[Originally published on Forbes.com]

At this point it should not be news to taxpayers that the last two filing seasons have been hard on tax professionals and that this season is not showing any signs of improvement. Still, it’s tax season and taxpayers need to be able to communicate with their tax professionals to ensure that their returns are filed timely, accurately, and most importantly this year, electronically. Indeed, according to a recent survey of tax professionals by Thomson Reuters communication skills are one of the most highly sought after talents in the tax industry. If communication and communication skills are so important, why aren’t tax professionals returning their clients’ calls? Maybe they are, just not in the way clients expect.

At this point it should not be news to taxpayers that the last two filing seasons have been hard on tax professionals and that this season is not showing any signs of improvement. Still, it’s tax season and taxpayers need to be able to communicate with their tax professionals to ensure that their returns are filed timely, accurately, and most importantly this year, electronically. Indeed, according to a recent survey of tax professionals by Thomson Reuters communication skills are one of the most highly sought after talents in the tax industry. If communication and communication skills are so important, why aren’t tax professionals returning their clients’ calls? Maybe they are, just not in the way clients expect.

Most clients grossly underestimate the sheer volume of client calls and e-mails tax professionals receive during filing season. Clients prove it every time they start a call or e-mail with “I know you’re busy but…” Even tax professionals who have administrative support to help with the volume are often overwhelmed by it. Amanda McGowan, an Enrolled Agent in the Denver, Colorado area, teaches a class on achieving the “no call office.” But after speaking with many tax professionals on social media it has become clear that “no call” doesn’t really mean no calls at all. Even the most vehement proponents of the no call office realize that speaking on the phone has its advantages:

- It provides flexibility for clients with different communication styles and different resources.

- Voice inflections often add important nuance to the conversation.

- It allows for open ended questions and, consequently, a more thorough discussion.

- Sometimes it’s simply faster to pick up the phone to do a deeper dive into the reasoning behind a question than to draft an e-mail that contains enough questions to provide a thoroughly anticipatory follow up discussion.

Nevertheless, in the recent chaotic filing atmosphere many tax professionals have realized that the only way to handle call volume is to set firm boundaries around how and when calls will be taken and returned. To ensure that they get enough time to focus on tax returns some tax professionals practice time blocking. They set aside time, usually the times they find most productive, for deep work and block less productive time for returning calls and answering e-mails. How does that look in practice? Well, if your tax professional is a morning person it usually means your calls and e-mails will go unanswered until the afternoon. If your tax professional is a night owl it means you could receive an e-mail response to your voice message in the middle of the night (they aren’t expecting an immediate reply) or that they will return your call in the morning because they reserve their afternoons and evenings for deep work.

Often time blocking is used in addition to call scheduling. To make the best use of their time tax professionals are not refusing to take or return calls, they are simply refusing to take unscheduled calls. Unscheduled calls disrupt workflow and often cannot be resolved without additional research, which then necessitates yet another call. Tax professionals who require calls to be scheduled also typically require the reason for the call to be provided before booking the call. Providing the reason for the call when you book the call allows your tax professional to look up your tax information, review your question, and do any research necessary to answer the question before they ever get on the phone. Pre-booking often makes for a much more satisfactory experience on both sides of the call.

Sometimes, however, tax professionals prefer to follow up to voice messages by e-mail. Why? Because they need to document the conversation for your file. Responding to voice messages by phone typically requires the tax professional to respond twice: once by returning the phone call and again by typing notes documenting the call into your tax file. If the question requires research or is reasonably complex, often the most practical solution for the busy tax professional is to “eliminate the middle man” and respond with an e-mail instead of by phone even when that is not the client’s preferred means of communicating.

Remember, tax professionals are business people and they have to work in ways that are good business. In other words, it may only feel like your tax professional isn’t being responsive when they are, just perhaps not in the way you expect. So what can taxpayers do to help ensure their tax professional returns their calls?

- Don’t call with questions that can be answered by looking at the firm’s website (e.g., Are you open on Saturday?). If your practitioner’s firm has a website try looking there for answers before you call. Many firms have prepared handouts that answer common questions available on their websites (e.g., valuing charitable contributions, tracking business mileage, deductibility of business meals, etc.).

- Don’t expect exceptions to be made for you. If your tax professional sends office updates, newsletters, or other mass e-mail messages, read them. Often these one-to-many communications contain answers to your questions because many other clients are asking the same questions and it’s more efficient to respond to everyone at once than to provide individual responses.

- Respect the office policy concerning when calls will be returned and by whom. Schedule your call if that is what the office requires. Don’t insist on talking to a firm principal or partner when someone else has been provided with the information you were seeking and has been tasked with returning your call.

- Provide a reason for the call when you are calling. Often it is more practical for the tax professional to return your call using e-mail rather than the phone. If you just leave your name and number but no reason for the call, depending on the office your call may not be returned at all.

- Don’t phone to ask if your tax professional got your e-mail or your earlier voicemail unless it has been longer than five to seven business days after you reached out to them.

- Don’t call or leave a voicemail just to see if your tax professional has everything they need to prepare your return. Pro tip: If a tax professional is missing information, they will contact you.

- And never, ever call your tax professional just to “check the status” of your return or you may find yourself looking for a new tax professional.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

For Tax Year 2020 taxpayers who take the standard deduction can make an above-the-line adjustment for cash contributions of up to $300 on their 1040s. There’s a marriage penalty here. The $300 for 2020 is on a per return, not a per taxpayer basis. So single filers can make a $300 adjustment and married taxpayers filing a joint return can make a $300 adjustment. The IRS has recently issued guidance (that contradicts the actual law) that says married taxpayers filing separately can only take a $150 adjustment. It’s incorrect but the tax savings are not worth the expense if the IRS decides to assess a penalty (more on that later).

In the more recently passed legislation the marriage penalty was removed. Each taxpayer may contribute up to $300 in cash to qualified charitable organizations. So for Tax Year 2021 it is possible to take an up to $600 above the line adjustment on a jointly filed return. Singles and Heads of Household still can take up to $300. Again, this is for taxpayers who do not itemize their deductions. Taxpayers who use Schedule A to itemize their deductions continue to deduct all of their qualified contributions on that schedule.

Now for the fine print. The IRS will be watching. The Service has stated that there will be a 50% penalty if you claim this adjustment without proper substantiation. What does that mean? It means receipts. Here’s a link to some information on proper recordkeeping for charitable contributions. In general, clients should always be maintaining the records necessary to substantiate their charitable contributions. But for this adjustment in particular it is even more important for the #taxpro to keep the receipts that substantiate this adjustment in the client’s tax file for the applicable years in case the IRS comes looking for them. Don’t be the client who tells your #taxpro “just take the max.” And if you are a #taxpro who “just takes the max” without proper substantiation then you aren’t really a #taxpro in my opinion. True tax professionals do not open their clients up to these types of penalties. They are too easily avoided. If you don’t have the proper documentation it’s going to cost you more in penalties than you saved in taxes by taking an unsubstantiated adjustment. Just don’t do it.

Remember, this adjustment has the following conditions:

- The taxpayer must not be itemizing their deductions on the return.

- The taxpayer must be able to substantiate the deduction.

- The contribution must be made in cash or a cash equivalent (cash, check, credit card, etc.). In other words it can’t be taken for donated “stuff”.

- The contribution must be made to a qualified charitable organization. Shorthand for that is that it must be made to a recognized 501(c)(3) organization.

See that last bit? It’s important to understand that not every tax exempt organization is a recognized 501(c)(3) organization.

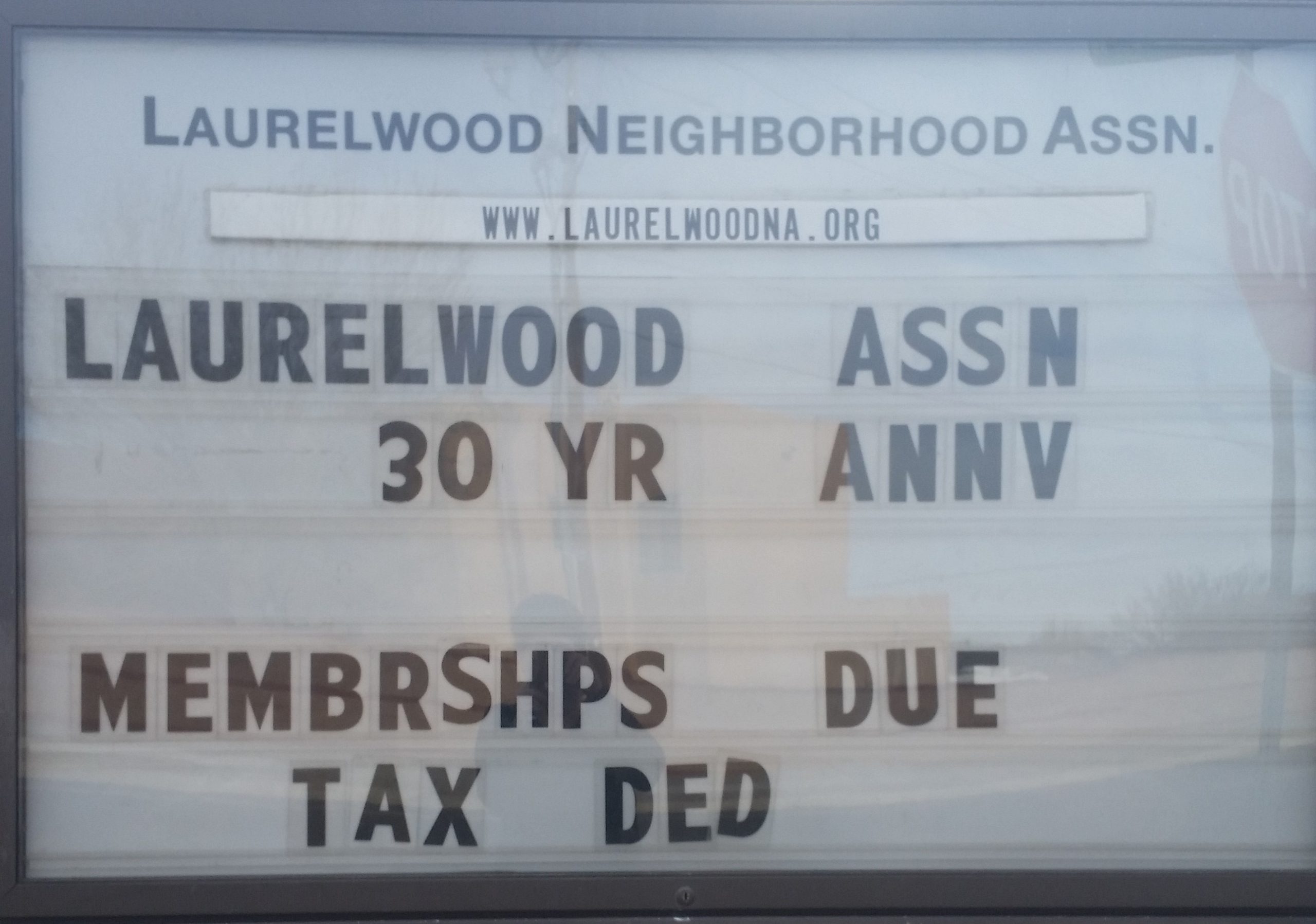

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

If you have questions about whether or not your contribution is deductible it’s always better to ask your #taxpro or to look to reliable sources for more information. Reliable sources include the tax team at Forbes.com, the IRS website, and (sometimes) the knowledge base provided by your DIY software vendor. Reliable sources do not include TikTok, Twitter, or YouTube unless the person providing the advice is recognized as an expert in the field (again, the IRS, Forbes, etc.). And occasionally even trustworthy sources provide incorrect information. Right now information is changing so quickly what you are reading could already be obsolete. Be careful out there. Read the fine print and remember, if it sounds too good to be true it usually is.

#fullambo out

*If you paid substantially more than fair market value for an auction item you may be able to deduct the amount in excess of fair market value but be prepared to answer some questions and provide some proof to your tax professional.

We’re not quite to the new year yet, but I’m sprinting toward the goal line!

I’m also expecting that many taxpayers will be required to complete a new Form W4 soon. Form W4 is what your employer uses to determine how much federal and state income tax to withhold from your paycheck each pay period. It contains basic information such as your name, address and taxpayer ID number (usually your SSN). The old form used to ask you to calculate how many “allowances” or “exemptions” from withholding you wanted to claim. And there was a worksheet. The higher the number of allowances the lower the withholding. So, to have the maximum amount withheld you simply claimed “Single 0.” The new form doesn’t work that way. On the surface it looks more complex than the old form but my colleague, Sherrell Martin, has done this amazing video that shows that the new form is actually pretty easy to complete and she walks you through how to complete it!

I’m also expecting that many taxpayers will be required to complete a new Form W4 soon. Form W4 is what your employer uses to determine how much federal and state income tax to withhold from your paycheck each pay period. It contains basic information such as your name, address and taxpayer ID number (usually your SSN). The old form used to ask you to calculate how many “allowances” or “exemptions” from withholding you wanted to claim. And there was a worksheet. The higher the number of allowances the lower the withholding. So, to have the maximum amount withheld you simply claimed “Single 0.” The new form doesn’t work that way. On the surface it looks more complex than the old form but my colleague, Sherrell Martin, has done this amazing video that shows that the new form is actually pretty easy to complete and she walks you through how to complete it!

If you are going to use the video to complete your new W4 it will be helpful to first gather the following information:

- The annual salary/salaries for you and your spouse for each of your jobs

- The number of pay periods per job

- The number of children and other dependents that will be claimed on your tax return*

- The amount of your itemized deductions (if you are not taking the standard deduction)*

*This information can be easily found on the comparison worksheet included with your tax return. My clients can find their “comp sheet” toward the top of the left hand pocket of their tax folder (or near the top of their PDF return copy). Even if you don’t use a paid tax preparer, most DIY software provides a comp sheet.

So, gather your information and let Sherrell walk you through the process of completing your new W4. Remember this new W4 and the associated withholding tables are designed to have you withholding the most accurate amount of tax, not the amount that will get you a big refund. You could even end up with a balance due when you file your tax return.

At Tax Therapy we include a mid-year withholding check up with our full-service return preparation. We will do a basic estimate of your annual income, credits, deductions, and withholding to determine if you need to make any adjustments for the rest of the year. And, while helping clients complete a new W4 is not included with tax return preparation, we can help you do that for an additional fee. If you are interested please log into your TaxDome account using the link in the Client Resources tab and send us a message.

Remember when they were doing direct deposit or mailing a paper check? Well someone convinced someone that prepaid debit cards were a better idea. I won’t wax philosophical on the fact that you can’t usually pay rent with a debit card. Instead, I will link to this article from The Tax Girl letting you know that debit card is legit…so don’t throw it away!

Remember when I talked about college students who are dependents (or basically any child over 16) not being eligible for the dependent EIP or their own EIP? Well, that applies to adult dependents too. So if you’re claiming your parent as a dependent and they are wondering where their stimulus money is—it isn’t coming. Because they are a dependent over the age of 16. Yeah—this is a drag.

What’s not a drag is that I have been moving through the returns and Cat may be coming back part time starting next week. Can I get a hallelujah?!

And we are open by appointment for document drop off, return review and signature, and for new client intake appointments.

That’s about it for today!

Wow! That’s all I can say. This blog post is late because I have managed to string together three productive work days in a row and it feels like it’s gonna hold through the rest of the week!

Wow! That’s all I can say. This blog post is late because I have managed to string together three productive work days in a row and it feels like it’s gonna hold through the rest of the week!

So, where are we at? Unfortunately we are still in early to mid-March as far as return processing goes. That said, Cat is coming to pick up the last pile of returns for scanning this week and I am moving through the piles. I am still fiddling with some of the more complicated returns but I’m working on those in tandem with some of the more straightforward ones. The short version is, returns are getting finished.

This is the first time this year I have felt like tax season is working. The first time I have felt like it’s actually tax season and things are working the way they are supposed to—stacked up but moving.

I will be working on returns the rest of this week and back in and working next week as well. I don’t have Cat available for data entry right now (she can’t do that from home) but if you’ve been with me any length of time you know how fast I type. I’ll get ’em done. Have a great week and enjoy the weekend.

#fullambo out

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

The backlog is slowly clearing. That means, for those of you whose returns still haven’t made it into the office, we will be ready to start accepting new paperwork soon. So here’s the plan—

Whether or not the stay-at-home is extended beyond May 15th, I will re-open the office for document drop offs by appointment only on Tuesday, May 19th. My 24th wedding anniversary is Monday the 18th so I’ll probably take that day off. If you wish to make an appointment to drop off your tax return documents or missing paperwork (K1s, corrected broker 1099s, etc.), please just call or e-mail and I or Cat will get back to you and will set you up!

I will probably re-open the office to new clients at the beginning of June. We will still be, to the greatest extent possible or required, limiting in-person visits to the office. Re-opening to new clients simply means that I will once again be accepting inquiries from new clients. So, if you know anyone who hasn’t filed but wants to, June is when I’ll be accepting referrals again. That should be plenty of time to meet the July 15th filing deadline.

Thanks to all of you for hanging in there through this chaotic tax season with me!

#fullambo out

OK! Still feeling like I’ve turned a corner. Getting returns processed. Cat is finding her “work at home” groove too. We are moving slowly through the stacks that have been here since mid-March when all hell broke loose. I am still having to set aside some of the more complex ones for when I am able to fully focus. When it comes to tax returns it’s a lot harder to fix them than it is to just get them right the first time. So I want to make sure I’m in top form when I’m working on the ones with a lot of moving parts (you know who you are).

If you still haven’t gotten your stuff into the office, that’s OK! Once I feel like most of the backlog has been cleared I will get a bit more pro-active about getting what remains out into the office. I’m hoping that this will roughly coincide with at least a lightening of some of the stay-at-home restrictions. We will see—that’s going to depend both on how quickly I work and how well we do at flattening the curve here in NM.

Again, we’ve got until July 15th and I’m planning on having most of them out well before then unless additional chaos ensues.

Thanks for hanging in there with us!

#fullambo out

Economic Impact Payments

I got mine. So I can answer one question—no, the IRS is not going to “do the math” to see if your dependent child who was eligible for the Child Tax Credit (CTC) in 2018 or 2019 is going to be eligible in 2020. You will get the additional $500 payment if the child was CTC eligible (age 16 or under) on your most recently filed return. Every now and then my procrastination pays off. I’m pretty sure I’ll be filing my personal 1040 on July 14th.

I got mine. So I can answer one question—no, the IRS is not going to “do the math” to see if your dependent child who was eligible for the Child Tax Credit (CTC) in 2018 or 2019 is going to be eligible in 2020. You will get the additional $500 payment if the child was CTC eligible (age 16 or under) on your most recently filed return. Every now and then my procrastination pays off. I’m pretty sure I’ll be filing my personal 1040 on July 14th.

Moving forward, and I am advising individual clients as their returns are prepared, I will be either filing immediately or recommending that you wait until you receive your Economic Impact Payment (EIP or ‘stimulus check’) to file your 2019 return. The recommendation will be based on whatever is most advantageous for you. I have already advised some clients whose income was higher in 2019 than it was in 2018 to wait to file their 2019 return until they receive their EIP. I’ll be doing the same for clients with kids who were 16 in 2018. It’s called “tax planning” and it’s one of the reasons you pay a #taxpro.

Non-filers (you aren’t required to file a return, not that you simply haven’t filed a return)

If you aren’t a client, or if you are a former client who dropped below the threshold for having to file a return, you have a couple of options depending on your individual circumstances:

- If you receive Social Security payments your EIP will be automatic. You will receive a direct deposit or a check without having to take any additional steps.

- If you don’t receive Social Security payments but you get, for example, SSI or VA payments and are still not required to file a return the IRS is providing a tool for you to enter the information necessary for you to receive your EIP.

It is important to remember that you should, under no circumstances, have to pay to receive your EIP. For best results always start at irs.gov or irs.gov/coronavirus, not Google. And watch out for phone calls and e-mails phishing for information as well. The scammers are out in force on this one.

Filers Who May Not Have Direct Deposit Information on File or Want to Update Their Direct Deposit information

According to Kelly Phillips Erb (aka The Tax Girl) in this Forbes article, the Treasury Department has created a new web tool for filers of 2018 or 2019 tax returns to input or update their direct deposit information (a whole two days before the #taxpro community expected it!). This tool can be used if you normally don’t get a refund, but rather, have to pay the IRS each tax season. You can use this tool to verify the amount of your EIP, confirm whether it will be direct deposit or check, and (if you are getting a paper check) enter direct deposit information to receive your payment more quickly as long as your check hasn’t already been mailed. Paper checks aren’t supposed to start being mailed until the end of this month or early May according to my most recent reading. You can also update your direct deposit information if your deposit isn’t already pending.

You need to have your most recently filed tax return in hand to answer some of the questions. If I prepared your return it is likely that the information the tool will be requesting will be on your COMPARE sheet (that handy three-year comparison that is usually at or near the top of the left-hand pocket of your tax folder).

Update! Word on the street (OK, on #TaxTwitter) is that the tool is not working correctly. Especially if you have not filed a 2019 return. Please be patient and check back once or twice a day. They will get it running eventually. Or I’ll post that they’ve scrapped it.

Finally, according to The Tax Girl:

For security reasons, the IRS plans to mail a letter about the economic impact payment to your last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment.

Based on my reading there are a host of complicating factors for economically vulnerable taxpayers, taxpayers who file injured spouse claims (one taxpayer of a married filing joint couple owes back child support and the other doesn’t), divorced taxpayers, etc. I’m not going to go into the weeds on those. If you are interested, I highly recommend the Procedurally Taxing Blog, but beware, the blog is written for tax attorneys and is not for the faint of heart. Nevertheless, several recent posts discuss some of the complicating factors in mostly plain language.

And that, taxpayers, is all I have to say about that. So, moving on…

Deadlines

As I already reported, the filing and payment deadline has been extended to July 15th. Pretty much all of the deadlines significant to my practice (including those for filing Tax Court petitions) have been extended. If you have to file an FBAR you have an automatic extension until October 15th. The good news is that the IRS recently clarified that the July 15th deadline specifically applied to taxpayers required to file a Form 8938 (for certain taxpayers with foreign bank account balances). Estate income tax returns as well as estate and gift wealth transfer tax returns have also, for the most part, been granted extended deadlines.

The one tiny bit that was still weird has also been fixed! All of the extensions resulted in Quarter 1 estimated tax payments being due after Quarter 2 payments were due. Until recently Quarter 1 payments were due on July 15th but Quarter 2 payments were still due on June 15th. That has been fixed. Now all balances due on 2019 returns as well as Quarter 1 and Quarter 2 estimated tax payments are due on July 15th (as of this writing). That’s good news and bad news. Yes, everyone has more time, but that does make it easier to forget about payments and to, perhaps, lose sight of just how much will be due in total on July 15, 2020. Consequently, I am encouraging all taxpayers with the means to do so to make their payments on time and/or to set calendar reminders with amounts due to ensure that those payments get made by the new deadline.

And speaking of payments…

Installment Agreements

If you are in an existing Installment Agreement with the IRS your payments have also been suspended. If you mail them a check, you can stop until July 15th. If you are in a direct debit agreement you need to contact your bank and ask them to suspend the payments temporarily. It is extremely important that you ensure that you direct the bank to reinstate your payments approximately two weeks before the first payment due after July 15th to ensure that you don’t default your agreement. I expect the IRS to be fairly graceful about this given the circumstances, but it’s always better not to count on that grace. And again, if the payments are not causing economic hardship, I certainly recommend that you continue to make them even though you don’t have to.

Student Loan Payments and Interest

One thing that I have not mentioned that was included in the CARES Act is that the Act suspends student loan payments through September 30, 2020. Both principal and interest payments are suspended with no penalty and no interest will accrue on these loans during the suspension period. So if making those payments is causing you a hardship, you can temporarily stop making them. Again, just don’t forget to start again when the suspension period ends!

That is what I know as of right now. The pace of legislation and the related relief provisions and the implementation guidance has slowed down a bit, especially for most of my clients. Larger firms and CPAs who handle larger small businesses are still getting hit pretty hard. Guidance concerning the Paycheck Protection Program loans (more on that in a future post) for partnerships and self-employed people just came out a day or two ago. I still expect that there will be more relief coming (including addressing the ‘donut hole’ for EIPs for college age dependents) but for now, the tax practitioner community is slowly catching up to the most recent batch of tax law changes and additional guidance.

Hang in there. Stay home. Stay healthy.

#fullambo out

When, where, how, I don’t know yet, but remember yesterday’s post where I mentioned the “donut hole” for college-age dependents? Two Michigan senators have introduced legislation to address that and it will probably be part of a larger Phase 4 relief package according to Kay Bell at Don’t Mess with Taxes.

This is me, showing you how to hold onto some of your money (or to mitigate the tax consequences of using it)…

Required Minimum Distributions (RMDs)

Recent legislation has suspended RMDs for 2020. If you haven’t already taken your RMD for 2020, you don’t have to. This includes RMDs from inherited IRAs.

You know what else got suspended? RMDs that were required by April 1, 2020 because the taxpayer turned 70.5 in 2019. Yep, so if you had to take your very first RMD in 2019, you actually had until April 1, 2020 to take it and now you don’t have to take it at all. Great if you happened to forget about it!

And remember, if you are turning 70.5 in 2020 your RMD age was increased to 72 (by the SECURE Act) so you don’t have a “first” RMD requirement this year. You take your first RMD by April 1 the year you turn 72.

But, Amber, what if I did take my RMD? Well, there might be some relief for you too. You have 60 days to roll that money back into your account or into an IRA (but you are only allowed one of these rollovers in a 12-month period, so be careful if you’ve done one recently). There’s a lot of fine print on this so it’s best to talk with either your investment adviser or an investment adviser you can trust. I happen to know one. Feel free to use the form on the home page or send me an e-mail if you would like his contact details. He can answer your questions, help you determine if you are eligible for the 60-day rollover, and can help you set up an IRA if you are allowed to put your funds back but maybe want a new account instead of, say, your employer’s 401(k).

Speaking of IRAs…

The deadline for making deductible contributions to your IRA has been extended to July 15, 2020 to coincide with the extended filing deadline. So if you haven’t filed your return yet you can still tweak your contribution (maybe contribute your Economic Impact Payment if you are sure you won’t need it). If you’ve already filed your return I expect you can still make an additional payment through July 15 and simply amend your return to reap the additional tax benefits. Please bear in mind that I have no official guidance on this specifically related to the CARES Act. It just seems logical that you would be able to amend your return to take advantage of the later contribution deadline. Remember, however, that amended returns must be filed on paper and if you use a paid preparer you will be charged for the work. You may even be charged more than you would save in taxes. It’s important to do the math. And it’s really important not to ask your #taxpro to do the math for you right now. I recommend waiting until at least mid-May to give us a chance to get through the returns on our desks (most of us are still working like the deadline wasn’t extended) and until some of this small business loan business has settled down (more on that in a future post).

I Need Money Now!

The CARES Act also provides some help if you need to take money out of your IRA or 401(k).

You can take out up to $100,000 from your IRA penalty free. Not tax free! But not subject to the 10% penalty for early withdrawal if you are under age 59.5. You can also include this income in three equal parts over three years instead of all in tax year 2020. That can help you use your money and stay in a lower tax bracket! And, in an unprecedented move, you also have three years to put some or all of that money back should your circumstances change.

If you are allowed to take a loan from your 401(k) the amount has been increased to a maximum of $100,000 (from $50,000). The due date for repayment has also been delayed for one year.

Please note that these must be “COVID-19 Related” distributions or loans. It is important to consult your IRA trustee/custodian (for an IRA distribution) or your company’s plan administrator and/or plan custodian (for 401(k) loans and distributions) to ensure that you meet the criteria for the distribution and to ensure you understand all of the requirements (the fine print). They can’t give advice on the tax consequences (how much to withhold, etc.) but they can tell you if you qualify for the COVID-19 distribution based on your specific circumstances and give other information related to your specific investments or plan. Finally, considering the state of the stock market right now, it may be best to avoid selling stocks that are in your retirement accounts right now. I mean, you want to buy low, sell high, not the other way around. So if you can avoid cashing out, it is probably best do try to ride this chaos out without selling low.

#fullambo out