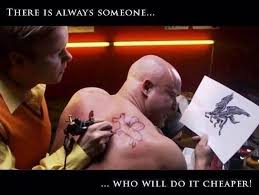

Looking for a #taxpro? Be careful what you wish for!

A colleague recently posted the following on a tax humor group:

Posted in local community group—Need recommendations for someone to prepare tax returns – looking for someone that is good and may do them on the side – not looking for an HR Block or pricey accounting firm.

You may be wondering why professional tax practitioners find this humorous. You may be thinking “I don’t need a big firm or a big name either, my tax return isn’t that complicated.” We’re laughing because if you don’t do taxes for a living it’s easy to look at the output (the actual tax return) and think “this can’t be that difficult” or “my return just isn’t that hard.” And maybe it isn’t. But maybe it is. The first rule of tax return preparation is…

The person who posted this comment could be walking into tax trouble—or worse. But first let me say that there are many excellent, reputable, professional taxpros working part-time from home or virtual offices. Some of them have retired from larger practices but still want to keep their skill set, so they keep up with the tax law changes and do some returns every season. Some are simply the second, supplemental income in a multiple income household and this type of seasonal work is a good fit for their lifestyle and schedule. Others may be full-time bookkeeping professionals that offer tax return preparation during filing season to generate additional income. Any of these people may be good choices. And low overhead (not renting an office, not having staff, etc.) often translates into a lower price for return preparation even on relatively complex returns.

Nevertheless, one thing you are going to read over and over on this blog is that while price should be a consideration, it should not be the only consideration when choosing a tax professional. When you pay someone to do your tax return, you are typically placing your entire financial identity into that person’s hands. And even tax professionals working from a home office are required to have a written security plan and should be aware of their obligations and actively working to protect their data and your information. That effort is built into the cost of most professionally prepared tax returns. So is continuing education. Year-round tax professionals are pretty much constantly immersed in tax law. It’s our full-time job and we are typically monitoring and aware of tax law changes (or even interpretations) that affect the types of clients we work with all year long. If you are considering hiring a seasonal preparer you want to be sure that they are, at a minimum, keeping themselves up to date on the most important tax law changes. It amazes me how many muggles (non taxpros) I have spoken to that are unaware of the sweeping tax legislation passed by Congress in December of last year! If you are a DIY tax person that could be a problem this year. And if you hire a seasonal professional who is not conscientious about keeping up with the laws that could be an even bigger problem. You are trusting that person to know what they may not know. And you may not realize that your return was prepared incorrectly until a year or more later when the notices start appearing in your mailbox.

Finally, sometimes seasonal preparers don’t always know what they don’t know. Enrolled practitioners (EAs, CPAs, attorneys) are bound by Treasury Circular 230 which has a “competence clause.” We are not supposed to accept work that we are not capable of completing correctly. This can play out in many different ways depending on who you hire. Big CPA firms may not be the best for individual returns. Indeed many only do individual returns if they are also doing the business return because business returns are their primary focus. Really small, seasonal preparers who do mostly individual returns may not be a good choice for your small business, especially if it is an S-corp or a partnership, because those entity returns have specific requirements and the knowledge required to prepare the entity returns is vastly different from that required to do an individual return. Even an experienced, well-rounded, tax general practitioner may not be the best choice for certain specialized returns (clergy, airline pilots and flight attendants, over-the-road truck drivers, international taxpayers, etc.). Who is the best option for you? Like so much in the tax business “it depends”.

Tax Therapy specializes in individual and micro business returns. Returns that large CPA firms may not want to do because they don’t see them as profitable enough. That’s not wrong of them. Their business model is designed around serving clients with specific needs. Mine is designed around a completely different set of clients. If you’re too large, I might refer you elsewhere because taking on your business wouldn’t allow me to meet the needs of my existing customers. Or your entity structure might be beyond my competence level. Taxes are more complicated than you think and competent tax professionals come in a range of business styles and prices. Don’t assume that a franchise-prepared return will be cheap. Don’t assume that someone with an office will be prohibitively expensive. And never choose based on price alone!