After almost a year, I’m back on the blog. Heading into the third pandemic-affected filing season, much has changed here at Tax Therapy.

First, I am working from home for the foreseeable future. That means the practice has transitioned from mostly office-based to mostly virtual. The only clients I will be seeing in person are those who qualify for a house call. I am still taking paper documents through the mail or, if you are in the Albuquerque area, by local courier. If you are a potential client please continue to browse the website and then, if you feel like I can meet your return preparation needs, click here to book a discovery call.

Second, I am (for the most part) now working solo. Cat has a new full-time job and will be helping as necessary to wrangle actual, and occasionally electronic, documents, but she will not be here to provide near instant answers to your phone calls and e-mails. Please allow 24-48 hours for a response and understand that during March it can take me up to 72 hours to respond to your inquiries.

Third, while I am currently accepting new clients, I am only accepting new 1040 clients (individual returns). I will not accept new clients who require entity returns (Forms 1065 or 1120-S) once filing season has started. Entity returns are much more complicated and the new client onboarding process is much too involved for one person working alone to attempt during tax season. Entity returns also have a March 15th deadline and I don’t feel that I can realistically meet that deadline for entity clients who are brand new in January. If you are interested in having me prepare your entity return, I encourage you to use the contact form to let me know and I will put you on a list of potential clients to contact later this year (typically starting in June).

Finally, my cutoff date for accepting new clients will likely be even earlier this year than it was last year. Last year I stopped accepting new clients on March 10th. This year I expect to stop accepting new clients as early as February 20th to ensure that I can manage my workload and meet the April 18th filing deadline for as many clients as possible. I have not yet decided whether or not I will be taking new clients during the summer and fall extension period. As Magic 8-ball says “signs point to no” but I reserve the right to change my mind.

Everyone (the IRS, the National Taxpayer Advocate, tax industry organizations, and tax professionals) are predicting another “hairy” filing season. Personally, I’m feeling a return to something resembling normal but I am also preparing for a bumpy ride. So put on your seatbelts and let’s get going!

A couple of weeks ago I was talking with some colleagues about being forced to watch videos to learn features available in new software and just how much I didn’t like that. The videos are slow. I can read faster than that and I comprehend better as well. Usually, I’m going to want to read about something and then maybe watch the video to see how it’s actually done. That’s not how I roll 100% of the time, but in general I’m a reader not a watcher.

A couple of weeks ago I was talking with some colleagues about being forced to watch videos to learn features available in new software and just how much I didn’t like that. The videos are slow. I can read faster than that and I comprehend better as well. Usually, I’m going to want to read about something and then maybe watch the video to see how it’s actually done. That’s not how I roll 100% of the time, but in general I’m a reader not a watcher.

I’m considering this in light of recent client pushback concerning my (admittedly lengthy) “help” e-mails. I’m writing volumes of free help information that targets specific issues my clients are having and distributing it to clients along with links to video help and the knowledge base provided by the software. My business is doing tax returns, not doing tech support on my client management software. That said, I want to help when different clients are all having the same or similar problems. So, I write. Why don’t I do video? Because the software has done that. Also because some people, like me, prefer written to video help. So, I’m doing my best to do both what works for the office and what allows me to “meet clients where they are” so to speak.

While the office has always been able to manage contact free service in one form or another (mail, portal, etc.) after last year I decided that we needed to automate some of the more routine administrative aspects of the return preparation process as well as to increase our “one to many” communication. The change was necessary in order to accommodate client volume while still maintaining a degree of personal service and some work life balance for the office staff (me and Cat). We want to be able to focus on tax returns and complex issues, not booking appointments or answering e-mails about the secure portal. Pushback on these changes has included clients leaving and me telling clients that we can no longer meet their expectations and to find a new preparer. Yes. I have fired clients who, instead of asking for help with a specific problem, simply wanted to complain about not liking the changes I am making—to my business.

I get it. Change is hard. No one likes it. Me included. I’m in my 50s and it’s not getting any easier for me to adapt either. But sometimes it’s adapt or die. Last year it became adapt or die for this office. The changes I’m implementing, while causing some short-term pain, will be both beneficial and necessary for the long-term future of my business. So, while it is unfortunate that some clients have chosen to leave or I have chosen to curate them from my client list, I still hope that they find another preparer who meets their needs. Specifically I hope that

- The new #taxpro pays attention to office and internet security

- The new practitioner’s business model meets both their price point and their income needs

- If the new practitioner’s business model is built on working 60-80 hour weeks during tax season (especially during this tax season which has been compressed by an additional two weeks and hundreds of pages of new tax law) that they are able to prepare the return accurately. The cognitive decline that comes from a lack of sleep is a real thing. Tired #taxpros make more mistakes.

- If the new practitioner’s business model is built on doing a high volume of returns at a low price that they spend enough time with you and on your return to prepare it accurately the first time. And if they don’t that they are around in the off season to help you with any resulting IRS or state notices.

Why do I hope this? Because high-volume, low- to mid-price business models are getting increasingly harder to sustain without automation. The Covid-19 related legislation alone is adding 20-30 minutes to each tax return I prepare just to make sure I’m getting clients all the benefits for which they may be eligible and the correct amount of stimulus money. I read about one #taxpro who says he spends his summer amending returns for free because of all the mistakes he makes during season. He works six or seven days a week and ten to fourteen hour workdays. No wonder he’s making mistakes. Then there’s the general cognitive decline that comes with age. I do not have the memory I had when I was 30. Or even 40. I’ve added automations as “brain extenders” because I’m not willing to run the risks that come with cognitive decline when those risks affect your tax returns.

Maybe you don’t care. Maybe face-to-face completely unautomated service is so important to you that you go out and find a relatively young “old school” preparer. Maybe you won’t outlive them. Maybe they won’t also decide that their business model is unsustainable and decide to make changes. Maybe the demands of the job the way they are currently doing it won’t cause them to make errors. Or maybe, just maybe, it won’t be this year and it won’t be your return.

#fullambo out

The two most beautiful words I heard on #TaxTwitter this weekend were “seller’s market.” What does that mean? It means that good #taxpros are in demand. Good #taxpros. I’m seeing loads of newbies on FaceBook who have passed a test or taken a few classes and decided to open a tax practice asking for advice on everything from what to charge to who qualifies as a dependent to, wait for it, how to prepare a Schedule C.

I’ve mentioned before that “not caught is not the same as accurately filed.” By the time taxpayers get the notices on these returns these preparers have probably closed up shop for the season and are nowhere to be found. Not all of them. Some, who decided to charge really low prices to get clients in the door, will still be working filing what I hope are free amended returns to fix their mistakes. That sucking sound you hear is their profit margins going down the toilet because they charged too little to begin with and now they have the pleasure of doing the return twice. At least I hope they aren’t charging for the amended returns. I had to call a client yesterday morning and to tell her I recently became aware of some “fine print” that could result in tax savings for her and because it was something I missed on her returns I would, once I verified my mistake was really a mistake and she qualified for this benefit, be filing three years’ worth of amended returns for her, for free. Why? Because I’m a good #taxpro. And we are in demand.

You want to know how I know we are in demand? Because the first question potential clients are asking me isn’t “How much do you charge?” it’s “Are you taking new clients?” The answer is yes, but not all of them.

Last year was hard on tax professionals. Some of us aren’t convinced “last year” ever ended. People made themselves ill, people got hives from the stress, people died, some died at their desks and here we are starting what appears to be another chaotic filing season. Last year was absolutely brutal on me and I only have a small practice and not many small business clients. I was stressed, exhausted, and angry. I’ve been working continuously since last January and I’m still stressed, exhausted, and angry. I’m just handling it better. Part of the reason I got no break was that I decided that what made the 2020 extended filing season so unsustainable was the administrative work (e-mails, phone calls, etc.) associated with scheduling appointments for potential and existing clients, answering the same questions over and over, and chasing paperwork (specifically my engagement packet and annual client interview) while trying to keep up with tax law changes and preparing tax returns. Part of the reason I’m handling the stress better is that I spent most of October through December of 2020 adding software that automates the administrative parts of return processing and appointment scheduling so that Cat and I can focus on preparing complete and accurate tax returns for our clients instead of answering the same handful of questions dozens (or hundreds) of times by phone or e-mail.

So why the salt? In a word? Pushback.

So why the salt? In a word? Pushback.

I get it. Change is hard. If you think it’s hard to adjust to a new system imagine having to actually set up the new system and use it, not just once but hundreds of times. And yet, most of my clients are managing. Even the ones I thought of as “not super techy” are giving it a try and figuring it out. It’s an imperfect system and I’m learning as I go. It’s not always easy and at times everyone has been frustrated (clients, me, Cat). I am letting the frustrated clients know that I appreciate their patience and feel their pain. I also understand that it’s harder to adapt to a new system when you only use it once or twice a year. I’m cutting some slack, but I’m not cutting slack like I did in 2020 when I basically did whatever I could to help my clients even if it meant sacrificing my own well being.

After fielding a few calls from disgruntled clients, I decided yesterday that I’m simply not taking pushback on my new client management system. My office processes are reasonably flexible and always have been. I will take what I am learning this year and make refinements that make the system and my processes easier on both the client and the office side. I don’t want to frustrate my clients, but I also don’t want to be crushed under the weight of admin work that can be automated.

Consider this, when you find a doctor that is taking new patients do you tell that doctor how to run her practice? I don’t think so. Well, when you find a tax professional, especially an ethical, competent, experienced tax professional, who is taking new clients, it’s probably a good idea to work within their systems instead of telling them how you want to do things.

If you’re reading this and thinking “Well, that’s nasty, I will just take my business elsewhere” I understand. But remember…seller’s market. I’m not trying to price gouge you. I’m not trying to make your life hard. I’m trying to earn a living in a demanding job with extremely high consequences of failure without killing myself in the process. So if my office policies and procedures don’t meet your idea of the way you think things should be done, shop around and find someone with a practice that does. It may be a seller’s market, but there will always be practitioners out there at all price points, experience, and service levels.

Clients who value me will find me and clients who don’t will find a practitioner that better meets their needs. Because truthfully, when it comes to preparing your tax returns, if you can’t tell the difference between me and the person at your church who is using Turbo Tax and charging $100 per return, we are both probably better off if you choose that person, me for the long-term health of my business and you, well, until you aren’t.

#fullambo out

That’s me in super sneaky spy mode.

At the end of the day yesterday I was mailing some paperwork to a couple of clients (yes, we still do that here, especially for clients with limited internet access). I had to create mailing labels for the envelopes. We have a dedicated label printer to help with that job. When I upgraded the office computers this December, I also very carefully went through and updated firmware, drivers, and software for all of our peripheral devices including the label printer. Well, wouldn’t you know the label printer has new software. Software that wants to connect to MS Outlook 365. I hit the connect button and then it asked for my login information to MS Office 365. And then I stopped. Why? Because I had to give that a think:

- When I connect my Office 365 account to the vendor software for the label maker, just how much access are they getting?

- Do I trust that they are only going to use information within Outlook itself or by entering my MS Office 365 credentials do they have tentacles into my other Office applications as well?

- Even if I trusted that the “connect” software was only looking at the Outlook contact information, do I have any idea what the vendor is doing with that data or their requirements to keep it private?

I had no answers to these questions. Still don’t. So, while it’s an order of magnitude less convenient for me, until I can find answers or a workaround where I can control who’s doing what with the data, we’re typing each label for printing. Here’s why…

Every paid tax preparer has to have a written information security plan (or WISP). It describes our security protocols and our processes in the event of a data breach, unauthorized disclosure, or disaster. #Taxpros reading this, yes, your WISP needs to include disaster recovery provisions in addition to data breach and disclosure. Data breach (hacking, etc.) and unauthorized disclosure are two different dogs. Paid tax return preparers are required to obtain specific consent for certain disclosures of their clients’ information. Many, possibly most, #taxpros think of this as needing consent to talk to the parents of an independent adult child about that child’s taxes (when they are paying for return prep) or for talking with a client’s financial advisor to optimize their retirement account withdrawals or for providing a copy of a tax return to a mortgage broker. But there’s more to it than that.

Any time a paid preparer discloses private (not necessarily sensitive, not necessarily confidential) client information to another party they are supposed to have specific consent. Of course there are exceptions, return preparation software being the most obvious. I did not include my label machine’s vendor in my client consents for this year. I did ask for specific consent for my scheduling application, my mass e-mailing software, my client management software, my billing software, the application I used to send texts to clients, etc. Why? Because that’s what I’m required to do. And, yes, I think to an extent it is overkill. I think the IRS is way behind the times with respect to understanding just how automated and how connected tax office operations have become. I did my best to ensure that I was complying with the spirit of the IRS requirements without getting my office and my clients so bogged down in authorization paperwork that no time was left over to actually prepare tax returns. I took a hard look at the software subscriptions I was using to automate my practice and was careful to only include in each of them that client information that was absolutely necessary (for example, the mass e-mailing software only has e-mail addresses, no physical addresses or phone numbers, the texting software only has phone numbers and birthdates for sending birthday texts). I didn’t just create a spreadsheet from my tax software or Outlook and import that into each application.

Why am I telling you all of this? Because my social media is filled with tax professionals (new and experienced) who are using automation tools (and their cell phones) in their practices. And it is becoming clear to me just how many are only looking at convenience and not security. The vibe I’m getting is something along the lines of “well everyone else is doing it so it must be OK/safe.” It really isn’t. Security and convenience are always a balancing act. Some things at Tax Therapy are more difficult (or more manual) than they have to be because I have thought through the security consequences and decided to err on the side of a bit more manual processing. If your #taxpro has given it some thought and decided that they can accept or mitigate the potential risks of a given technology, that’s fine. Every practice is different and has different resources to devote to IT, software evaluation, etc. It’s all of those #taxpros who aren’t even giving the security side a second thought that I’m concerned about. And if you’re a taxpayer using a paid preparer, you should be too.

Paid tax return preparers are not allowed to sell your data. But what happens when they provide your data without your specific consent to a vendor who then sells it or uses it to sell you more products? I’m looking at you, Intuit! I’ve been reading that clients of preparers who use Intuit’s suite of professional products are being solicited to use one of Intuit’s DIY products when they sign in to, for example, retrieve their W2s and 1099s or complete their tax professional’s annual client organizer. Not cool. Not cool at all.

I can’t run my office profitably without a certain degree of automation. There’s only so many days in tax season, only so many hours in a day, and only so much brain time in a given set of hours. But Tax Therapy clients can rest assured that I have devoted a huge portion of my (not inconsequential) brain power to ensuring that I’m only disclosing as much of their data as I absolutely have to to a given vendor and that I am getting their consent to do so each year. Tax professionals, what about your office? Taxpayers, what about your #taxpro?

This post is based on actual conversations that have occurred in the Tax Therapy office.

This post is based on actual conversations that have occurred in the Tax Therapy office.

Mid-March 2019. The phone rings and I answer it.

Me: Tax Therapy, this is Amber.

Caller: Hi, yes, I was wondering if you could do my taxes?

Me: Well we are taking new clients.

Caller: When can I get an appointment?

Me: Before I do that I need to let you know that we do not do taxes while you wait. Our process is to send you some preliminary paperwork to complete, have an intake appointment where we review the paperwork and your documents with you as well as doing an ID check, and then you leave your stuff and we put it into our processing queue and call you when it’s ready for review and signature. Right now the turnaround is about three weeks [2/3 of our volume came in during a 2 week period in March that year] but if you get onboarded I will make every effort to ensure that you are filed on time.

Caller: Oh. I really wanted to get them done right away.

Me: In that case I recommend using one of the large franchises, especially if you can find one that is locally owned and operated. They are set up for while you wait return processing. I am not.

Caller: I didn’t want to do that. I don’t like them and they are expensive.

Me: I’m sorry but I really don’t have anything else to offer you. Most of the smaller shops I know are either not taking new clients or fully booked right now.

Call ends.

Conversations like these happen all the time in small tax practices all across the country. When I’m helping tax practitioners with practice management I often tell them that managing client expectations is important. Equally important is communicating boundaries to potential clients.

This post is for taxpayers who may be shopping for a #taxpro for the first time or looking to make a change this filing season. The time to shop is now. Actually the time to shop was last fall, but most #taxpros aren’t thoroughly in the thick of things right now and can still accept new clients without requiring an extension.

If you are looking for a #taxpro it’s important to understand some of the realities of running a tax business.

First, it’s a business. In most cases your fee is not simply profit to us but is paying for things like software, insurance, and continuing education. Not to mention office rent, phone/internet, and staff. We cannot discount our fees because of your circumstances or expectations.

Overhead is a thing. Ever gone through a fast food drive through, purchased two full meals and thought “Wow. For a little more money I could have had better food and supported a local business.” When you purchase from a large franchise you are paying for convenience, consistency (which, like fast food, can still be hit or miss), and their overhead (physical space, employee training, and advertising). Small shops often have lower overhead but that doesn’t mean they have no overhead.

Tax season is, by its nature, time limited. In other words, there is a fixed amount of time to see clients. Many #taxpros factor this into their pricing. They figure they can do X number of returns in a season and need to make $ to cover their overhead and make a profit (in other words, actually pay themselves for the work they’re doing). Big franchises have some higher paid employees but also make use of armies of lower paid, lower experienced employees to maximize their profits (higher return volume, done for lower cost). In some big “fancy” firms your return may be reviewed and signed by a highly paid, highly experienced professional, but they may only be giving it a cursory review. Again, this helps firms increase their profits (which should be the goal of any business). In smaller shops, it’s often a highly experienced #taxpro actually working on your return with the help of some lower paid support staff. And there are only so many hours a day that we can “brain.”

If you’ve ever heard the phrase “good, fast, or cheap; pick any two” that applies. If you want personalized service and someone to take the time to listen to your calls and explain things to you, that is often not going to be your cheapest option. You may be able to find that level of service for a reasonable price (something in line with what a franchise would charge or maybe even a bit less due to lower overhead) but those firms are not going to be willing to adapt their business model to your expectations. In other words, they cannot change from a drop off firm to a while you wait firm because that is what you want. They are a drop off firm because that is how they both do their best work and because its factored into their price structure.

If you want while you wait service, expect to pay for it. Same thing if you want a highly personalized experience or need a lot of advice or want your #taxpro to be available year round.

If you’re looking for a lower price you may need to find a #taxpro who doesn’t maintain a physical office (rent is a huge part of overhead). No office may not guarantee a lower price, but if you need a #taxpro with a physical office space do not expect bargain basement prices. You may need to accept a longer turnaround time because they don’t have staff to help them. And having staff doesn’t guarantee fast turnaround (especially if the firm is already backlogged). Doing a thorough and accurate job on a tax return takes time, no matter how simple you may think your situation is. You may also need to accept that your #taxpro is only available during tax season and that you may not be able to find them if a situation arises May-December. Or that if you do find them, they may not have the time or experience needed to help you.

Finally, this is why #taxpros get really prickly mid season (OK, sometimes earlier) about price shoppers. Especially #taxpros in solo firms. At the height of tax season time spent on the phone with price shoppers is time that could be spent doing billable work.

Early April 2019 – Monday Morning

Cat was not working Saturday so I turned off the phone so I could focus on finishing returns. I worked a full 8-10 hour day. I either took Sunday off or spent it doing office administration or housework instead of working on tax returns. I get to the office and check the voicemail which includes a few inquiries from potential clients.

Me: Hi, this is Amber from Tax Therapy, I’m returning your call from Friday night.

Caller: Oh. I already found someone. You weren’t fast enough.

Me: OK. Great. Good luck and thanks for calling.

I think the caller expected me to feel bad. I did not. Again, my tax practice (and those of many other solo practitioners) are not set up to do high intake volume late in the season. I am well aware of my physical and mental limitations. There is a fixed amount of “deep work” I can do in a given day/week/filing season. By the time this caller called I was 90% focused on moving returns out of the office and doing “extension triage,” 5% focused on ongoing resolution matters for clients, and 5% focused on process improvements for next filing season. In other words, by the time this caller decided to look for a #taxpro, the current filing season was already all over but some shouting in my office. I still might have been accepting new clients, but not one whose turnaround expectations were so high. I mean, if the caller couldn’t wait until the next business day for me to return the call, what’s the likelihood of them accepting an extension?

The Final Word in Confusion

The big tax franchises and the DIY software providers spend a lot of resources convincing people that “every person is a tax person” and that return preparation is a transaction. A widget for sale. And the more widgets they sell the more profit they earn. When you’re looking for a smaller shop, before you start calling about price take some time to decide which type of shop you are really looking for. Do you want a high-volume transaction type shop or a smaller, more relationship oriented shop? Are you just looking for fast turnaround on a basic return or do you want more personal service? After you’ve answered those questions, then you can look at what’s available in your area and start price shopping. And again, be aware that if you’re calling during peak season many relationship shops may not be able to meet your expected turnaround time, may charge a higher price if they can meet it, and may not be taking new clients at all.

This post is not about the different types of credentials for paid tax practitioners. You can read about that here. This post is about the difference between box fillers and true tax professionals. Even someone with letters can be a box filler instead of a true tax professional.

This post is not about the different types of credentials for paid tax practitioners. You can read about that here. This post is about the difference between box fillers and true tax professionals. Even someone with letters can be a box filler instead of a true tax professional.

If you are a taxpayer reading this I hope it gives you some insight into why some of us charge what we do, why some of us ask way more questions than your prior preparer did, and why some of us get really salty and give you a version of “don’t let the door hit you in the butt” when you tell us in March that someone at your church will do your taxes more cheaply and without all the questions.

If you are a tax practitioner (enrolled or unenrolled, full time or part time, self employed or employee) reading this I hope it makes you think about your professional obligations and what type of tax professional you currently are and what type you want to be. Again, not the letters, letters show a degree of dedication and seriousness, but aren’t a guarantee of passion for the profession or, sadly, competence.

I’ve been noticing certain entrepreneurial types selling practitioner education, especially for the EA credential (which requires a test but not a college degree or an apprenticeship period), by saying that once someone completes the training and/or passes the EA exam that they are ready to prepare tax returns and represent taxpayers before the IRS. They are not ready. They are especially not ready to open their own businesses (many have no idea about information security requirements, insurance, etc.). Now, I love the Enrolled Agent credential because it doesn’t present as many barriers to entry to the profession as, for example, the CPA credential. Too often these barriers to entry have been arbitrarily used to keep our profession old, white, and male. But the lack of barriers to entry is both a blessing and a curse.

Lately I’ve been tweeting about some of what I see in FaceBook groups for paid tax practitioners. Some (not all) of these practitioners are new EAs and they are now opening their own tax practices without any actual experience preparing tax returns. It’s awful. Truly awful. Not as bad as some of the advice being given by finance and business “influencers” on the various social media platforms (save me from Tik Tok Tax!), but still pretty bad. Here are a few examples:

- An investment adviser who does “a small amount of tax prep” asking other professionals how to set up accounting software.

- A brand new CPA with zero tax experience preparing returns for “friends & family” with zero awareness of the most basic knowledge needed to prepare a Schedule C (Profit/Loss from Business)

- Paid preparers telling other paid preparers who does and doesn’t qualify as a dependent without explaining the tests for “qualifying child” v “qualifying relative” or citing form instructions or any substantial authority

So what is the difference between a true tax professional and a box filler?

- True tax professionals know to consult the form instructions and/or a quick reference tool (which they are willing to purchase each year) before asking questions of other practitioners on social media. It always amazes me how many people who get paid to prepare tax returns clearly do not consult the form instructions when they have a question about an entry on a return.

- True tax professionals understand the concept of “substantial authority” when taking a position (even something as seemingly obvious as filing status or who qualifies as a dependent) on a tax return. IRS publications and what other people said on social media and googled articles may all be correct, but they are not authority. Tax practitioners need to be aware that there is actual “substantial authority” underlying the correct answers and know where to find it just in case the return is ever examined (audited).

- True tax professionals have a grasp of tax concepts beyond simply which amounts from which forms go on which lines of a tax return. They understand how the lines and forms are related to each other and the tax concepts (capital gains, passive income, business income & expense, etc.) underlying the mechanics of the return. Box fillers know mechanics (what goes where). True tax professionals can look at a tax return and spot items that look “wonky” and can (and will) go back into their software to investigate.

- True tax professionals do not rely on software to find errors or to prepare a return. They use it for automation and arithmetic. They know enough to be able to spot when the arithmetic might be wrong or when the return is not correct (i.e., something is being reported on the wrong line, form, or schedule).

- True tax professionals, even if they rarely consult the Internal Revenue Code (IRC), understand fundamental concepts in tax law such as gross income, business versus hobby, capital gains, etc. They may not be able to quote IRC “chapter and verse” (yet), but they have learned enough to have internalized the fundamentals.

- True tax professionals know what they don’t know and know when to refer a client or potential client to a specialist. For example, I know the basics of cryptocurrency taxation and if one of my clients decides to dabble, I’m pretty confident that I could prepare an accurate return. If, however, a serious crypto trader wanted to be my client, I would consult with the crypto specialists I know to determine what additional skills and software I should have before accepting this engagement. I might need to spend money to get the education and resources I need to take this client but that could also open the opportunity for more of the same type of client. If I’m not willing or able to spend the necessary money and time (maybe I just don’t want to do that kind of work) then I am ready to refer this client to someone who specializes.

All that said, many taxpayers only need a box filler. Single people with a few W2s and no children who could DIY but don’t want to do not necessarily need a true tax professional. The problem with choosing a box filler is that if life changes complicate the tax situation your box filler may not know how to prepare the return. And worse, the box filler may not know what they don’t know. Taxpayers should exercise caution when choosing someone to prepare their tax returns and anyone accepting payment for preparing a tax return needs to consider the harm they are doing to taxpayers and the professional preparer community when they work outside their competence level.

#fullambo out

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

For Tax Year 2020 taxpayers who take the standard deduction can make an above-the-line adjustment for cash contributions of up to $300 on their 1040s. There’s a marriage penalty here. The $300 for 2020 is on a per return, not a per taxpayer basis. So single filers can make a $300 adjustment and married taxpayers filing a joint return can make a $300 adjustment. The IRS has recently issued guidance (that contradicts the actual law) that says married taxpayers filing separately can only take a $150 adjustment. It’s incorrect but the tax savings are not worth the expense if the IRS decides to assess a penalty (more on that later).

In the more recently passed legislation the marriage penalty was removed. Each taxpayer may contribute up to $300 in cash to qualified charitable organizations. So for Tax Year 2021 it is possible to take an up to $600 above the line adjustment on a jointly filed return. Singles and Heads of Household still can take up to $300. Again, this is for taxpayers who do not itemize their deductions. Taxpayers who use Schedule A to itemize their deductions continue to deduct all of their qualified contributions on that schedule.

Now for the fine print. The IRS will be watching. The Service has stated that there will be a 50% penalty if you claim this adjustment without proper substantiation. What does that mean? It means receipts. Here’s a link to some information on proper recordkeeping for charitable contributions. In general, clients should always be maintaining the records necessary to substantiate their charitable contributions. But for this adjustment in particular it is even more important for the #taxpro to keep the receipts that substantiate this adjustment in the client’s tax file for the applicable years in case the IRS comes looking for them. Don’t be the client who tells your #taxpro “just take the max.” And if you are a #taxpro who “just takes the max” without proper substantiation then you aren’t really a #taxpro in my opinion. True tax professionals do not open their clients up to these types of penalties. They are too easily avoided. If you don’t have the proper documentation it’s going to cost you more in penalties than you saved in taxes by taking an unsubstantiated adjustment. Just don’t do it.

Remember, this adjustment has the following conditions:

- The taxpayer must not be itemizing their deductions on the return.

- The taxpayer must be able to substantiate the deduction.

- The contribution must be made in cash or a cash equivalent (cash, check, credit card, etc.). In other words it can’t be taken for donated “stuff”.

- The contribution must be made to a qualified charitable organization. Shorthand for that is that it must be made to a recognized 501(c)(3) organization.

See that last bit? It’s important to understand that not every tax exempt organization is a recognized 501(c)(3) organization.

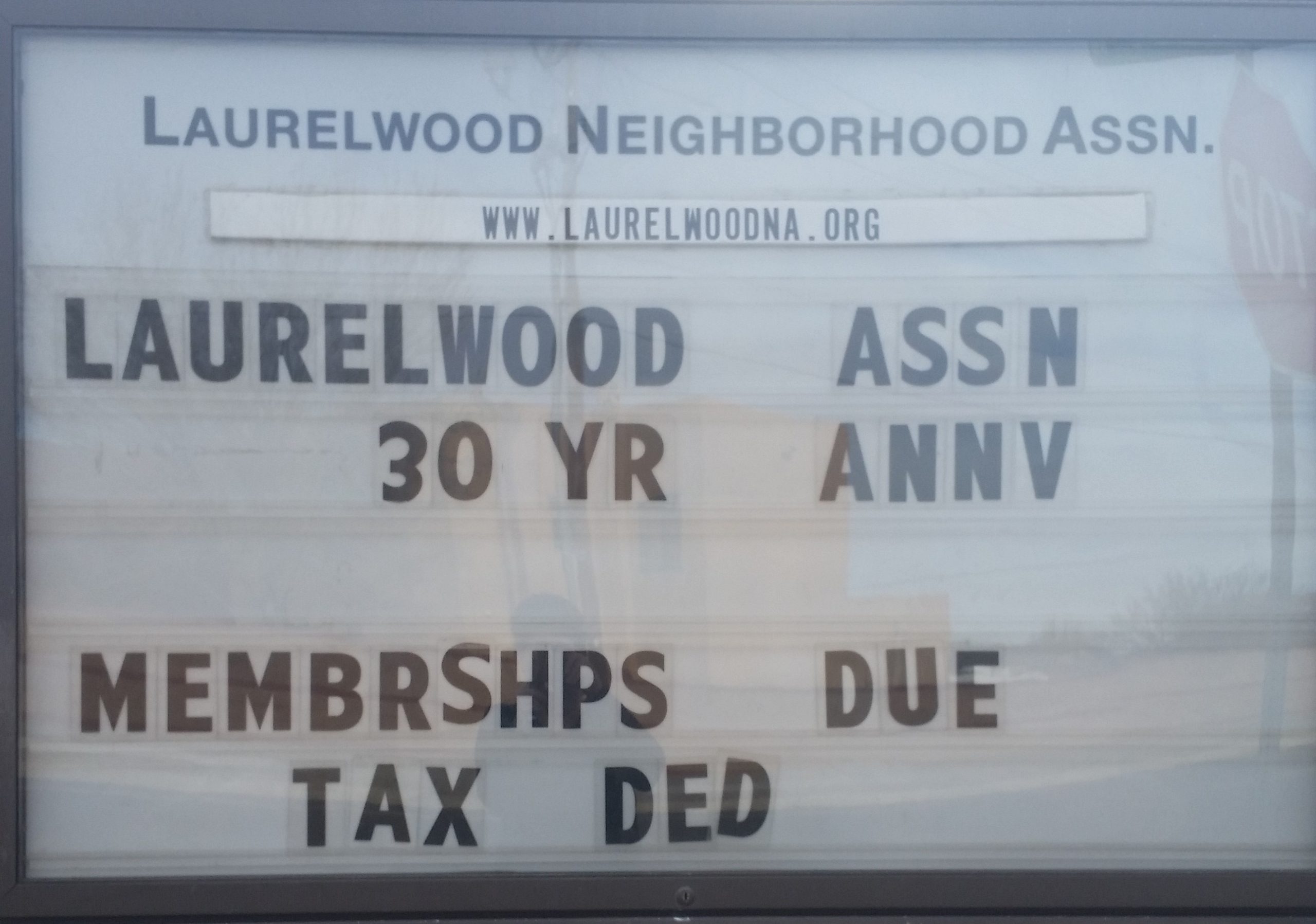

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

If you have questions about whether or not your contribution is deductible it’s always better to ask your #taxpro or to look to reliable sources for more information. Reliable sources include the tax team at Forbes.com, the IRS website, and (sometimes) the knowledge base provided by your DIY software vendor. Reliable sources do not include TikTok, Twitter, or YouTube unless the person providing the advice is recognized as an expert in the field (again, the IRS, Forbes, etc.). And occasionally even trustworthy sources provide incorrect information. Right now information is changing so quickly what you are reading could already be obsolete. Be careful out there. Read the fine print and remember, if it sounds too good to be true it usually is.

#fullambo out

*If you paid substantially more than fair market value for an auction item you may be able to deduct the amount in excess of fair market value but be prepared to answer some questions and provide some proof to your tax professional.

Remember when they were doing direct deposit or mailing a paper check? Well someone convinced someone that prepaid debit cards were a better idea. I won’t wax philosophical on the fact that you can’t usually pay rent with a debit card. Instead, I will link to this article from The Tax Girl letting you know that debit card is legit…so don’t throw it away!

Remember when I talked about college students who are dependents (or basically any child over 16) not being eligible for the dependent EIP or their own EIP? Well, that applies to adult dependents too. So if you’re claiming your parent as a dependent and they are wondering where their stimulus money is—it isn’t coming. Because they are a dependent over the age of 16. Yeah—this is a drag.

What’s not a drag is that I have been moving through the returns and Cat may be coming back part time starting next week. Can I get a hallelujah?!

And we are open by appointment for document drop off, return review and signature, and for new client intake appointments.

That’s about it for today!

It’s Thursday and, after a fairly productive start to the week and a really hectic Wednesday, I am working from home. I have a 2-hour class today and I also needed to catch up on reading and administrative tasks.

The tax returns, however, keep on trucking. I’ll be back in the office tomorrow (Friday) working on returns. I’m still at the pile that came in in mid-March, which (if you have been keeping up with this blog) is most of them. But I’m finally seeing light at the end of the tunnel! I still expect to get most of the returns that normally would not have been on extension filed by the end of this month.

I am still planning on opening the office by appointment only beginning Tuesday afternoon, May 19th. I have already booked a few appointments so if you are wanting an appointment in May (and not in June) it’s best to call or e-mail and book now.

You can also call or e-mail if you are a client with a question about your Economic Impact Payment. I’ve been answering those as I can and I appreciate everyone’s understanding concerning the fact that while I have a lot of information on the process, I have absolutely no control over the IRS, the Treasury Department, or their tools (electronic or human).

I am still urging everyone to stay home to the greatest extent possible and to use e-mail, the phone, Zoom, the secure portal, or USPS/courier to communicate with me.

Enjoy your weekend everyone!

#fullambo out

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

The backlog is slowly clearing. That means, for those of you whose returns still haven’t made it into the office, we will be ready to start accepting new paperwork soon. So here’s the plan—

Whether or not the stay-at-home is extended beyond May 15th, I will re-open the office for document drop offs by appointment only on Tuesday, May 19th. My 24th wedding anniversary is Monday the 18th so I’ll probably take that day off. If you wish to make an appointment to drop off your tax return documents or missing paperwork (K1s, corrected broker 1099s, etc.), please just call or e-mail and I or Cat will get back to you and will set you up!

I will probably re-open the office to new clients at the beginning of June. We will still be, to the greatest extent possible or required, limiting in-person visits to the office. Re-opening to new clients simply means that I will once again be accepting inquiries from new clients. So, if you know anyone who hasn’t filed but wants to, June is when I’ll be accepting referrals again. That should be plenty of time to meet the July 15th filing deadline.

Thanks to all of you for hanging in there through this chaotic tax season with me!

#fullambo out