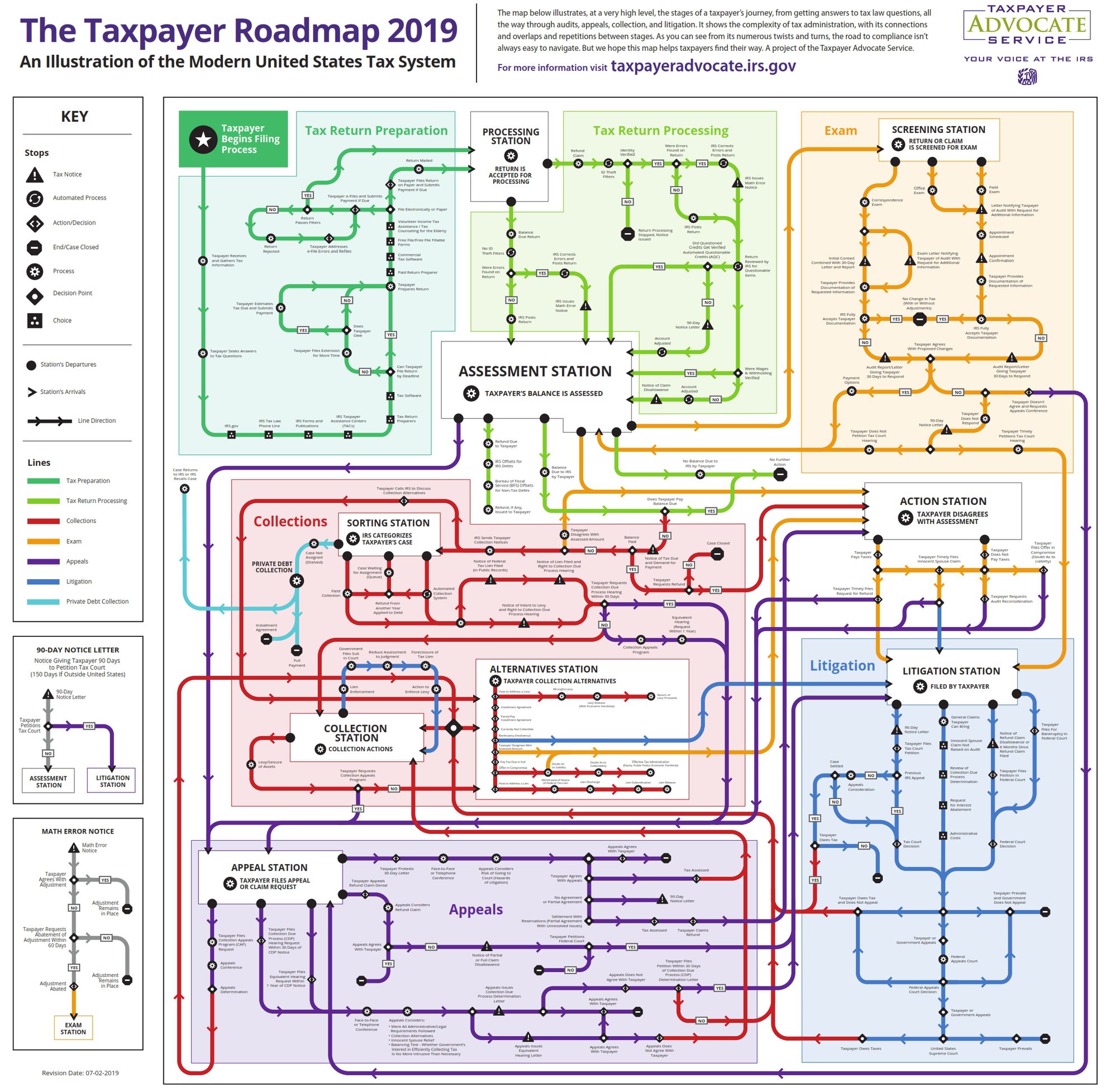

This is My Brain

Next time you think a #taxpro “just puts numbers in boxes” consider this map. Now, there are some people who call themselves taxpros but who won’t help you once you are out of that first green box. Those are the ones who put numbers in boxes and disappear when you have a problem.

Unenrolled taxpros (those who aren’t EAs, CPAs, or attorneys) who stay current in the IRS Annual Filing Season Program can help you through the first box. They can also help you through the next two boxes and the big red box in the middle but only if they prepared the return. Their rights to represent before the IRS are limited to returns they prepared.

Enrolled Agents, CPAs, and attorneys can help you prepare your returns (top left box) and can help you with matters in all of the other boxes except the big blue box at the bottom right. Their rights to represent you are unlimited before the IRS.

The box at the bottom right (Litigation Station) means that your issue is no longer an administrative issue with the IRS. It is now a judicial matter that must be handled by a court. Depending on the matter you may be able to hire a Tax Court Practitioner (shorthand for a non-attorney admitted to practice in Tax Court) or a “real” attorney. Tax Court Practitioners can help with the first two stops in the litigation station (Tax Court)—their practice at the judicial level is limited to matters that are within the jurisdiction of the U.S. Tax Court. For all other judicial matters you need an actual attorney.

I am happy to report that as of June 18, 2019 I am a non-attorney admitted to practice in Tax Court! I can help you at any state of this process except for the last two stops of the Litigation Station. Have a tax problem? Call for some #taxtherapy!