Introducing Best of #TaxTwitter

Content Warning: “Strong” Language

Content Warning: “Strong” Language

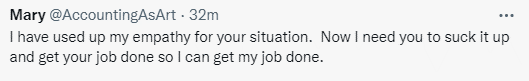

Today is the deadline for pass-thru entity (PTE) returns and #taxpros are getting salty. Like dead fish encased in brine salty. The tough, crusty, dried up jerky kind of salty, not the useful in small quantities anchovy kind of salty. Even those of us who don’t do many PTE returns are exhausted and cranky…

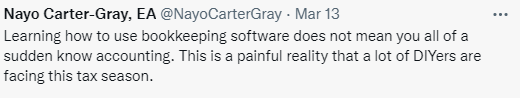

We are tired of large companies deciding what we do is a commodity that they can package, “appify”, and sell to untrained individuals and we’re equally tired of individuals buying what those companies are selling and deciding, because they don’t really understand what it is we do, that our services, training, and years of experience have no value. Until they (the individuals) fuck it up and need someone to fix it (but still don’t want to pay)…

It’s always more expensive for us to clean up a mess than to avoid making the mess in the first place. But, good accounting is like good editing. Most people don’t appreciate it until it is gone. For some reason it’s also way sexier for many small business owners to create a giant crisis that has to be cleaned up like some financial augean stables instead of just mucking those bitches out regularly. Pro Tip: Tax and accounting professionals do not think your “shoebox” full of receipts is charming and we’re not suprised you both have a large tax bill and don’t feel like you made any money.

It’s always more expensive for us to clean up a mess than to avoid making the mess in the first place. But, good accounting is like good editing. Most people don’t appreciate it until it is gone. For some reason it’s also way sexier for many small business owners to create a giant crisis that has to be cleaned up like some financial augean stables instead of just mucking those bitches out regularly. Pro Tip: Tax and accounting professionals do not think your “shoebox” full of receipts is charming and we’re not suprised you both have a large tax bill and don’t feel like you made any money.

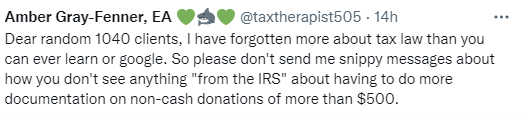

Furthermore, we aren’t making this shit up. If we tell you we need something we have looked for it at least twice before stopping to send you an e-mail. If we tell you we need something it’s not just to bust your chops, it’s necessary to file an accurate return (you know, so if you get audited, we can defend you)…

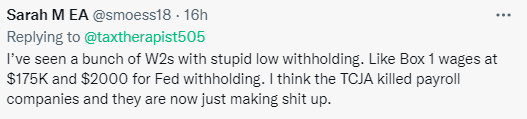

And we don’t like giving bad news, sometimes the same bad news, over and over again. We can check your withholding mid-year and we can report it on your tax return. We cannot, however, control your payroll department or your employer’s third-party payroll provider (if anyone is making shit up, it’s the payroll companies)…

Every #taxpro I know is keeping a “to be curated” list for the end of this season. If you like your #taxpro, you should do your level best not to end up on their list. You may not think you are being snippy or argumentative and that “you’re just asking” but you need to carefully consider whether you really need to be asking right now or if you can just trust your #taxpro to get it right, give them the information they are requesting, and review any tax rules that are still unclear to you at your review appointment.

Like Southwest Airlines, we know you have choices when choosing a #taxpro but more and more of us (especially those of us transitioning to retirement or those who are just getting started and starting as they mean to go on) are OK with problematic clients choosing someone else.