The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

For Tax Year 2020 taxpayers who take the standard deduction can make an above-the-line adjustment for cash contributions of up to $300 on their 1040s. There’s a marriage penalty here. The $300 for 2020 is on a per return, not a per taxpayer basis. So single filers can make a $300 adjustment and married taxpayers filing a joint return can make a $300 adjustment. The IRS has recently issued guidance (that contradicts the actual law) that says married taxpayers filing separately can only take a $150 adjustment. It’s incorrect but the tax savings are not worth the expense if the IRS decides to assess a penalty (more on that later).

In the more recently passed legislation the marriage penalty was removed. Each taxpayer may contribute up to $300 in cash to qualified charitable organizations. So for Tax Year 2021 it is possible to take an up to $600 above the line adjustment on a jointly filed return. Singles and Heads of Household still can take up to $300. Again, this is for taxpayers who do not itemize their deductions. Taxpayers who use Schedule A to itemize their deductions continue to deduct all of their qualified contributions on that schedule.

Now for the fine print. The IRS will be watching. The Service has stated that there will be a 50% penalty if you claim this adjustment without proper substantiation. What does that mean? It means receipts. Here’s a link to some information on proper recordkeeping for charitable contributions. In general, clients should always be maintaining the records necessary to substantiate their charitable contributions. But for this adjustment in particular it is even more important for the #taxpro to keep the receipts that substantiate this adjustment in the client’s tax file for the applicable years in case the IRS comes looking for them. Don’t be the client who tells your #taxpro “just take the max.” And if you are a #taxpro who “just takes the max” without proper substantiation then you aren’t really a #taxpro in my opinion. True tax professionals do not open their clients up to these types of penalties. They are too easily avoided. If you don’t have the proper documentation it’s going to cost you more in penalties than you saved in taxes by taking an unsubstantiated adjustment. Just don’t do it.

Remember, this adjustment has the following conditions:

- The taxpayer must not be itemizing their deductions on the return.

- The taxpayer must be able to substantiate the deduction.

- The contribution must be made in cash or a cash equivalent (cash, check, credit card, etc.). In other words it can’t be taken for donated “stuff”.

- The contribution must be made to a qualified charitable organization. Shorthand for that is that it must be made to a recognized 501(c)(3) organization.

See that last bit? It’s important to understand that not every tax exempt organization is a recognized 501(c)(3) organization.

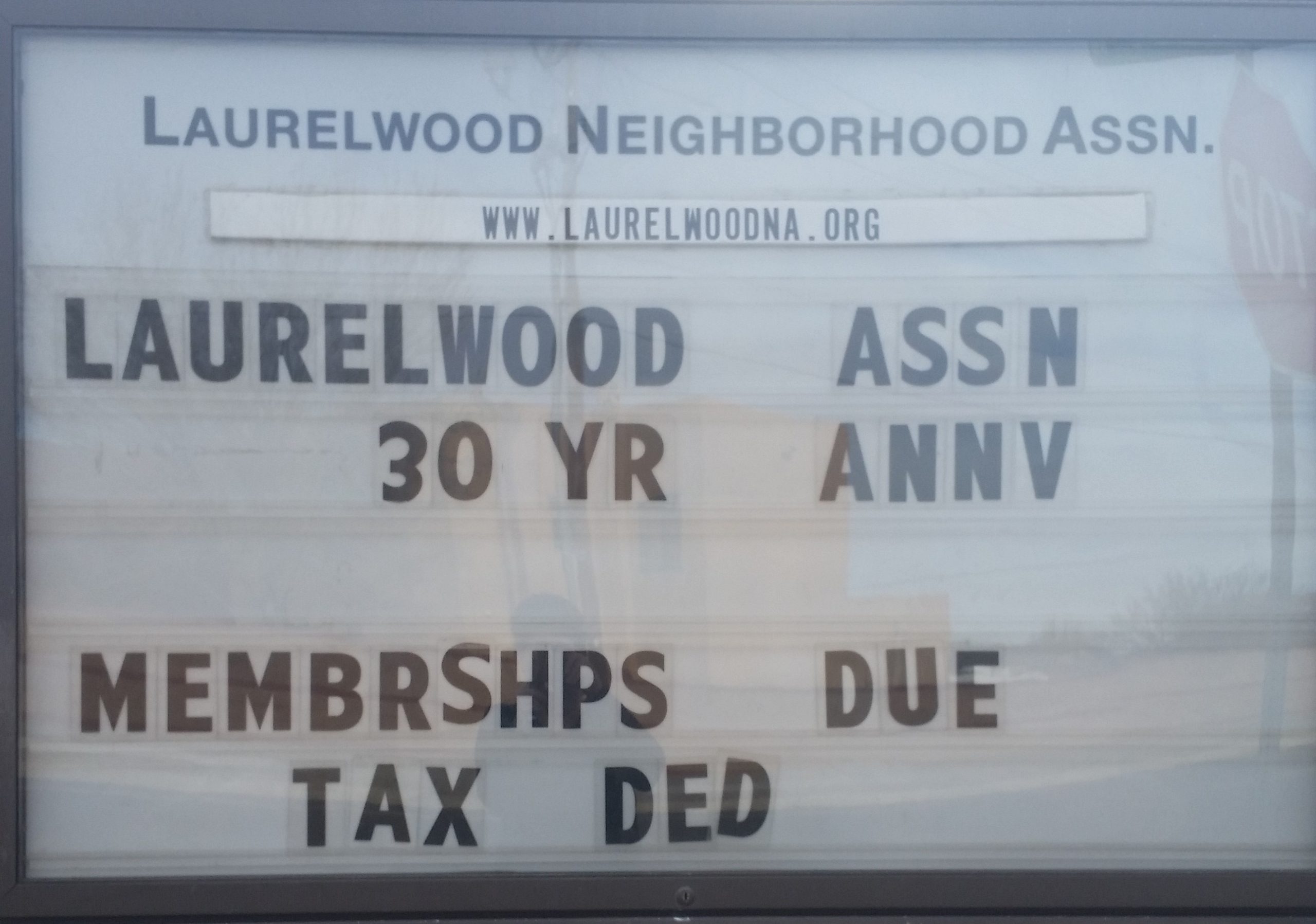

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

If you have questions about whether or not your contribution is deductible it’s always better to ask your #taxpro or to look to reliable sources for more information. Reliable sources include the tax team at Forbes.com, the IRS website, and (sometimes) the knowledge base provided by your DIY software vendor. Reliable sources do not include TikTok, Twitter, or YouTube unless the person providing the advice is recognized as an expert in the field (again, the IRS, Forbes, etc.). And occasionally even trustworthy sources provide incorrect information. Right now information is changing so quickly what you are reading could already be obsolete. Be careful out there. Read the fine print and remember, if it sounds too good to be true it usually is.

#fullambo out

*If you paid substantially more than fair market value for an auction item you may be able to deduct the amount in excess of fair market value but be prepared to answer some questions and provide some proof to your tax professional.

We’re not quite to the new year yet, but I’m sprinting toward the goal line!

I’m also expecting that many taxpayers will be required to complete a new Form W4 soon. Form W4 is what your employer uses to determine how much federal and state income tax to withhold from your paycheck each pay period. It contains basic information such as your name, address and taxpayer ID number (usually your SSN). The old form used to ask you to calculate how many “allowances” or “exemptions” from withholding you wanted to claim. And there was a worksheet. The higher the number of allowances the lower the withholding. So, to have the maximum amount withheld you simply claimed “Single 0.” The new form doesn’t work that way. On the surface it looks more complex than the old form but my colleague, Sherrell Martin, has done this amazing video that shows that the new form is actually pretty easy to complete and she walks you through how to complete it!

I’m also expecting that many taxpayers will be required to complete a new Form W4 soon. Form W4 is what your employer uses to determine how much federal and state income tax to withhold from your paycheck each pay period. It contains basic information such as your name, address and taxpayer ID number (usually your SSN). The old form used to ask you to calculate how many “allowances” or “exemptions” from withholding you wanted to claim. And there was a worksheet. The higher the number of allowances the lower the withholding. So, to have the maximum amount withheld you simply claimed “Single 0.” The new form doesn’t work that way. On the surface it looks more complex than the old form but my colleague, Sherrell Martin, has done this amazing video that shows that the new form is actually pretty easy to complete and she walks you through how to complete it!

If you are going to use the video to complete your new W4 it will be helpful to first gather the following information:

- The annual salary/salaries for you and your spouse for each of your jobs

- The number of pay periods per job

- The number of children and other dependents that will be claimed on your tax return*

- The amount of your itemized deductions (if you are not taking the standard deduction)*

*This information can be easily found on the comparison worksheet included with your tax return. My clients can find their “comp sheet” toward the top of the left hand pocket of their tax folder (or near the top of their PDF return copy). Even if you don’t use a paid tax preparer, most DIY software provides a comp sheet.

So, gather your information and let Sherrell walk you through the process of completing your new W4. Remember this new W4 and the associated withholding tables are designed to have you withholding the most accurate amount of tax, not the amount that will get you a big refund. You could even end up with a balance due when you file your tax return.

At Tax Therapy we include a mid-year withholding check up with our full-service return preparation. We will do a basic estimate of your annual income, credits, deductions, and withholding to determine if you need to make any adjustments for the rest of the year. And, while helping clients complete a new W4 is not included with tax return preparation, we can help you do that for an additional fee. If you are interested please log into your TaxDome account using the link in the Client Resources tab and send us a message.

We (the tax community) were expecting something last Wednesday. “Something” passed the House Monday and the Senate yesterday and the President was expected to sign. He didn’t. I still expect that individual taxpayers will be receiving a second round of economic impact payments but when and how much remains a mystery. If you want to read an excellent summary of what’s going on and why some of the proposed fixes look good on paper but are maybe not so realistic you can do no better than this article by The Tax Girl.

In the meantime, do the #taxpro community a favor. Don’t call or e-mail your tax professional with questions about the stimulus money. We don’t know. And many of us do mass updates (via e-mail, blog posts, etc.) but we haven’t done one yet because—we don’t know. We’re all trying hard to both prepare for the upcoming filing season and maybe enjoy some holiday time with our families. We’ll let you know as soon as we know. You can count on that!