I love living here in the west. We have lots of sayings about “things cowboy” out here:

I love living here in the west. We have lots of sayings about “things cowboy” out here:

- Cowboy (or cowgirl) up.

- Not my rodeo, not my clowns.

- Not my cattle, not my (uh) manure.

- Big hat, no cattle.

And the list goes on. I’ve visited lots of places in this country and all of them have their advantages, but I can’t imagine ever making a home east of the Rockies. I love the wide open spaces and the freedom they inspire. But sometimes what is an advantage in some circumstances (lots of freedom) proves to be a disadvantage in others, which brings me to today’s topic—tax cowboys.

Unlike, say, rancher type cowboys (who in my experience are a pretty conservative group if a bit dismissive of the whole “paperwork thing”), tax cowboys are more like rodeo cowboys. They are risk takers. They see the tax code and form instructions as a personal challenge. As obstacles to be overcome. As an opportunity to show you (the client) what they’re made of. They’re personable. They have swagger. They are really easy to like and even easier to believe because they often tell you what you want to hear. The problem is the risks they are taking are with your taxes and your money, not their own.

Tax cowboys aren’t the same as ghost preparers. They are often highly experienced, well educated #taxpros. They often are not the lowest bidder on price. They will sign your return as a paid preparer. And yes, signing a tax return as a paid preparer comes with its own set of risks. But the thing about tax cowboys is the big risks they are taking are with positions on your tax return and therefore with your money. “Not caught” is not the same as “accurately filed” and relying on the advice of a paid preparer may get you out of some penalties and interest, but it is rarely enough to get you out of owing more tax (sometimes a lot more tax) if your return is ever examined (audited) by the IRS and/or by the state. You sign that return too. By signing it (or authorizing the e-filing) you are stating that you have reviewed the return and agree with what’s on it. That’s why this office always includes time for a review before you sign the e-file authorization form.

Let me repeat “not caught” is not the same as “accurately filed” and tax cowboys are playing with your money and rolling the dice for you. The consequences will be on you. Fixing the issues will be on you. You may think you like the result now, but you won’t like it later and the algorithms that catch these problems are only getting more sophisticated. Be sure you know the big picture and are ready for the whole eight-second ride!

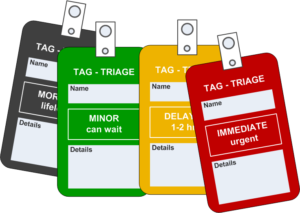

Tax Therapy is a small office. If you call during the off season (June through December), chances are high that I (Amber Gray-Fenner, Enrolled Agent) will pick up the phone. It is also likely that I will be the one responding to e-mails sent to the info or admin accounts. During tax season, however, there are usually two of us here: Me (Amber Gray-Fenner, Enrolled Agent) and Cat (Administrative Professional). A big part of Cat’s job during tax season (especially from about February 20th until the filing deadline) is what I call “Administrative Triage.”

Tax Therapy is a small office. If you call during the off season (June through December), chances are high that I (Amber Gray-Fenner, Enrolled Agent) will pick up the phone. It is also likely that I will be the one responding to e-mails sent to the info or admin accounts. During tax season, however, there are usually two of us here: Me (Amber Gray-Fenner, Enrolled Agent) and Cat (Administrative Professional). A big part of Cat’s job during tax season (especially from about February 20th until the filing deadline) is what I call “Administrative Triage.”

During the height of tax season I am up to my eyeballs in tax returns and research. Cat acts as a gatekeeper to ensure that I am performing at the highest possible level. She can answer most questions about our office policies and procedures. For example—

- Do you take credit cards?

- When do I pay?

- Did you get my stuff?

- When will my return be ready?

- When can I drop off documents?

- Where is the office located?

- Are you taking new clients?

- How much do you charge?

So many times when you think you need to speak to me, you don’t. Cat can answer your questions. If it’s a tax question or something more complicated, she will take a message or forward your e-mail and sometimes, if it really was a “quick question,” she will call you back or e-mail you with the answer(s) I have provided. It is only with Cat’s expert administrative help that I can manage the tax season workload. She is a critical part of “what makes office go.” So please, if you have a question or concern call (505-352-0058) or e-mail Cat rather than trying to reach me directly. If I am truly needed I typically respond within two business days.

All the time. My Dad is in his 80s and lives in another state. I have two (almost grown) children. I understand emergencies happen. If they happen to you, please do your best to call or e-mail to reschedule your appointment or to let us know what is going on. We will work with you to make arrangements or file an extension or whatever is needed. But I don’t charge for missed appointments and I don’t want to have to start.

If you are sick please do not come to the office. Please reschedule your appointment. It’s just me and Cat here and if either one of us gets sick during tax season it makes keeping up with the office workload pretty much impossible.

Please also do your best to avoid bringing your children to your review and signature appointment. I don’t mind kids. I don’t even mind kids in the office, but review and signature appointments aren’t always over quickly and interruptions just make them longer. And, when you and I are focused on your children, it makes it much more difficult to focus on your tax return and any planning questions you may have. Not to mention the office is not a child friendly environment—there are lots of breakables around, f-bombs are sometimes dropped, and if it’s after regular hours, there may be alcohol being consumed (by me and/or other clients). I understand emergencies happen and if you need to bring your kids to the office I am not going to stop you. I know how that goes! But please understand their needs and their thresholds and ensure that they have something to occupy them, that if they have food or drink that it is something that will not require clean up, and if they are sick—please leave them at home and reschedule.

No, this one is not about following the law. That goes without saying in the Tax Therapy office! This one is about office procedures, policies, and preferences that help us to process returns efficiently, keep prices reasonable, and keep my head from exploding.

If you have never actually been to the office, it is really small! Bigger than the old Nob Hill office, but still really small. We are a largely paperless office and we don’t have much in the way of storage space. So if you have ever walked in with a huge box of stuff and seen the look of panic in my eyes, that’s why.

Your attention to the following rules is much appreciated and helps tax season go more smoothly for us, which means faster turnaround time on everyone’s tax returns:

- Don’t even think about bringing “shoeboxes” or bags of receipts. Save your receipts and organize them (or not) however you wish but don’t submit them all. We do not do bookkeeping, sort paperwork, or run totals for you unless arrangements have been made in advance and these services are not included in the fee for preparing your tax return.

- Use the organizer! Review the client interview. Check the applicable boxes. Write notes and questions in the space provided. Total your receipts according to the categories on your organizer paperwork and record the totals where indicated on the organizer.

- Don’t submit your documents in “weird” folders. We keep your originals in your tax folder and we keep your tax folder in fire- and water-proof lock boxes. Large accordion files, folders with handles, etc. don’t fit in these boxes. If you bring your documents in in something like this, expect that Cat will remove them and return the container to you.

- Don’t use staples or tape to group your documents (paper clips or binder clips are OK). We scan the documents you provide to us and we have to remove tape and staples before scanning. We like returning things to you how you gave them to us, so we usually re-tape or re-staple paperwork. This may seem like not such a big deal, but when you consider how many thousands of documents we handle throughout tax season, trust me, it adds up. Paper clips and binder clips (within reason) are much easier and faster to remove and re-attach.

- Give us all of your tax documents but please open envelopes and self mailers and remove “filler” items. For IRS/State notices keep and submit the envelope. For general tax information like W2s and 1099s, retaining the envelope is not necessary.

That’s it. Nothing too complicated but it really makes a huge difference for us!

If I had a quarter for every time a client called or e-mailed with a “quick question” or a potential client said “my taxes are really simple” I could probably retire (not that I want to). If you’ve ever asked me a “quick question” you’ll know that most of the time my answer is along the lines of either “Off the top of my head I’d say this, but let me do some more checking and call you back.” or “I’ll have to run the numbers and call you back.” Truth is, in general, there are no quick questions. The tax code is complex and highly dependent on individual facts and circumstances—not to mention actual numbers. Just because a friend or relative or neighbor got this or that credit or deduction doesn’t necessarily mean that you get that credit or deduction too. Even if you think you are in similar financial circumstances you may not be. It never hurts to ask of course and I am happy to answer your questions, but I may not always be able to give the answer you are hoping to or expect to receive. And often I cannot answer your question without completing most or all of your tax return. That is why I encourage you to write down your questions on your organizer paperwork and return them with your other tax documents. And remember, a certain amount of “question time” is built into the price of your tax return preparation fee but extensive planning or calculations are considered a consult and billed hourly. I will always let you know if you are straying into billable territory. Also, if you are not a client, I cannot answer your questions, review your self-prepared returns, etc. I also don’t answer specific tax questions at social gatherings but I am happy to nerd out with you on tax policy!

The question is not can you, but should you?

I often answer calls from potential clients (often referrals from existing clients) who have 1099 (independent contractor/self employed) income. Sometimes they call because they “ran into problems with Turbo Tax.” More often it’s someone’s first time getting a 1099 instead of a W2 and s/he doesn’t know what to do. As always with potential clients who are self employed one of my first questions is “Are you aware of New Mexico’s Gross Receipts Tax and your filing requirements?” The answer is usually “No.” My response is a version of the following: “Well, this is separate from income tax and it is important to remain in compliance. I can help you with that too but GRT compliance consulting is a separate engagement from return preparation.” Sometimes after talking with them for a while I realize they may have filing requirements in other states. Being self-employed is not for the faint of heart. I can practically hear the panic on the other end of the line.

Often I am then asked about my charges and I provide the basics and some of the information about how I add value and reference this post as well. I tell the callers to think about it and to call me back if they would like me to send them an organizer (our preliminary paperwork packet). I remind them my job is to make sure that they are in filing compliance and are paying the correct amount of tax (no more, no less). Usually that’s the last time I talk to them. Frankly, I am usually surprised when a caller like this calls back. And that is OK. I would rather know early on that they won’t be a client than have them come on board and then end up arguing with them about the return results and having them refusing to pay for the work. That situation happened a couple of times last year and has resulted in a pre-payment policy for new clients coming in during tax season. These callers may find another #taxpro. Or they may go ahead and do their returns themselves and hope for the best. I have a colleague who makes probably half of his annual income representing clients before the IRS for mistakes they made because they tried to do their returns themselves. Remember this meme?

It goes hand in hand with my mantra “The rep rates are three times the prep rates.” You may see my prices and think “way too expensive.” But what I charge for preparing an accurate return is about one-third of my rates for representing clients in front of the IRS or a state taxing authority. My return preparation charges are in line with national and regional averages. Representation, however, is pretty much “lawyer work” and my rates are similar to what a lawyer will charge. And that’s a “regular” lawyer. Not a tax attorney.

In the end, the decision to do your own taxes is up to you but if you are self-employed (especially here in New Mexico) it may be a “false economy.” The amount of time and money you may have to spend to fix your mistakes could be more than just hiring the right #taxpro in the first place.

The Tax Girl (Kelly Phillips Erb) has an excellent post called 12 Questions to Ask When Choosing a Tax Preparer. It’s a great post, especially if you have actually narrowed the list of possibles to a few probably qualified candidates. My list of 5 questions overlaps some with hers, but is geared more toward finding that short list in the first place:

- What are your credentials? (CPA, Attorney, EA, Annual Filing Season Program Completion, etc.) Kelly covers that in her post or for more information click here or read this earlier post. You might also ask about professional affiliations. Is the practitioner a member of the NATP, NAEA, AICPA, etc? While membership in professional organizations does not necessarily indicate competence, it may indicate a certain level of seriousness about the profession.

- How much continuing education do you normally do each year? Each credential comes with its own requirements. Note that CPA and Attorney continuing education requirements do not necessarily have to be in tax matters while those for Enrolled Agents and the AFSP are specific to tax matters and professional ethics. In my opinion 15 hours of continuing tax education each year is the bare minimum for maintaining professional competence. I am required to have 30 hours per year (the EA credential requires 24 per year average over three years, my NAEA membership requires 30 per year). I usually take 50 or more.

- How long have you been preparing returns and how many returns do you prepare each year? Experience isn’t always required, but it is helpful. I was talking to someone a few years ago who said that she had a former IRS employee interested in buying her tax practice. She said that during her first conversation with him it came up that he had never actually prepared a tax return. Depending on the complexity of your return, that could be important. The number of returns prepared per year speaks both to the preparer’s experience and to his or her availability. My personal opinion is that even with outstanding office processes and a certain amount of support staff it is difficult for any one preparer to handle more than 250-300 or so returns per year. Now, if that preparer is part of a larger office where interviews and data entry and other tasks are handled by support staff the number could be larger (even much larger). This is more of a judgment area for you. How much personal interaction do you need/want with your preparer? Are you willing to pay more for more/better access (some preparers offer ‘concierge’ service for a premium)? The answer to those questions may help you to determine if your potential preparer is right for you.

- How much experience do you have with my type of return? If you have rental properties; live abroad; are clergy; are in the military; have income from multiple partnerships, trusts, etc.; or if the return is a business entity return (or any number of other highly-specialized situations) it is important that your preparer have experience with that type of return. People who routinely work in multiple states (truck drivers, pilots, flight attendants) need specialized support as do farmers, ranchers, and professional fishers. It’s OK to go with someone who has only limited experience, but you should be comfortable with their ability and willingness to research the necessary issues (which is one reason why that continuing education question is so important). For example, I recently declined a potential client because I don’t generally do returns for retail businesses (the business return side of my practice focuses more on the needs of freelance professionals and personal service providers).

- How will you protect my information? Don’t expect an extremely detailed explanation, but paid preparers are required to have a written security plan. That should include computer security (firewall, malware protection, and update schedules are the bare minimum). In addition to computer security, the preparer should also have policies on staff training (if applicable) and physical protection of your information (how paper files, laptop and desktop computers, and backup media are secured). Finally, you should ask about their data storage and backup plans. This post contains a few more specific questions related to computer security. Again, don’t expect specifics, just enough information to ensure that your data is reasonably protected from being damaged, lost, or stolen.

Notice that not one of these questions is “How much do you charge?” Preparer fees exist on a continuum and those competing on price alone are rarely your best option. Cost is always a concern and, as someone who also does personal finance coaching, I would be remiss if I told you to simply throw caution to the wind and to hire whomever you want. Many preparers can and will give you an estimate based on prior year’s tax returns if the current year’s return is expected to be similar. You can download Tax Therapy’s Quote Request here. When evaluating cost consider the preparer’s credentials and continuing education (those are expensive to maintain), the office overhead (support staff and large offices are obviously more expensive to maintain than a lone preparer working out of a home office), and level of service provided (can they represent you, are they in the office all year, etc.). As with all financial decisions trade-offs exist. Find the preparer that best meets all of your needs and realize that may not be the lowest cost option. Of course it is important to remember that higher price is not a guarantee of quality service. As always, choose wisely, choose well.

Many years ago, when my kids were still little, I mentioned to my friend, Julia, that we were having a birthday party at a kid-oriented pizza franchise (to remain nameless). She promptly responded “I have a strict policy of not eating at restaurants that have rodents as a mascot.”

I remembered this on the drive back from lunch recently when I saw the guy (talking on the cell phone) dressed as the Statue of Liberty waving the sign for one of the big tax franchises. I’m not against tax franchises in general. Some of the best, most experienced #taxpros I know either got their start at a franchise or own/operate a franchise.

I’ve said often that price should not be one’s primary consideration when choosing a tax preparer. I blogged recently about the importance of having a preparer who is serious about technology and information security issues. I guess another consideration should be a certain seriousness about the profession. The person preparing your tax return is holding your financial life and identity in their hands. You don’t necessarily want to choose the lowest bidder and you maybe want to reconsider choosing the one with the mascot.

In an earlier post I discussed the various types of paid tax professionals and at the end I mentioned that, at an absolute minimum, your preparer needs to hold a valid preparer tax identification number (or PTIN). Ghost preparers are paid preparers who do not hold PTINs. They are often (but not always) small, independent, tax season only preparers using software meant for personal preparation (such as TurboTax) to illegally prepare returns for other individuals for pay.

Update (February 8, 2019): Read what the IRS has to say about ghost preparers here.

The main difference between a true ghost preparer and, let’s say, your aunt who files your return using her copy of TurboTax and you slip her $50 bucks for her help is that ghost preparers hold themselves out as actual tax professionals, often to family and friends, but often to others as well.

The problem with ghost preparers (and for that matter your aunt) is that they have absolutely no accountability to the IRS or to you, the taxpayer, for their work. They do not have to comply (or even pay attention to) safeguarding your personal information from disclosure or theft. They do not have to abide by any ethics rules. And they do not have to help you (often they are not allowed to help you) if you receive a notice from the IRS for an audit or any other issue that pertains to your tax return. Their responsibility ends once your return is filed whether correctly or incorrectly or, worse still, fraudulently.

So how do you avoid using a ghost preparer to prepare your income tax return? Before you give the preparer any information make sure s/he has a PTIN. If the preparer doesn’t know what you’re talking about run, don’t walk, to another preparer. The IRS Return Preparer Office has a searchable directory that you can use to determine if your preparer has a PTIN but it does not include those who do not have not obtained any professional credentials or qualifications. If you’re still unsure, check out this article by The TaxGirl (Kelly Phillips Erb).

Think you’ve seen a ghost preparer? The easiest way to tell is to look at the signature area of your tax return. Under the signature block there is an area that says “Paid Preparer Use Only”. That block should have your preparer’s name and contact information. Older returns may have the preparer’s PTIN; newer returns often have the PTIN masked. If it says “self prepared” your preparer is a ghost preparer. Remember, if your return preparer used your return to commit fraud his or her name isn’t anywhere on the return. You effectively own that fraud.

So please, be careful when choosing a #taxpro. Of all the options available you should be able to find one who both meets your needs with respect to the level of complexity of your return and your price requirements. Remember you are entrusting this individual with your identity and most if not all of the details of your financial life (and many of the details of your personal life). It’s too important a decision to make quickly or based on price alone.