Tax Season and the American Consumer

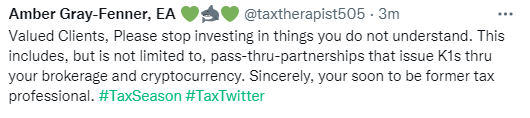

Here’s a pro tip that just might save your (tax) life this filing season. Your #taxpro is not amazon dot com and “Where’s my stuff?” questions not only will often go unanswered they may get your job moved to the bottom of the work pile and/or placed on extension (which is not an audit flag, just FYI). Why? Because between non-stop tax law changes that have been happening since the Tax Cuts and Jobs Act (TCJA) was passed in December 2017, the pandemic, and the extension of time for large brokerage firms to issue final statements to their clients (March 15th), tax season has been effectively compressed from roughly 10 weeks beginning in mid-February and ending in mid-April to four weeks, beginning in mid-March and ending in mid-April. Tax firms and individual tax professionals have to do a full season’s work in less than half the amount of time that has traditionally been available and the returns are more complex than ever thanks to both law changes and changes in investment options that often require reporting that taxpayers do not understand.

Here’s a pro tip that just might save your (tax) life this filing season. Your #taxpro is not amazon dot com and “Where’s my stuff?” questions not only will often go unanswered they may get your job moved to the bottom of the work pile and/or placed on extension (which is not an audit flag, just FYI). Why? Because between non-stop tax law changes that have been happening since the Tax Cuts and Jobs Act (TCJA) was passed in December 2017, the pandemic, and the extension of time for large brokerage firms to issue final statements to their clients (March 15th), tax season has been effectively compressed from roughly 10 weeks beginning in mid-February and ending in mid-April to four weeks, beginning in mid-March and ending in mid-April. Tax firms and individual tax professionals have to do a full season’s work in less than half the amount of time that has traditionally been available and the returns are more complex than ever thanks to both law changes and changes in investment options that often require reporting that taxpayers do not understand.

I turned my stuff in early. It shouldn’t take so long. Maybe. Maybe not. Maybe it’s your expectations that are, if not unreasonable, perhaps simply unrealistic based on the actual facts of the situation. Let me explain…

In some ways, tax season works a lot like Black Friday shopping “doorbusters.” To get the best deals (fastest turnaround) you have to shop within a specified period of time. And the earlier you shop the more likely you are to score the deals (fast turnaround). Nevertheless, many other factors can affect your ability to get those deals (fast turnaround):

- Availability of product

- Size of the store

- Number of cashiers

- Other customers shopping for the same product

You all know that the best deals are usually reserved for the earliest shoppers. And sometimes those shoppers start queueing up well before the store opens to get the deals. The doors open, they rush in grab the giant TV and head for the checkout lines and are in and out before you’ve had your first cup of coffee and then they go on Twitter and smugly proclaim “I don’t know what all the fuss was about, I didn’t have any problem.” In tax terms, these “shoppers” are the taxpayers that get their tax documents shortly after January 31st, complete their engagement paperwork and interviews (in my office) or organizers (other tax offices), and have that information into the tax office by mid-to late February. At that time most tax offices are ready to do returns, but there’s not a high volume of returns coming in (no lines forming at the cashiers) so turnaround time is pretty fast as long as all of the information necessary to do the return is there.

Then there are the shoppers that arrive a while before the store opens (say 30-60 minutes) drink their coffee in their car and watch the lines forming. They aren’t in a big hurry and they’re pretty sure that there will still be plenty of deals they want to buy. Those shoppers get in and, while they don’t always get every deal they were looking for (some have sold out), they find some good deals. And, while they may have to wait in line, the lines aren’t too long and for the most part the transactions aren’t super complicated (more on that below) so their shopping experience is slow, but mostly painless. In tax terms, these shoppers come in from mid- to late February or early March. Tax offices aren’t too bogged down, but there may be lines–entity returns due on March 15th) that are being completed or put on extension. To handle the lines, maybe the tax firm opens additional check-out lines (brings in seasonal staff to work on individual 1040s while the permanent staff are working on the entity returns). Then again, maybe they don’t (more on that below).

Then there are the shoppers that arrive right when the store opens or a few minutes after, which is where we are now. Peak season. At this point in season, every available check-out line is open. Every cashier has been working nonstop for hours (or days). The lines are long and getting longer because the transactions are now complicated. The cashiers are having to listen to customers complain that they missed out on the deals. By the time they got in, all of the product they were seeking was gone. The cashiers are having to deal with coupons. The paper coupons are hard enough. Then there are the phone coupons where the customer waits until the transaction is almost complete to find the coupon on their phone. Then there are the customers who didn’t read the fine print on the coupon and proceed to argue with the cashier (and hold up the line). Then there are the customers whose transaction is simple, it’s just freaking huge. Like two or three shopping carts’ worth of items. Customers end up in these long lines and routinely discuss amongst themselves how businesses should be running to prevent these problems. Thing is, in retail, maybe long lines aren’t a problem they want to solve. Maybe, just maybe, the retailers are hoping the customers will see the long lines and venture back into the store to do more shopping and wait for the lines to go down.

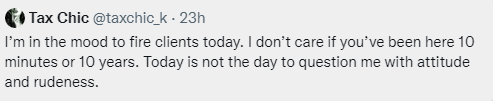

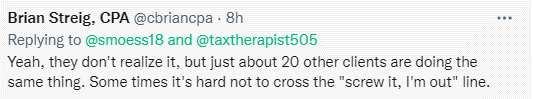

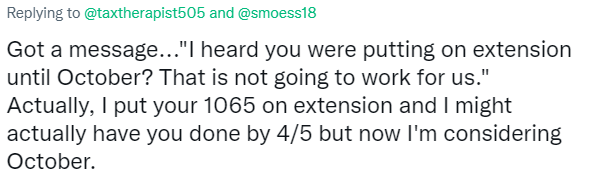

And that, dear readers, is where the metaphor ends (temporarily). Because tax professionals don’t have that option and we really aren’t looking for you to “shop more.” We want to get you checked out so we can move on to the next customer. And we want the store to close at the end of the day because right now the store has been open continuously since February 2020 and we are burned out and exhausted. Many tax professionals have realized over the last three filing seasons that more volume is not the answer and are actively curating their client lists. Some of them are curating in real time.

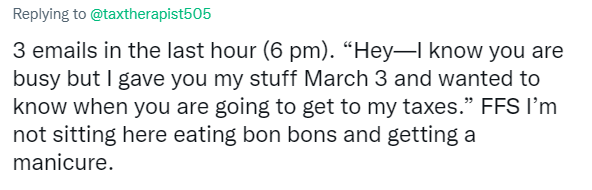

Which brings me back to “Where’s my stuff?” and (briefly) back to the shopping metaphor. Those questions are the equivalent of the shopper who, coming in late to a store in chaos, interrupts the cashier in the middle of a transaction to ask a “quick question” about where the deal on page 10 of the ad is located in the store. The shopper is slowing down workflow and pushing their inquiry to the front of a line that others were in much earlier. That shopper may have been in the store for an hour or two (or three), but the person they just cut in front of has been in the store since before dawn and has been waiting patiently in line for 45 minutes, and is ready to go home.

The thing with a store is that shoppers can see just how long the lines are in a way that does not happen in a tax office. I know. You submitted your documents weeks ago and you got a message that they were in data entry (also weeks ago) and now it seems as if they’ve fallen into a black hole. They haven’t. Your tax pro is working as fast as they can to get client returns processed and out the door. You just can’t see how long the line in front of you actually is (or how full the carts are, or how complicated the transaction will be).

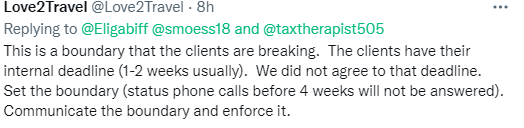

Nevertheless, the fact that you (the taxpayer), can’t see the lines does not mean that the lines do not exist. They exist. And they are long. They are so long that many clients will be put on extension or will simply be turned away for not getting in line soon enough. For example, I have turned away a handful of returning clients that I did not hear from until mid-March. I gave their place in line to a new client who got in line earlier. And before I did this I did make several “the store is closing” announcements. At this point in tax season most tax professionals are at maximum capacity. They either will not take new work (even from returning clients) or they will but it will require an extension. This is, unlike retail, at the tax professional’s discretion (or that of their firm).

Taxpayers and clients often don’t understand the idea of “maximum capacity.” They think that there is still a month left in tax season and that should be plenty of time to do their return. This is because they cannot see the line that has formed in front of them. Sure, you have everything, you are pretty sure your return isn’t complicated, there’s a month left, why are you being turned away? You are being turned away because there isn’t a month left in tax season to do your return that just came in. You’re being turned away (or put on extension) because there’s a month left in tax season to do all of the other returns lined up in front of you including the large and complicated transactions that looked easy. “It’s one big TV how long could that basket take?” Well, except that isn’t the TV that is on sale, the shopper doesn’t understand and wants to argue, and there are another 50 small items under the TV that no one noticed until the transaction was in process. Welcome to tax season.

Tax professionals didn’t get into this profession for the money or the glory. Many got into it because they want to help people. Help people not get in tax trouble. Help educate people on how the tax system works. Help. People. So please, help us help you by not making unnecessary inquiries during peak season. And, trust me, your “where’s my stuff” inquiry is unnecessary. Most tax professionals are well aware of the number of returns they have to process per day/per week to finish their workload by the filing deadline. Many (including me) send periodic status updates about workflow and turnaround time. If your tax professional does this please wait for the next status update rather than making an individual inquiry. Most tax clients are unaware that they are one of possibly dozens of clients making the same unnecessary inquiry and that answering those inquiries (individually or by writing a blog post) takes valuable time away from doing actual tax work. And, sadly, not just the time it takes to answer the inquiry, but the time it takes to get our emotions back under control and regain our focus because these questions produce such strong emotional responses.

Finally, please keep in mind that tax offices also have logistical restrictions. Like a small mom and pop shop maybe they don’t have the physical room to hire more staff. Maybe their profit margins don’t allow them to hire more staff. Maybe there’s not enough time to find qualified staff (or there aren’t qualified staff available). Maybe there are qualified applicants but not enough time to train them on the shop’s unique processes. Maybe there were plenty of staff but someone (or a family member) got ill or died. Maybe someone quit because they couldn’t handle the stress (or the pushback from cranky clients). I know I’ve lost clients because I no longer have a physical office. I know I’ve lost them because I don’t keep regular office hours. I know I’ve lost them because I can only handle a specified amount of volume during tax season. Thing is, when I’ve recommended these customers go to a larger firm with the resources and willingness to take them on in mid-March, they don’t like the price. When I’ve recommended they visit one of the large franchises who are specifically set up for walk-in traffic and while you wait service, they say they want more personal service or that they trust me, but not these franchise shops. Like the song says “you can’t always get what you want.” I’ve heard many people who have never run a business pontificate on what retailers and service professionals should or should not be doing to provide better service. The thing is, these people are making recommendations based on a tragically incomplete data set (grasp of the circumstances). And, quite frankly, that’s not entirely their fault. Our consumer culture has conditioned everyone to be a shopper all the time and to expect near instant gratification while also receiving a ridiculously low price. Nevertheless, it’s time tax clients start attempting to understand that, especially after the last three filing seasons, tax practices don’t work like retail in general (which is, by the way, having its own problems). We are looking for long-term clients, not year-to-year customers. We are looking for people who understand and appreciate the value we provide. That value may be accuracy or thoroughness, it may be year-round availability, it may be consistency (having the same taxpro work on your return year after year). It may be a combination of any or all of these factors (and more) but what it likely won’t be is fast turnaround during peak season (even if your work came in relatively early, so did a bunch of other work). You can ask to speak to a manager, but don’t be surprised if that manager tells you to shop somewhere else.

#fullambo out