Time to prepare your 2018 tax return! DIY or #TaxPro?

A popular brand of DIY software is fond of telling you “It doesn’t take a genius to do your taxes.” At least that’s what they were telling you last year. This year they are telling you about all the “CPAs” they have on staff to help answer your questions. They have enrolled agents too. Don’t know the difference or never heard of an enrolled agent? Click here for more information on the different types of #taxpros.

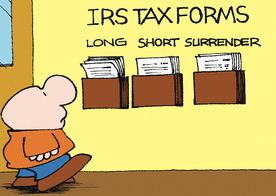

So if it doesn’t take a genius to do your taxes, why in the world do they need all that extra staff to answer your questions? Because preparing a tax return is not as easy as it looks. Even experienced professionals have questions (and make errors) in things as seemingly straightforward as filing status or who qualifies as a dependent. Answer to the latter? It depends on what “the dependent” is being qualified for—different tax benefits (credits) have different requirements! Add a small business or even a rental property to your tax return and the complexity just went up by an order of magnitude. Heck, I know geniuses (card-holding Mensa geniuses) who prefer to hire a #taxpro than to do it themselves because while they are super smart in general and really super smart in their fields, they are also smart enough to recognize when they don’t want to deal with something that isn’t necessarily complex (read the rules and apply them) but can be dizzyingly complicated (lots of interlocking moving parts and even more “ifs and buts”).

Still, when it comes to tax returns you have plenty of options but they come in two flavors—

Do It Yourself With Software: Whether you choose a package like TurboTax or file online for free through the IRS website, this option will work for you if you have a basic understanding of what needs to be done and if your tax situation is relatively uncomplicated. When I say “relatively uncomplicated” I mean that you are a W2 employee with a minimal number (or no) itemized deductions and only basic banking and investment accounts. Of course, the requirements of the Affordable Care Act (a.k.a. Obamacare) add a level of complexity for anyone who doesn’t have Medicare or employer-provided coverage for everyone in the household. If you changed jobs, had a gap in coverage, or received the Premium Tax Credit, you still may want to consult a tax professional even if the rest of your return is fairly simple.

Pay a Professional: If you own your own business, have a rental property, have brokerage accounts that are not retirement accounts, are eligible for the Earned Income Tax Credit, have higher education expenses, have income in more than one state, or any number of other “complicating factors” it may be in your best interests to consult a #taxpro. I know that the tax software companies want you to believe you can have a rental property or own your own business and still do your taxes yourself, and maybe you can, but the consequences of failure are relatively high so maybe you don’t want to.

Before you make your decision you also need to consider your own threshold for pain. DIY involves re-familiarizing yourself with something that is largely alien to you once each year (whereas I and many #taxpros pretty much eat, breathe, and sleep tax law year round). I have clients who did their own tax returns for years before coming to me. What changed their mind? They decided they had better things to do than read form instructions, answer software interview questions in a language in which they are not fluent (internal revenue code), and in general try to figure out if they were doing everything right.

And what if you didn’t do everything right and get a notice? I have some friends who became clients after making a couple of minor errors on a return that resulted in an IRS notice. I was able to review the notice and quickly find one of the two errors and when they went to the IRS to sort it out, the IRS pointed out the other one (it was an age issue my software would have caught easily had they been customers). My ability to easily see what a big part of the problem was sold them on deciding to hire a #taxpro moving forward. When they came to their first review & signature appointment I had them sign their e-file authorizations and they said “What do we do now?” and I answered “Go have a beer?” They have really learned to enjoy not having to spend hours every year preparing their own return.

These same clients also learned that I am here year round if they get a notice or have a question. I’m really not sure how DIY box software handles “after the return is filed” issues. I’m pretty sure they don’t make themselves available to answer questions year round if you decide to say, sell your rental house. Even if you are hiring a professional you want to make sure your #taxpro is both willing and available to help. Many big franchises are closed off season and many part-time solo practitioners go back to their “regular” jobs after filing season and don’t want to help (or aren’t available even if they do want to help).

Yes. Hiring a professional costs more than doing it yourself. But there are both risks and opportunity costs to doing it yourself. Sometimes the cheapest option is not the best option. I’ll discuss more on costs in a future post.

Still not sure? Read what the IRS has to say here.