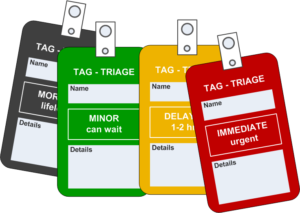

Administrative Triage

Tax Therapy is a small office. If you call during the off season (June through December), chances are high that I (Amber Gray-Fenner, Enrolled Agent) will pick up the phone. It is also likely that I will be the one responding to e-mails sent to the info or admin accounts. During tax season, however, there are usually two of us here: Me (Amber Gray-Fenner, Enrolled Agent) and Cat (Administrative Professional). A big part of Cat’s job during tax season (especially from about February 20th until the filing deadline) is what I call “Administrative Triage.”

Tax Therapy is a small office. If you call during the off season (June through December), chances are high that I (Amber Gray-Fenner, Enrolled Agent) will pick up the phone. It is also likely that I will be the one responding to e-mails sent to the info or admin accounts. During tax season, however, there are usually two of us here: Me (Amber Gray-Fenner, Enrolled Agent) and Cat (Administrative Professional). A big part of Cat’s job during tax season (especially from about February 20th until the filing deadline) is what I call “Administrative Triage.”

During the height of tax season I am up to my eyeballs in tax returns and research. Cat acts as a gatekeeper to ensure that I am performing at the highest possible level. She can answer most questions about our office policies and procedures. For example—

- Do you take credit cards?

- When do I pay?

- Did you get my stuff?

- When will my return be ready?

- When can I drop off documents?

- Where is the office located?

- Are you taking new clients?

- How much do you charge?

So many times when you think you need to speak to me, you don’t. Cat can answer your questions. If it’s a tax question or something more complicated, she will take a message or forward your e-mail and sometimes, if it really was a “quick question,” she will call you back or e-mail you with the answer(s) I have provided. It is only with Cat’s expert administrative help that I can manage the tax season workload. She is a critical part of “what makes office go.” So please, if you have a question or concern call (505-352-0058) or e-mail Cat rather than trying to reach me directly. If I am truly needed I typically respond within two business days.