After almost a year, I’m back on the blog. Heading into the third pandemic-affected filing season, much has changed here at Tax Therapy.

First, I am working from home for the foreseeable future. That means the practice has transitioned from mostly office-based to mostly virtual. The only clients I will be seeing in person are those who qualify for a house call. I am still taking paper documents through the mail or, if you are in the Albuquerque area, by local courier. If you are a potential client please continue to browse the website and then, if you feel like I can meet your return preparation needs, click here to book a discovery call.

Second, I am (for the most part) now working solo. Cat has a new full-time job and will be helping as necessary to wrangle actual, and occasionally electronic, documents, but she will not be here to provide near instant answers to your phone calls and e-mails. Please allow 24-48 hours for a response and understand that during March it can take me up to 72 hours to respond to your inquiries.

Third, while I am currently accepting new clients, I am only accepting new 1040 clients (individual returns). I will not accept new clients who require entity returns (Forms 1065 or 1120-S) once filing season has started. Entity returns are much more complicated and the new client onboarding process is much too involved for one person working alone to attempt during tax season. Entity returns also have a March 15th deadline and I don’t feel that I can realistically meet that deadline for entity clients who are brand new in January. If you are interested in having me prepare your entity return, I encourage you to use the contact form to let me know and I will put you on a list of potential clients to contact later this year (typically starting in June).

Finally, my cutoff date for accepting new clients will likely be even earlier this year than it was last year. Last year I stopped accepting new clients on March 10th. This year I expect to stop accepting new clients as early as February 20th to ensure that I can manage my workload and meet the April 18th filing deadline for as many clients as possible. I have not yet decided whether or not I will be taking new clients during the summer and fall extension period. As Magic 8-ball says “signs point to no” but I reserve the right to change my mind.

Everyone (the IRS, the National Taxpayer Advocate, tax industry organizations, and tax professionals) are predicting another “hairy” filing season. Personally, I’m feeling a return to something resembling normal but I am also preparing for a bumpy ride. So put on your seatbelts and let’s get going!

A couple of weeks ago I was talking with some colleagues about being forced to watch videos to learn features available in new software and just how much I didn’t like that. The videos are slow. I can read faster than that and I comprehend better as well. Usually, I’m going to want to read about something and then maybe watch the video to see how it’s actually done. That’s not how I roll 100% of the time, but in general I’m a reader not a watcher.

A couple of weeks ago I was talking with some colleagues about being forced to watch videos to learn features available in new software and just how much I didn’t like that. The videos are slow. I can read faster than that and I comprehend better as well. Usually, I’m going to want to read about something and then maybe watch the video to see how it’s actually done. That’s not how I roll 100% of the time, but in general I’m a reader not a watcher.

I’m considering this in light of recent client pushback concerning my (admittedly lengthy) “help” e-mails. I’m writing volumes of free help information that targets specific issues my clients are having and distributing it to clients along with links to video help and the knowledge base provided by the software. My business is doing tax returns, not doing tech support on my client management software. That said, I want to help when different clients are all having the same or similar problems. So, I write. Why don’t I do video? Because the software has done that. Also because some people, like me, prefer written to video help. So, I’m doing my best to do both what works for the office and what allows me to “meet clients where they are” so to speak.

While the office has always been able to manage contact free service in one form or another (mail, portal, etc.) after last year I decided that we needed to automate some of the more routine administrative aspects of the return preparation process as well as to increase our “one to many” communication. The change was necessary in order to accommodate client volume while still maintaining a degree of personal service and some work life balance for the office staff (me and Cat). We want to be able to focus on tax returns and complex issues, not booking appointments or answering e-mails about the secure portal. Pushback on these changes has included clients leaving and me telling clients that we can no longer meet their expectations and to find a new preparer. Yes. I have fired clients who, instead of asking for help with a specific problem, simply wanted to complain about not liking the changes I am making—to my business.

I get it. Change is hard. No one likes it. Me included. I’m in my 50s and it’s not getting any easier for me to adapt either. But sometimes it’s adapt or die. Last year it became adapt or die for this office. The changes I’m implementing, while causing some short-term pain, will be both beneficial and necessary for the long-term future of my business. So, while it is unfortunate that some clients have chosen to leave or I have chosen to curate them from my client list, I still hope that they find another preparer who meets their needs. Specifically I hope that

- The new #taxpro pays attention to office and internet security

- The new practitioner’s business model meets both their price point and their income needs

- If the new practitioner’s business model is built on working 60-80 hour weeks during tax season (especially during this tax season which has been compressed by an additional two weeks and hundreds of pages of new tax law) that they are able to prepare the return accurately. The cognitive decline that comes from a lack of sleep is a real thing. Tired #taxpros make more mistakes.

- If the new practitioner’s business model is built on doing a high volume of returns at a low price that they spend enough time with you and on your return to prepare it accurately the first time. And if they don’t that they are around in the off season to help you with any resulting IRS or state notices.

Why do I hope this? Because high-volume, low- to mid-price business models are getting increasingly harder to sustain without automation. The Covid-19 related legislation alone is adding 20-30 minutes to each tax return I prepare just to make sure I’m getting clients all the benefits for which they may be eligible and the correct amount of stimulus money. I read about one #taxpro who says he spends his summer amending returns for free because of all the mistakes he makes during season. He works six or seven days a week and ten to fourteen hour workdays. No wonder he’s making mistakes. Then there’s the general cognitive decline that comes with age. I do not have the memory I had when I was 30. Or even 40. I’ve added automations as “brain extenders” because I’m not willing to run the risks that come with cognitive decline when those risks affect your tax returns.

Maybe you don’t care. Maybe face-to-face completely unautomated service is so important to you that you go out and find a relatively young “old school” preparer. Maybe you won’t outlive them. Maybe they won’t also decide that their business model is unsustainable and decide to make changes. Maybe the demands of the job the way they are currently doing it won’t cause them to make errors. Or maybe, just maybe, it won’t be this year and it won’t be your return.

#fullambo out

The two most beautiful words I heard on #TaxTwitter this weekend were “seller’s market.” What does that mean? It means that good #taxpros are in demand. Good #taxpros. I’m seeing loads of newbies on FaceBook who have passed a test or taken a few classes and decided to open a tax practice asking for advice on everything from what to charge to who qualifies as a dependent to, wait for it, how to prepare a Schedule C.

I’ve mentioned before that “not caught is not the same as accurately filed.” By the time taxpayers get the notices on these returns these preparers have probably closed up shop for the season and are nowhere to be found. Not all of them. Some, who decided to charge really low prices to get clients in the door, will still be working filing what I hope are free amended returns to fix their mistakes. That sucking sound you hear is their profit margins going down the toilet because they charged too little to begin with and now they have the pleasure of doing the return twice. At least I hope they aren’t charging for the amended returns. I had to call a client yesterday morning and to tell her I recently became aware of some “fine print” that could result in tax savings for her and because it was something I missed on her returns I would, once I verified my mistake was really a mistake and she qualified for this benefit, be filing three years’ worth of amended returns for her, for free. Why? Because I’m a good #taxpro. And we are in demand.

You want to know how I know we are in demand? Because the first question potential clients are asking me isn’t “How much do you charge?” it’s “Are you taking new clients?” The answer is yes, but not all of them.

Last year was hard on tax professionals. Some of us aren’t convinced “last year” ever ended. People made themselves ill, people got hives from the stress, people died, some died at their desks and here we are starting what appears to be another chaotic filing season. Last year was absolutely brutal on me and I only have a small practice and not many small business clients. I was stressed, exhausted, and angry. I’ve been working continuously since last January and I’m still stressed, exhausted, and angry. I’m just handling it better. Part of the reason I got no break was that I decided that what made the 2020 extended filing season so unsustainable was the administrative work (e-mails, phone calls, etc.) associated with scheduling appointments for potential and existing clients, answering the same questions over and over, and chasing paperwork (specifically my engagement packet and annual client interview) while trying to keep up with tax law changes and preparing tax returns. Part of the reason I’m handling the stress better is that I spent most of October through December of 2020 adding software that automates the administrative parts of return processing and appointment scheduling so that Cat and I can focus on preparing complete and accurate tax returns for our clients instead of answering the same handful of questions dozens (or hundreds) of times by phone or e-mail.

So why the salt? In a word? Pushback.

So why the salt? In a word? Pushback.

I get it. Change is hard. If you think it’s hard to adjust to a new system imagine having to actually set up the new system and use it, not just once but hundreds of times. And yet, most of my clients are managing. Even the ones I thought of as “not super techy” are giving it a try and figuring it out. It’s an imperfect system and I’m learning as I go. It’s not always easy and at times everyone has been frustrated (clients, me, Cat). I am letting the frustrated clients know that I appreciate their patience and feel their pain. I also understand that it’s harder to adapt to a new system when you only use it once or twice a year. I’m cutting some slack, but I’m not cutting slack like I did in 2020 when I basically did whatever I could to help my clients even if it meant sacrificing my own well being.

After fielding a few calls from disgruntled clients, I decided yesterday that I’m simply not taking pushback on my new client management system. My office processes are reasonably flexible and always have been. I will take what I am learning this year and make refinements that make the system and my processes easier on both the client and the office side. I don’t want to frustrate my clients, but I also don’t want to be crushed under the weight of admin work that can be automated.

Consider this, when you find a doctor that is taking new patients do you tell that doctor how to run her practice? I don’t think so. Well, when you find a tax professional, especially an ethical, competent, experienced tax professional, who is taking new clients, it’s probably a good idea to work within their systems instead of telling them how you want to do things.

If you’re reading this and thinking “Well, that’s nasty, I will just take my business elsewhere” I understand. But remember…seller’s market. I’m not trying to price gouge you. I’m not trying to make your life hard. I’m trying to earn a living in a demanding job with extremely high consequences of failure without killing myself in the process. So if my office policies and procedures don’t meet your idea of the way you think things should be done, shop around and find someone with a practice that does. It may be a seller’s market, but there will always be practitioners out there at all price points, experience, and service levels.

Clients who value me will find me and clients who don’t will find a practitioner that better meets their needs. Because truthfully, when it comes to preparing your tax returns, if you can’t tell the difference between me and the person at your church who is using Turbo Tax and charging $100 per return, we are both probably better off if you choose that person, me for the long-term health of my business and you, well, until you aren’t.

#fullambo out

This post is based on actual conversations that have occurred in the Tax Therapy office.

This post is based on actual conversations that have occurred in the Tax Therapy office.

Mid-March 2019. The phone rings and I answer it.

Me: Tax Therapy, this is Amber.

Caller: Hi, yes, I was wondering if you could do my taxes?

Me: Well we are taking new clients.

Caller: When can I get an appointment?

Me: Before I do that I need to let you know that we do not do taxes while you wait. Our process is to send you some preliminary paperwork to complete, have an intake appointment where we review the paperwork and your documents with you as well as doing an ID check, and then you leave your stuff and we put it into our processing queue and call you when it’s ready for review and signature. Right now the turnaround is about three weeks [2/3 of our volume came in during a 2 week period in March that year] but if you get onboarded I will make every effort to ensure that you are filed on time.

Caller: Oh. I really wanted to get them done right away.

Me: In that case I recommend using one of the large franchises, especially if you can find one that is locally owned and operated. They are set up for while you wait return processing. I am not.

Caller: I didn’t want to do that. I don’t like them and they are expensive.

Me: I’m sorry but I really don’t have anything else to offer you. Most of the smaller shops I know are either not taking new clients or fully booked right now.

Call ends.

Conversations like these happen all the time in small tax practices all across the country. When I’m helping tax practitioners with practice management I often tell them that managing client expectations is important. Equally important is communicating boundaries to potential clients.

This post is for taxpayers who may be shopping for a #taxpro for the first time or looking to make a change this filing season. The time to shop is now. Actually the time to shop was last fall, but most #taxpros aren’t thoroughly in the thick of things right now and can still accept new clients without requiring an extension.

If you are looking for a #taxpro it’s important to understand some of the realities of running a tax business.

First, it’s a business. In most cases your fee is not simply profit to us but is paying for things like software, insurance, and continuing education. Not to mention office rent, phone/internet, and staff. We cannot discount our fees because of your circumstances or expectations.

Overhead is a thing. Ever gone through a fast food drive through, purchased two full meals and thought “Wow. For a little more money I could have had better food and supported a local business.” When you purchase from a large franchise you are paying for convenience, consistency (which, like fast food, can still be hit or miss), and their overhead (physical space, employee training, and advertising). Small shops often have lower overhead but that doesn’t mean they have no overhead.

Tax season is, by its nature, time limited. In other words, there is a fixed amount of time to see clients. Many #taxpros factor this into their pricing. They figure they can do X number of returns in a season and need to make $ to cover their overhead and make a profit (in other words, actually pay themselves for the work they’re doing). Big franchises have some higher paid employees but also make use of armies of lower paid, lower experienced employees to maximize their profits (higher return volume, done for lower cost). In some big “fancy” firms your return may be reviewed and signed by a highly paid, highly experienced professional, but they may only be giving it a cursory review. Again, this helps firms increase their profits (which should be the goal of any business). In smaller shops, it’s often a highly experienced #taxpro actually working on your return with the help of some lower paid support staff. And there are only so many hours a day that we can “brain.”

If you’ve ever heard the phrase “good, fast, or cheap; pick any two” that applies. If you want personalized service and someone to take the time to listen to your calls and explain things to you, that is often not going to be your cheapest option. You may be able to find that level of service for a reasonable price (something in line with what a franchise would charge or maybe even a bit less due to lower overhead) but those firms are not going to be willing to adapt their business model to your expectations. In other words, they cannot change from a drop off firm to a while you wait firm because that is what you want. They are a drop off firm because that is how they both do their best work and because its factored into their price structure.

If you want while you wait service, expect to pay for it. Same thing if you want a highly personalized experience or need a lot of advice or want your #taxpro to be available year round.

If you’re looking for a lower price you may need to find a #taxpro who doesn’t maintain a physical office (rent is a huge part of overhead). No office may not guarantee a lower price, but if you need a #taxpro with a physical office space do not expect bargain basement prices. You may need to accept a longer turnaround time because they don’t have staff to help them. And having staff doesn’t guarantee fast turnaround (especially if the firm is already backlogged). Doing a thorough and accurate job on a tax return takes time, no matter how simple you may think your situation is. You may also need to accept that your #taxpro is only available during tax season and that you may not be able to find them if a situation arises May-December. Or that if you do find them, they may not have the time or experience needed to help you.

Finally, this is why #taxpros get really prickly mid season (OK, sometimes earlier) about price shoppers. Especially #taxpros in solo firms. At the height of tax season time spent on the phone with price shoppers is time that could be spent doing billable work.

Early April 2019 – Monday Morning

Cat was not working Saturday so I turned off the phone so I could focus on finishing returns. I worked a full 8-10 hour day. I either took Sunday off or spent it doing office administration or housework instead of working on tax returns. I get to the office and check the voicemail which includes a few inquiries from potential clients.

Me: Hi, this is Amber from Tax Therapy, I’m returning your call from Friday night.

Caller: Oh. I already found someone. You weren’t fast enough.

Me: OK. Great. Good luck and thanks for calling.

I think the caller expected me to feel bad. I did not. Again, my tax practice (and those of many other solo practitioners) are not set up to do high intake volume late in the season. I am well aware of my physical and mental limitations. There is a fixed amount of “deep work” I can do in a given day/week/filing season. By the time this caller called I was 90% focused on moving returns out of the office and doing “extension triage,” 5% focused on ongoing resolution matters for clients, and 5% focused on process improvements for next filing season. In other words, by the time this caller decided to look for a #taxpro, the current filing season was already all over but some shouting in my office. I still might have been accepting new clients, but not one whose turnaround expectations were so high. I mean, if the caller couldn’t wait until the next business day for me to return the call, what’s the likelihood of them accepting an extension?

The Final Word in Confusion

The big tax franchises and the DIY software providers spend a lot of resources convincing people that “every person is a tax person” and that return preparation is a transaction. A widget for sale. And the more widgets they sell the more profit they earn. When you’re looking for a smaller shop, before you start calling about price take some time to decide which type of shop you are really looking for. Do you want a high-volume transaction type shop or a smaller, more relationship oriented shop? Are you just looking for fast turnaround on a basic return or do you want more personal service? After you’ve answered those questions, then you can look at what’s available in your area and start price shopping. And again, be aware that if you’re calling during peak season many relationship shops may not be able to meet your expected turnaround time, may charge a higher price if they can meet it, and may not be taking new clients at all.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

The CARES Act and the more recent legislation (it doesn’t have a catchy name so I’ll call it CARES2) have created an above-the-line adjustment for certain charitable contributions. Pro-tip: If it’s “above the (AGI) line” it’s an adjustment to income; if it’s below the (AGI) line it is a deduction. If you are a #taxpro reading this it’s important to use the correct language. If you’re a taxpayer reading this the tax outcomes are largely the same but I like to use the right language.

For Tax Year 2020 taxpayers who take the standard deduction can make an above-the-line adjustment for cash contributions of up to $300 on their 1040s. There’s a marriage penalty here. The $300 for 2020 is on a per return, not a per taxpayer basis. So single filers can make a $300 adjustment and married taxpayers filing a joint return can make a $300 adjustment. The IRS has recently issued guidance (that contradicts the actual law) that says married taxpayers filing separately can only take a $150 adjustment. It’s incorrect but the tax savings are not worth the expense if the IRS decides to assess a penalty (more on that later).

In the more recently passed legislation the marriage penalty was removed. Each taxpayer may contribute up to $300 in cash to qualified charitable organizations. So for Tax Year 2021 it is possible to take an up to $600 above the line adjustment on a jointly filed return. Singles and Heads of Household still can take up to $300. Again, this is for taxpayers who do not itemize their deductions. Taxpayers who use Schedule A to itemize their deductions continue to deduct all of their qualified contributions on that schedule.

Now for the fine print. The IRS will be watching. The Service has stated that there will be a 50% penalty if you claim this adjustment without proper substantiation. What does that mean? It means receipts. Here’s a link to some information on proper recordkeeping for charitable contributions. In general, clients should always be maintaining the records necessary to substantiate their charitable contributions. But for this adjustment in particular it is even more important for the #taxpro to keep the receipts that substantiate this adjustment in the client’s tax file for the applicable years in case the IRS comes looking for them. Don’t be the client who tells your #taxpro “just take the max.” And if you are a #taxpro who “just takes the max” without proper substantiation then you aren’t really a #taxpro in my opinion. True tax professionals do not open their clients up to these types of penalties. They are too easily avoided. If you don’t have the proper documentation it’s going to cost you more in penalties than you saved in taxes by taking an unsubstantiated adjustment. Just don’t do it.

Remember, this adjustment has the following conditions:

- The taxpayer must not be itemizing their deductions on the return.

- The taxpayer must be able to substantiate the deduction.

- The contribution must be made in cash or a cash equivalent (cash, check, credit card, etc.). In other words it can’t be taken for donated “stuff”.

- The contribution must be made to a qualified charitable organization. Shorthand for that is that it must be made to a recognized 501(c)(3) organization.

See that last bit? It’s important to understand that not every tax exempt organization is a recognized 501(c)(3) organization.

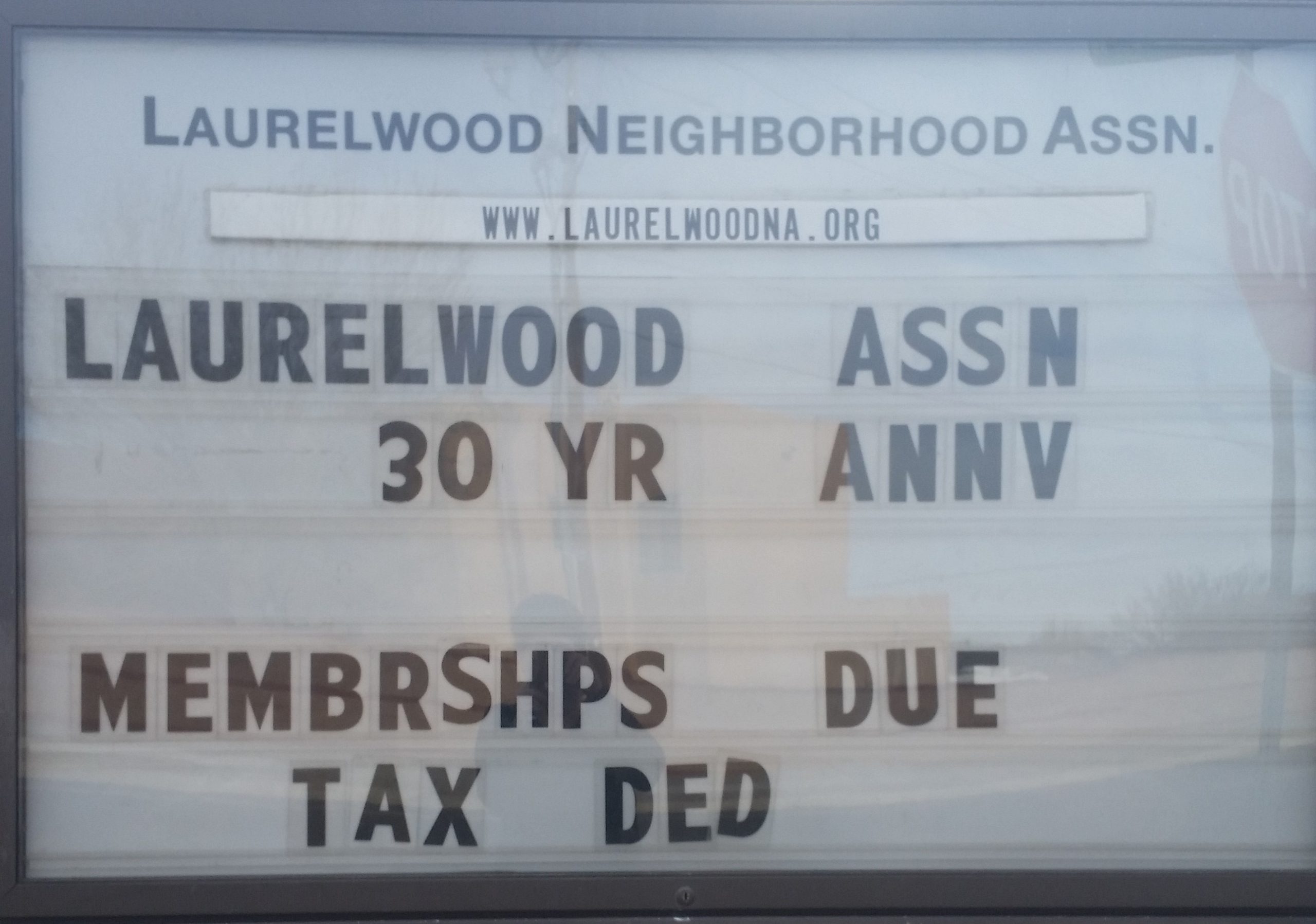

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

I saw this sign as I was driving home a while ago and thought “Yikes!” Your neighborhood association dues, homeowners association dues, and many other payments or contributions to tax exempt organizations are not tax deductible. Raffle tickets and purchases of auction items are also not deductible, no matter how worthy the cause.* Neither are contributions made to individuals (via gofundme or other types of crowdfunding) or contributions made to charitable organizations outside the U.S. (again, to be deductible the organization must be a 501(c)(3)).

If you have questions about whether or not your contribution is deductible it’s always better to ask your #taxpro or to look to reliable sources for more information. Reliable sources include the tax team at Forbes.com, the IRS website, and (sometimes) the knowledge base provided by your DIY software vendor. Reliable sources do not include TikTok, Twitter, or YouTube unless the person providing the advice is recognized as an expert in the field (again, the IRS, Forbes, etc.). And occasionally even trustworthy sources provide incorrect information. Right now information is changing so quickly what you are reading could already be obsolete. Be careful out there. Read the fine print and remember, if it sounds too good to be true it usually is.

#fullambo out

*If you paid substantially more than fair market value for an auction item you may be able to deduct the amount in excess of fair market value but be prepared to answer some questions and provide some proof to your tax professional.

Remember when they were doing direct deposit or mailing a paper check? Well someone convinced someone that prepaid debit cards were a better idea. I won’t wax philosophical on the fact that you can’t usually pay rent with a debit card. Instead, I will link to this article from The Tax Girl letting you know that debit card is legit…so don’t throw it away!

Remember when I talked about college students who are dependents (or basically any child over 16) not being eligible for the dependent EIP or their own EIP? Well, that applies to adult dependents too. So if you’re claiming your parent as a dependent and they are wondering where their stimulus money is—it isn’t coming. Because they are a dependent over the age of 16. Yeah—this is a drag.

What’s not a drag is that I have been moving through the returns and Cat may be coming back part time starting next week. Can I get a hallelujah?!

And we are open by appointment for document drop off, return review and signature, and for new client intake appointments.

That’s about it for today!

It’s Thursday and, after a fairly productive start to the week and a really hectic Wednesday, I am working from home. I have a 2-hour class today and I also needed to catch up on reading and administrative tasks.

The tax returns, however, keep on trucking. I’ll be back in the office tomorrow (Friday) working on returns. I’m still at the pile that came in in mid-March, which (if you have been keeping up with this blog) is most of them. But I’m finally seeing light at the end of the tunnel! I still expect to get most of the returns that normally would not have been on extension filed by the end of this month.

I am still planning on opening the office by appointment only beginning Tuesday afternoon, May 19th. I have already booked a few appointments so if you are wanting an appointment in May (and not in June) it’s best to call or e-mail and book now.

You can also call or e-mail if you are a client with a question about your Economic Impact Payment. I’ve been answering those as I can and I appreciate everyone’s understanding concerning the fact that while I have a lot of information on the process, I have absolutely no control over the IRS, the Treasury Department, or their tools (electronic or human).

I am still urging everyone to stay home to the greatest extent possible and to use e-mail, the phone, Zoom, the secure portal, or USPS/courier to communicate with me.

Enjoy your weekend everyone!

#fullambo out

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

In case you missed the memo, NM Governor Michelle Lujan Grisham (a.k.a. Notorious MLG), has extended the stay-at-home order through May 15th. Cat and I are going to continue to honor that by Cat staying at home. That means no phone support for me. That means leave a message! I am usually at the office (although I will admit that “gardener’s hours” are starting to kick in) and I stop work to pick up phone messages a few times a day.

The backlog is slowly clearing. That means, for those of you whose returns still haven’t made it into the office, we will be ready to start accepting new paperwork soon. So here’s the plan—

Whether or not the stay-at-home is extended beyond May 15th, I will re-open the office for document drop offs by appointment only on Tuesday, May 19th. My 24th wedding anniversary is Monday the 18th so I’ll probably take that day off. If you wish to make an appointment to drop off your tax return documents or missing paperwork (K1s, corrected broker 1099s, etc.), please just call or e-mail and I or Cat will get back to you and will set you up!

I will probably re-open the office to new clients at the beginning of June. We will still be, to the greatest extent possible or required, limiting in-person visits to the office. Re-opening to new clients simply means that I will once again be accepting inquiries from new clients. So, if you know anyone who hasn’t filed but wants to, June is when I’ll be accepting referrals again. That should be plenty of time to meet the July 15th filing deadline.

Thanks to all of you for hanging in there through this chaotic tax season with me!

#fullambo out

Come Monday—it is still not alright. But I am in the office processing returns and I will be available by phone, Zoom, or e-mail if you have questions. I know a lot of you have questions. I did send out a detailed e-mail (via Constant Contact) about the stimulus payments and expect to send out another later this week.

As you can see, a large part of my time is being spent communicating the details of new tax law to you all as a group and to many of you as individuals. This, obviously, slows me down with respect to return processing. Please know I’m working as fast as I can but that, again, I am now focused on “Tax Day” being July 15th. Also, what you may not realize is how much time I am devoting to learning the “fine print” of the new tax law. I thought last year was unprecedented for changing the tax rules in the middle of the game, but Congress said “Hold my beer.” So now I’m learning law that amounts to thousands of pages of new material in addition to how that interacts with certain new human resources law and small business administration loans. I’m not going to lie. Doing this during the off season would be plenty of work. Trying to do it while processing returns and answering questions is nothing short of daunting.

I recently read that 95% of small businesses fail within the first 5 years due to either bad management, under capitalization, or some combination of the two. Tax issues for small business owners have the same roots. Bad record keeping is often a sign of bad management. Mileage is one of the most highly scrutinized and most common areas on which small businesses are examined (audited). If you are a small business owner who isn’t keeping good mileage records you may be leaving money on the table. Worse, if you are audited, legitimate business mileage expenses may be disallowed because of your failure to keep adequate records.

The Self Help tab of the Tax Therapy website (Get Organized and Get Answers) offers additional resources to help you track and substantiate your business mileage. In a nutshell, your business mileage log should be contemporaneous (done at about the same time or shortly after you make the drive) and should show the date of the trip, the business purpose of the trip, and the miles driven. It is really common for people to not record the business purpose of the trip on the mileage log. It’s a lot easier to do this when you record the miles than it is to try to re-build that from an appointment calendar!

Finally, a great way to record your starting and ending odometer readings for your annual mileage total is to take a picture of your odometer with your phone on January 1 and again on December 31. If you haven’t taken a picture of your odometer this year, it’s not too late. It won’t be perfect, but it will be close and it will help you get into a really good habit! I hope that one of your New Year’s Resolutions, if you are a small business owner, is to improve your record keeping! It’s easy to do once you make a habit of it. And it’s one of the simplest ways to make sure your start up stays up!