tax file for the applicable years in case the IRS comes looking for them. Don’t be the client who tells your #taxpro “just take the max.” And if you are a #taxpro who “just takes the max” without proper substantiation then you aren’t really a #taxpro in my opinion. True tax professionals do not open their clients up to these types of penalties. They are too easily avoided. If you don’t have the proper documentation it’s going to cost you more in penalties than you saved in taxes by taking an unsubstantiated adjustment. Just don’t do it.

Remember, this adjustment has the following conditions:

- The taxpayer must not be itemizing their deductions on the return.

- The taxpayer must be able to substantiate the deduction.

- The contribution must be made in cash or a cash equivalent (cash, check, credit card, etc.). In other words it can’t be taken for donated “stuff”.

- The contribution must be made to a qualified charitable organization. Shorthand for that is that it must be made to a recognized 501(c)(3) organization.

See that last bit? It’s important to understand that not every tax exempt organization is a recognized 501(c)(3) organization.

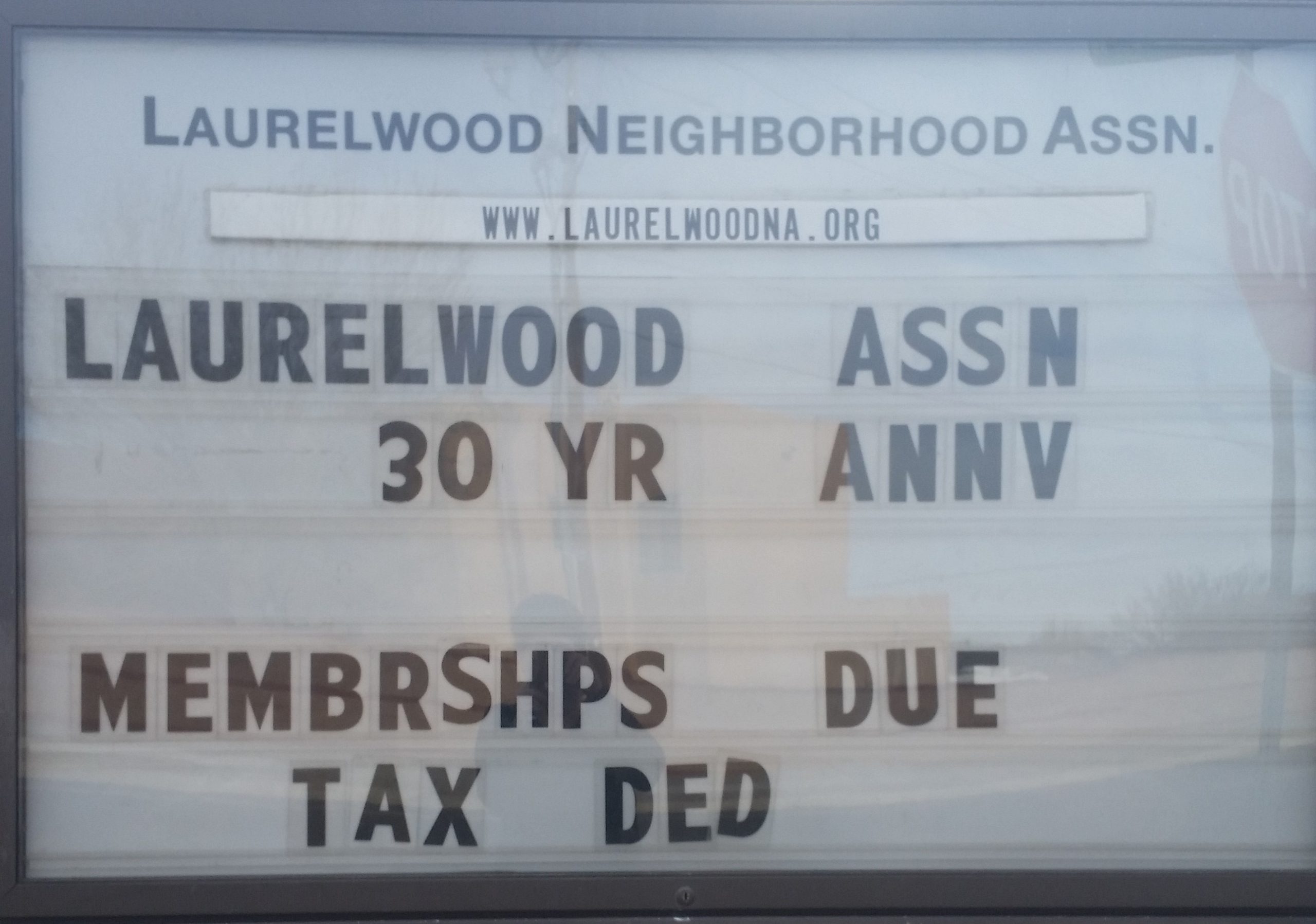

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

If you have questions about whether or not your contribution is deductible it’s always better to ask your #taxpro or to look to reliable sources for more information. Reliable sources include the tax team at Forbes.com, the IRS website, and (sometimes) the knowledge base provided by your DIY software vendor. Reliable sources do not include TikTok, Twitter, or YouTube unless the person providing the advice is recognized as an expert in the field (again, the IRS, Forbes, etc.). And occasionally even trustworthy sources provide incorrect information. Right now information is changing so quickly what you are reading could already be obsolete. Be careful out there. Read the fine print and remember, if it sounds too good to be true it usually is.

#fullambo out

*If you paid substantially more than fair market value for an auction item you may be able to deduct the amount in excess of fair market value but be prepared to answer some questions and provide some proof to your tax professional.

Control my life? I can’t even control my hair! This one is for my #taxpro friends and #TaxTwitter. I can’t find the tweet or the article linked in the tweet but former Taxpayer Advocate, Nina Olsen, expects this filing season to be “a disaster.” And she said this after, well, last filing season. So I’m going to offer some of my best pearls of wisdom (do as I say, not as I do) for managing the chaos (to paraphrase Alan Greenspan, both the known chaos and the unknown chaos).

Control my life? I can’t even control my hair! This one is for my #taxpro friends and #TaxTwitter. I can’t find the tweet or the article linked in the tweet but former Taxpayer Advocate, Nina Olsen, expects this filing season to be “a disaster.” And she said this after, well, last filing season. So I’m going to offer some of my best pearls of wisdom (do as I say, not as I do) for managing the chaos (to paraphrase Alan Greenspan, both the known chaos and the unknown chaos).

Control the Bits & Pieces

Clip (electronically) your research and save it to the client’s tax file with a file name long enough to help you when you go looking for it. For example, “Tony Nitti Article on Partnership Basis and Deductible Losses.” Or “IRC Section 1212 on net capital losses for individuals and entities.” Don’t ever count on being able to remember why you saved something or what a file is when it just says “IRC 1212”. Help yourself in advance. You’ll thank me later.

Same thing for e-mail responses to client questions. Mine are usually long and detailed. Save the whole thread with a file name that describes what is in the thread. For example, “E-mail on why K1 losses are not deductible – basis tracking issues.” That way you never have to remember what was in the e-mail. Yes, you can simply keep every e-mail you ever send and receive and use the search feature, but I find being able to simply go to a client’s tax file for a given year and find what we discussed and the decisions we made (and why) saved in PDF files incredibly convenient.

Control the Engagement

Use an engagement letter (long or short, that’s a subject for another day) that defines the scope of the engagement. Mine has said for years that the engagement specifically ends with e-filing (or with delivering prepared returns to the client for signature and mailing). This year I made a handy dandy “menu” that describes what is included with “full service” return preparation and what are “add on” services. Spoiler Alert: Chasing EIPs and refunds are not included with return preparation. You can include them if you want, just adjust your prices accordingly. In any case, define the terms of the engagement and stick to them. Don’t allow scope creep (or if you must, bill for it).

Automate Automate Automate

It doesn’t take fancy software. My goal this year was to get a self-scheduler online since we are now requiring an appointment to drop off documents where in non-COVID times we had an open door policy. Done. But I added some client management software as well. But you don’t need that (well, you probably do need the scheduling app). How much time do you spend answering the same e-mail inquiries over and over and over? I got a pro tip from The Number Queen herself early last year (or maybe late in 2019). Use custom e-mail signatures to automate responses! I’ve set up a wiki of common questions and canned responses. Each response is its own e-mail signature in Outlook. Get a question? Hit reply and then choose the appropriate pre-written signature response. Done. The bonus is the responses in the wiki are also used as mini-scripts for answering the most commonly phoned in questions as well. I’m also using the heck out of the wiki feature in Microsoft Teams to create volumes of information for the office on how we use specific pieces of software, handle specific inquiries, etc. I get tired of trying to remember what I decided and really tired of repeating my decisions (or worse, deciding something different than before for a different reason). So now I’m putting it all into our office wikis. Teams is pretty common. If you aren’t using the wiki app you are missing out.

Control the Dialogue

You are monitoring this stuff (the ever changing tax law stuff and what happens in your office). You know what clients are going to be asking. Use mass text or e-mailing software to schedule pre-emptive strikes. My clients are amazing. Generally they don’t call or e-mail about anything they are hearing in the media or from their friends because they know that if it’s important I will be sending out a mass e-mail—with actual facts in it. So they just wait to hear what I have to say. And if they are the 40% who don’t open the e-mail? Well, we paste the e-mail campaign into one of those phone/e-mail scripts I mentioned previously and just use that to respond.

I use this blog to control the dialog as well. I answer many common questions for clients and potential clients here. When we get an inquiry that’s something I’ve already written about, we have a pre-programmed response that says, “Hey, Amber has actually answered that [here]” and provide them with a link.

Stay in the Driver’s Seat

Finally, don’t let the clients drive your business. The customer is not always right. Start as you mean to go on! You will reap what you sow. What the hell does this clichefest mean? That it’s your business. It’s on you to set the rules of the game and to maintain your boundaries. If you allow clients to circumvent your well-thought out processes and policies you are going to end up doing more exception handling than actual work. That’s what happened to me last filing season. I cut lots of people lots of slack. The only person who didn’t get any slack was me. And that could have ended really badly. This year I am going into tax season with my systems, policies, and procedures as the armor that will protect me from whatever slings and arrows the IRS and Congress throw at me. I’m not expecting perfection (even Achilles had his heel) but if I can mitigate 80% of the chaos from the 20% of the clients and potential clients who cause it that is a big win!

Stay frosty out there.

#fullambo out

Remember when they were doing direct deposit or mailing a paper check? Well someone convinced someone that prepaid debit cards were a better idea. I won’t wax philosophical on the fact that you can’t usually pay rent with a debit card. Instead, I will link to this article from The Tax Girl letting you know that debit card is legit…so don’t throw it away!

Remember when I talked about college students who are dependents (or basically any child over 16) not being eligible for the dependent EIP or their own EIP? Well, that applies to adult dependents too. So if you’re claiming your parent as a dependent and they are wondering where their stimulus money is—it isn’t coming. Because they are a dependent over the age of 16. Yeah—this is a drag.

What’s not a drag is that I have been moving through the returns and Cat may be coming back part time starting next week. Can I get a hallelujah?!

And we are open by appointment for document drop off, return review and signature, and for new client intake appointments.

That’s about it for today!

It’s Thursday and, after a fairly productive start to the week and a really hectic Wednesday, I am working from home. I have a 2-hour class today and I also needed to catch up on reading and administrative tasks.

The tax returns, however, keep on trucking. I’ll be back in the office tomorrow (Friday) working on returns. I’m still at the pile that came in in mid-March, which (if you have been keeping up with this blog) is most of them. But I’m finally seeing light at the end of the tunnel! I still expect to get most of the returns that normally would not have been on extension filed by the end of this month.

I am still planning on opening the office by appointment only beginning Tuesday afternoon, May 19th. I have already booked a few appointments so if you are wanting an appointment in May (and not in June) it’s best to call or e-mail and book now.

You can also call or e-mail if you are a client with a question about your Economic Impact Payment. I’ve been answering those as I can and I appreciate everyone’s understanding concerning the fact that while I have a lot of information on the process, I have absolutely no control over the IRS, the Treasury Department, or their tools (electronic or human).

I am still urging everyone to stay home to the greatest extent possible and to use e-mail, the phone, Zoom, the secure portal, or USPS/courier to communicate with me.

Enjoy your weekend everyone!

#fullambo out

Wow! That’s all I can say. This blog post is late because I have managed to string together three productive work days in a row and it feels like it’s gonna hold through the rest of the week!

Wow! That’s all I can say. This blog post is late because I have managed to string together three productive work days in a row and it feels like it’s gonna hold through the rest of the week!

So, where are we at? Unfortunately we are still in early to mid-March as far as return processing goes. That said, Cat is coming to pick up the last pile of returns for scanning this week and I am moving through the piles. I am still fiddling with some of the more complicated returns but I’m working on those in tandem with some of the more straightforward ones. The short version is, returns are getting finished.

This is the first time this year I have felt like tax season is working. The first time I have felt like it’s actually tax season and things are working the way they are supposed to—stacked up but moving.

I will be working on returns the rest of this week and back in and working next week as well. I don’t have Cat available for data entry right now (she can’t do that from home) but if you’ve been with me any length of time you know how fast I type. I’ll get ’em done. Have a great week and enjoy the weekend.

#fullambo out

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

The backlog is slowly clearing. That means, for those of you whose returns still haven’t made it into the office, we will be ready to start accepting new paperwork soon. So here’s the plan—

Whether or not the stay-at-home is extended beyond May 15th, I will re-open the office for document drop offs by appointment only on Tuesday, May 19th. My 24th wedding anniversary is Monday the 18th so I’ll probably take that day off. If you wish to make an appointment to drop off your tax return documents or missing paperwork (K1s, corrected broker 1099s, etc.), please just call or e-mail and I or Cat will get back to you and will set you up!

I will probably re-open the office to new clients at the beginning of June. We will still be, to the greatest extent possible or required, limiting in-person visits to the office. Re-opening to new clients simply means that I will once again be accepting inquiries from new clients. So, if you know anyone who hasn’t filed but wants to, June is when I’ll be accepting referrals again. That should be plenty of time to meet the July 15th filing deadline.

Thanks to all of you for hanging in there through this chaotic tax season with me!

#fullambo out

OK! Still feeling like I’ve turned a corner. Getting returns processed. Cat is finding her “work at home” groove too. We are moving slowly through the stacks that have been here since mid-March when all hell broke loose. I am still having to set aside some of the more complex ones for when I am able to fully focus. When it comes to tax returns it’s a lot harder to fix them than it is to just get them right the first time. So I want to make sure I’m in top form when I’m working on the ones with a lot of moving parts (you know who you are).

If you still haven’t gotten your stuff into the office, that’s OK! Once I feel like most of the backlog has been cleared I will get a bit more pro-active about getting what remains out into the office. I’m hoping that this will roughly coincide with at least a lightening of some of the stay-at-home restrictions. We will see—that’s going to depend both on how quickly I work and how well we do at flattening the curve here in NM.

Again, we’ve got until July 15th and I’m planning on having most of them out well before then unless additional chaos ensues.

Thanks for hanging in there with us!

#fullambo out

Economic Impact Payments

I got mine. So I can answer one question—no, the IRS is not going to “do the math” to see if your dependent child who was eligible for the Child Tax Credit (CTC) in 2018 or 2019 is going to be eligible in 2020. You will get the additional $500 payment if the child was CTC eligible (age 16 or under) on your most recently filed return. Every now and then my procrastination pays off. I’m pretty sure I’ll be filing my personal 1040 on July 14th.

I got mine. So I can answer one question—no, the IRS is not going to “do the math” to see if your dependent child who was eligible for the Child Tax Credit (CTC) in 2018 or 2019 is going to be eligible in 2020. You will get the additional $500 payment if the child was CTC eligible (age 16 or under) on your most recently filed return. Every now and then my procrastination pays off. I’m pretty sure I’ll be filing my personal 1040 on July 14th.

Moving forward, and I am advising individual clients as their returns are prepared, I will be either filing immediately or recommending that you wait until you receive your Economic Impact Payment (EIP or ‘stimulus check’) to file your 2019 return. The recommendation will be based on whatever is most advantageous for you. I have already advised some clients whose income was higher in 2019 than it was in 2018 to wait to file their 2019 return until they receive their EIP. I’ll be doing the same for clients with kids who were 16 in 2018. It’s called “tax planning” and it’s one of the reasons you pay a #taxpro.

Non-filers (you aren’t required to file a return, not that you simply haven’t filed a return)

If you aren’t a client, or if you are a former client who dropped below the threshold for having to file a return, you have a couple of options depending on your individual circumstances:

- If you receive Social Security payments your EIP will be automatic. You will receive a direct deposit or a check without having to take any additional steps.

- If you don’t receive Social Security payments but you get, for example, SSI or VA payments and are still not required to file a return the IRS is providing a tool for you to enter the information necessary for you to receive your EIP.

It is important to remember that you should, under no circumstances, have to pay to receive your EIP. For best results always start at irs.gov or irs.gov/coronavirus, not Google. And watch out for phone calls and e-mails phishing for information as well. The scammers are out in force on this one.

Filers Who May Not Have Direct Deposit Information on File or Want to Update Their Direct Deposit information

According to Kelly Phillips Erb (aka The Tax Girl) in this Forbes article, the Treasury Department has created a new web tool for filers of 2018 or 2019 tax returns to input or update their direct deposit information (a whole two days before the #taxpro community expected it!). This tool can be used if you normally don’t get a refund, but rather, have to pay the IRS each tax season. You can use this tool to verify the amount of your EIP, confirm whether it will be direct deposit or check, and (if you are getting a paper check) enter direct deposit information to receive your payment more quickly as long as your check hasn’t already been mailed. Paper checks aren’t supposed to start being mailed until the end of this month or early May according to my most recent reading. You can also update your direct deposit information if your deposit isn’t already pending.

You need to have your most recently filed tax return in hand to answer some of the questions. If I prepared your return it is likely that the information the tool will be requesting will be on your COMPARE sheet (that handy three-year comparison that is usually at or near the top of the left-hand pocket of your tax folder).

Update! Word on the street (OK, on #TaxTwitter) is that the tool is not working correctly. Especially if you have not filed a 2019 return. Please be patient and check back once or twice a day. They will get it running eventually. Or I’ll post that they’ve scrapped it.

Finally, according to The Tax Girl:

For security reasons, the IRS plans to mail a letter about the economic impact payment to your last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment.

Based on my reading there are a host of complicating factors for economically vulnerable taxpayers, taxpayers who file injured spouse claims (one taxpayer of a married filing joint couple owes back child support and the other doesn’t), divorced taxpayers, etc. I’m not going to go into the weeds on those. If you are interested, I highly recommend the Procedurally Taxing Blog, but beware, the blog is written for tax attorneys and is not for the faint of heart. Nevertheless, several recent posts discuss some of the complicating factors in mostly plain language.

And that, taxpayers, is all I have to say about that. So, moving on…

Deadlines

As I already reported, the filing and payment deadline has been extended to July 15th. Pretty much all of the deadlines significant to my practice (including those for filing Tax Court petitions) have been extended. If you have to file an FBAR you have an automatic extension until October 15th. The good news is that the IRS recently clarified that the July 15th deadline specifically applied to taxpayers required to file a Form 8938 (for certain taxpayers with foreign bank account balances). Estate income tax returns as well as estate and gift wealth transfer tax returns have also, for the most part, been granted extended deadlines.

The one tiny bit that was still weird has also been fixed! All of the extensions resulted in Quarter 1 estimated tax payments being due after Quarter 2 payments were due. Until recently Quarter 1 payments were due on July 15th but Quarter 2 payments were still due on June 15th. That has been fixed. Now all balances due on 2019 returns as well as Quarter 1 and Quarter 2 estimated tax payments are due on July 15th (as of this writing). That’s good news and bad news. Yes, everyone has more time, but that does make it easier to forget about payments and to, perhaps, lose sight of just how much will be due in total on July 15, 2020. Consequently, I am encouraging all taxpayers with the means to do so to make their payments on time and/or to set calendar reminders with amounts due to ensure that those payments get made by the new deadline.

And speaking of payments…

Installment Agreements

If you are in an existing Installment Agreement with the IRS your payments have also been suspended. If you mail them a check, you can stop until July 15th. If you are in a direct debit agreement you need to contact your bank and ask them to suspend the payments temporarily. It is extremely important that you ensure that you direct the bank to reinstate your payments approximately two weeks before the first payment due after July 15th to ensure that you don’t default your agreement. I expect the IRS to be fairly graceful about this given the circumstances, but it’s always better not to count on that grace. And again, if the payments are not causing economic hardship, I certainly recommend that you continue to make them even though you don’t have to.

Student Loan Payments and Interest

One thing that I have not mentioned that was included in the CARES Act is that the Act suspends student loan payments through September 30, 2020. Both principal and interest payments are suspended with no penalty and no interest will accrue on these loans during the suspension period. So if making those payments is causing you a hardship, you can temporarily stop making them. Again, just don’t forget to start again when the suspension period ends!

That is what I know as of right now. The pace of legislation and the related relief provisions and the implementation guidance has slowed down a bit, especially for most of my clients. Larger firms and CPAs who handle larger small businesses are still getting hit pretty hard. Guidance concerning the Paycheck Protection Program loans (more on that in a future post) for partnerships and self-employed people just came out a day or two ago. I still expect that there will be more relief coming (including addressing the ‘donut hole’ for EIPs for college age dependents) but for now, the tax practitioner community is slowly catching up to the most recent batch of tax law changes and additional guidance.

Hang in there. Stay home. Stay healthy.

#fullambo out